As Ethereum’s (ETH) price struggles to break away from the critical $1,600 level, it leaves traders feeling frustrated due to its continuous consolidation. Nevertheless, in recent hours, a variety of on-chain indicators have shown conflicting signals amid Ethereum’s decreased volatility. As a result, there’s an increased chance of a robust price move for ETH in the upcoming week.

Ethereum’s Amount Of Supply Touches 1-Month Low

Based on insights provided by Glassnode data, there has been a notable surge in activity among short-term Ethereum holders in recent hours. On-chain data reveals that the quantity of Ethereum supply that was last active within one week to just one day ago has now reached its lowest point in one month. With the 1-day moving average (MA) dropping to 926,194.509 ETH, it signals a sentiment shift in Ethereum’s on-chain activity.

A lower number of Ethereum coins held by short-term holders who have not moved them for a week or less indicates that these holders are actively participating in buying and selling, rather than holding onto their assets. This can be a sign of increased short-term trading or a shift in sentiment among short-term traders. This can cause selling activity on Ethereum’s minor rallies.

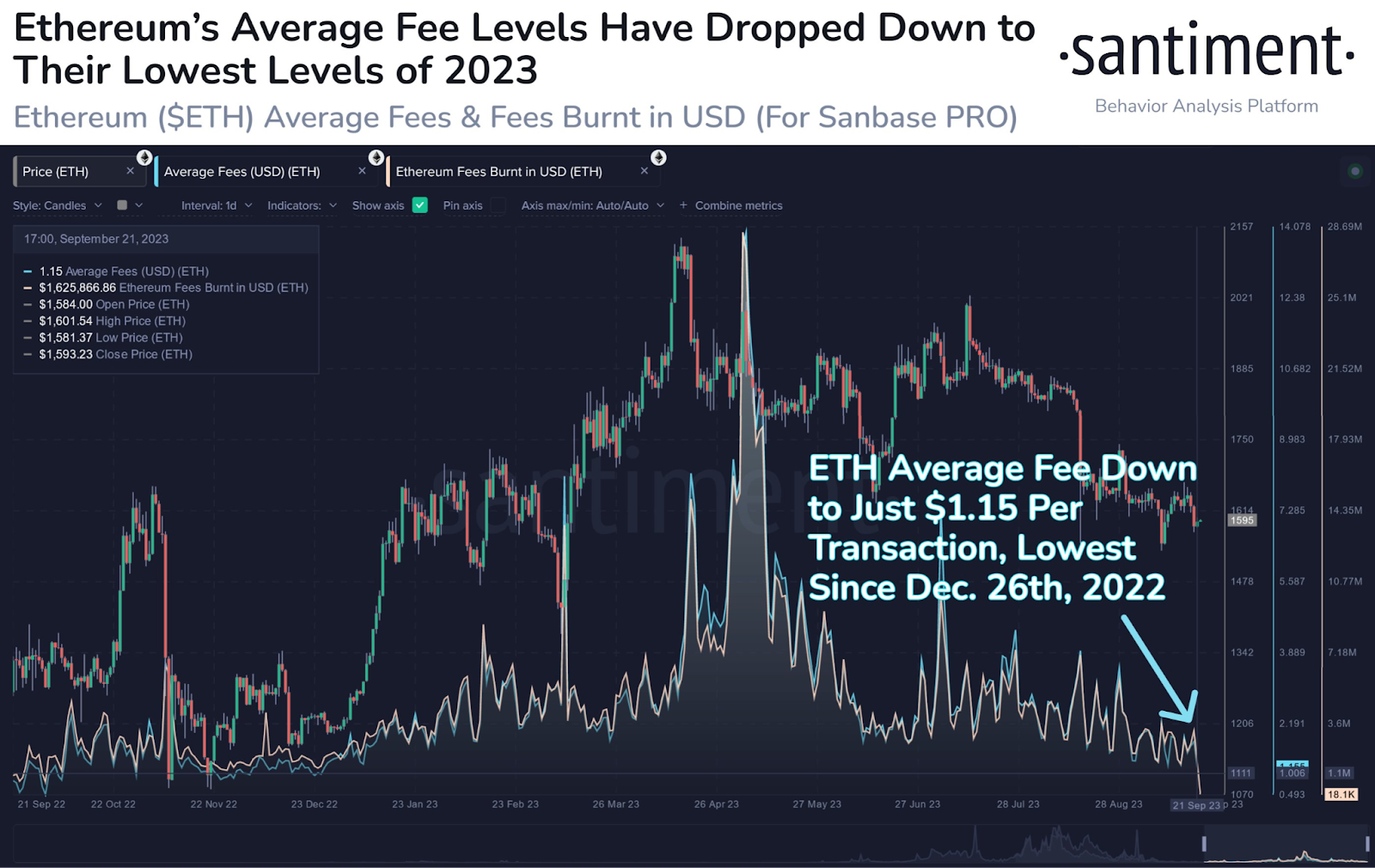

Nonetheless, there’s a noteworthy development observed by Santiment. Ethereum’s average fee has reached a nine-month low, reaching the level of $1.15, a figure last witnessed on December 26, 2022. According to Santiment, historical data suggests that Ethereum’s utility tends to rise when ETH becomes more affordable to transact, which can accelerate ETH’s recovery.

It’s worth highlighting that Ethereum’s average fees may experience a further significant decline as layer 2 solutions continue to snatch a massive portion of transactions from the Ethereum network. This is another contributing factor to the declining average fees observed in the Ethereum network.

What’s Next For ETH Price?

Ethereum continues to face rejection at the 20-day Exponential Moving Average (EMA) at a price of $1,602, signaling the ongoing bearish sentiment and a tendency for sellers to capitalize on price upticks. As of writing, ETH price trades at $1,588, declining over 0.55% from yesterday’s rate.

The bears are poised to strengthen their position further by pushing the price below the critical support level at $1,570. If they succeed in doing so, the ETH price might begin a downward trend, targeting the subsequent significant support level at $1,531.

Conversely, if the price reverses from its current position or experiences a rebound from the $1,570 mark, it would suggest that buyers are becoming active at lower price levels. The initial indicator of renewed strength will emerge in a breakthrough and a close above the $1,623 level, potentially paving the way for a bullish rally towards the $1,674 level.