Recently, there’s been a lot of uncertainty in the cryptocurrency market due to rumors about a major crypto exchange called Huobi facing financial trouble. To counter these rumors, a significant move was made by a prominent Tron (TRX) whale, who deposited a staggering $200 million in USDT and an additional $9 million worth of Ethereum (ETH).

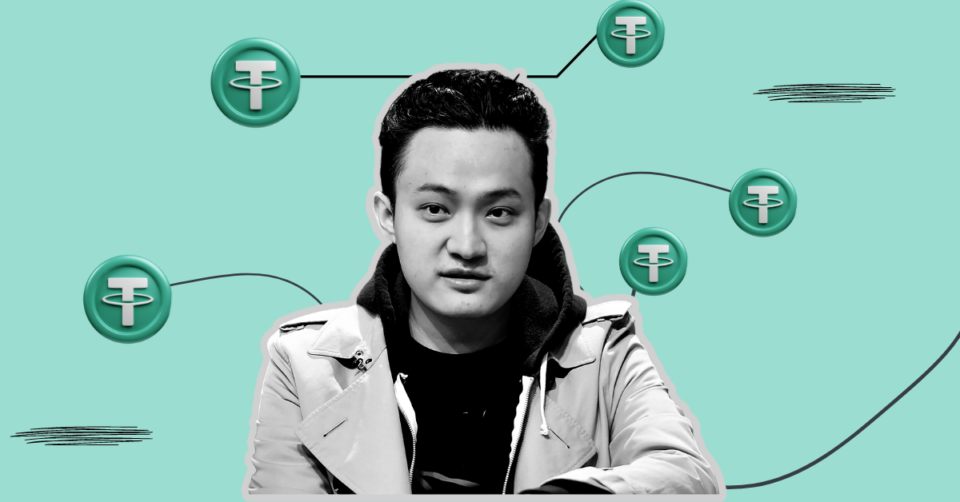

The transaction, facilitated by JustLendDAO, originated from a TRX wallet holding over half a billion US dollars. In a parallel development, Justin Sun, a prominent figure in the crypto space, deposited 5,000 Ether, valued at approximately $9.15 million. While Huobi’s spokesperson has publicly denied any connection between Sun and the whale deposits, the implications for Huobi’s future are noteworthy.

Strengthened Growth Prospects

Huobi’s future growth trajectory gains a substantial boost from these whale deposits, particularly due to the involvement of Justin Sun. As a tech billionaire with extensive experience and influence, Sun’s direct connection to global regulators as the Permanent Representative of Grenada to the World Trade Organization (WTO) in Geneva underscores the potential for navigating regulatory challenges.

These substantial deposits have propelled Huobi’s total assets to approximately $3.09 billion, according to data sourced from DefiLlama.

Token Stability Amidst Turmoil

The impact of the whale deposits extends beyond Huobi’s financial health, also stabilizing its native HT token. With a market capitalization of approximately $416 million, the HT token, which had been trading at around $2.61, experienced a notable stabilization. The 24-hour trading volume for the HT token reached approximately $16.3 million.

Conclusion

As the cryptocurrency market grapples with uncertainty sparked by insolvency rumors surrounding Huobi, the decisive actions of a Tron whale and the involvement of Justin Sun inject a sense of stability and optimism.

Huobi’s substantial increase in total assets, alongside the stabilization of its native token, position the exchange for potential future growth. As the situation continues to unfold, the crypto community watches with keen interest to see how Huobi navigates these challenging times.