The crypto market is starting to recover after a recent slump, and this is helping the price of Chainlink go up. Also, as inflation in the US starts to slow down, the trading interest continues to rise. However, LINK might soon trigger a correction as it becomes overvalued. This is due to a drop in crucial on-chain data, erasing hopes of further recovery.

Chainlink’s MVRV Drops Despite Recovery

Chainlink price has been on a strong recovery rally for over the last few hours. As a result, it broke above the crucial $14 level, triggering significant liquidations. Data from Coinglass shows that Chainlink faced $1.57 million liquidation. Of this, sellers liquidated over $1 million and buyers sold $470K worth of positions.

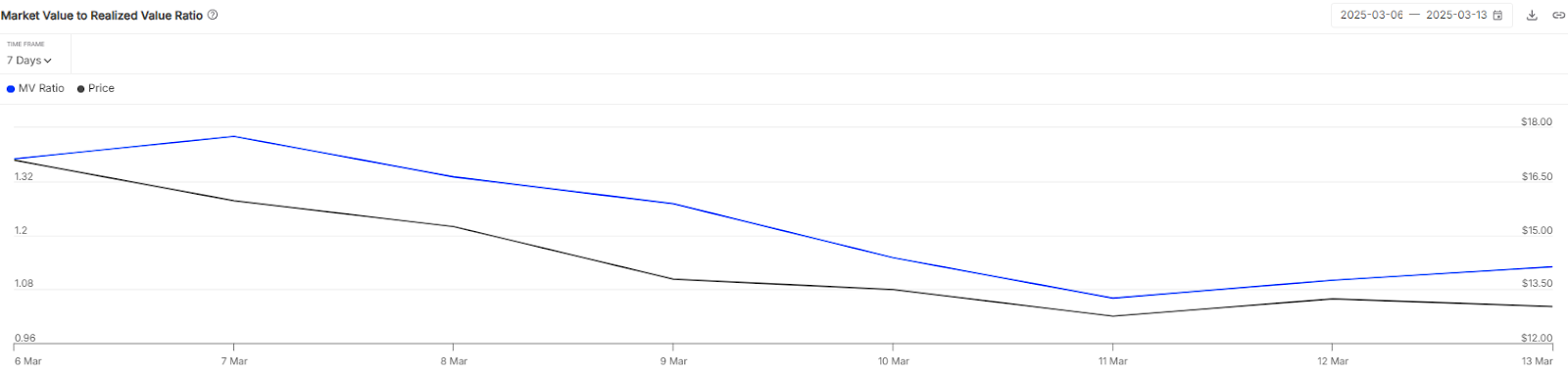

The current recovery rally of Chainlink might be preparing for a halt as the MVRV ratio hovers around 1.1 despite the price surge in LINK. IntoTheBlock shows that the MVRV ratio for Chainlink dropped from the peak of 1.42 to 1.13 as LINK price recovered.

A falling MVRV ratio during a price rise suggests that the average price at which tokens were last traded isn’t matching the current market price. This may mean that the recent increase in LINK price is fueled more by speculation than by real gains in the altcoin’s value. This makes Chainlink overvalued as it moves above resistance level.

Also read: Trump Crypto Executive Order Sparks New Bill for U.S. Bitcoin Reserve

As a result, there’s a possibility that the LINK price might see a correction near the immediate Fibonacci channel. Despite this, Chainlink remains a top altcoin due to strong development activity and strong technical support.

The significant accumulation by large investors, with 3 million purchases in the last five days, along with high trading volumes, shows strong investor confidence. Additionally, the open interest’s surge by 35% toward $580 million shows rising confidence among traders.

What’s Next for LINK Price?

Chainlink has been displaying a strong upward trend, approaching the $15 resistance level amid significant buying interest. This demand has helped LINK stay above key Fibonacci support levels, with its price now at $14.4 after a 11.52% increase over the past 24 hours.

LINK/USDT is facing some resistance at around $14.7, a point where bearish sentiment begins to increase. However, with the Relative Strength Index (RSI) nearing the overbought threshold at 78, Chainlink might be heading towards a correction. It is poised to test the $14.7 level again, and breaking above this could set it on a path towards $17.6.

On the flip side, if selling pressure intensifies at these resistance levels, it could negate recent gains. Should LINK fail to break through the $14.7-$15 range, its price might fall to around $11.7. A drop below this level could lead to a significant correction.

With the long/short ratio currently at 2.17, indicating a surge in buying trend, there’s a risk of a fake breakout. Presently, 68.5% of traders anticipate a further upward movement in LINK’s price.