The broader crypto market came under heavy pressure today as a sharp wave of crypto liquidations ripped through leveraged positions, dragging Bitcoin, Ethereum, and major altcoins lower within hours. Over $700 million in crypto positions were liquidated during the session, with long traders bearing the brunt of the damage. The speed of the move suggests the decline was driven less by fresh selling and more by cascading margin calls as key intraday supports failed.

Crypto Liquidations Drive the Selloff as Leverage Unwinds

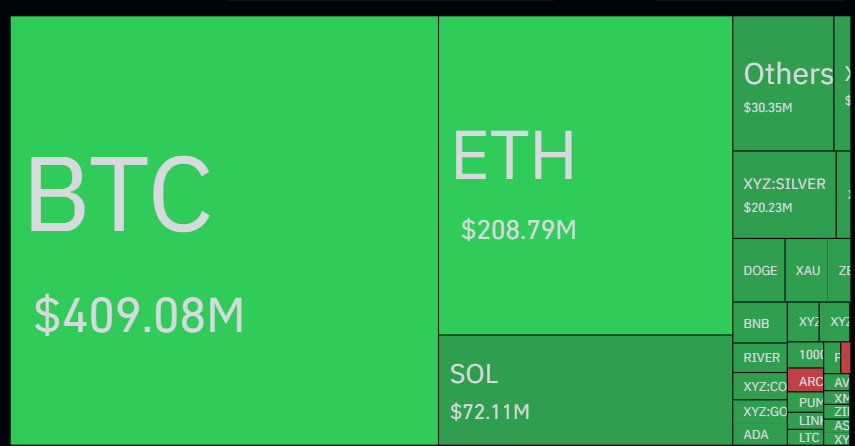

Today’s market selloff triggered over $700 million crypto positions liquidated over the past 24 hours, with long positions accounting for the clear majority of losses. Bitcoin led the wipeout, accounting for over $410 million in liquidations, as BTC slipped toward the $71,000 level. Ethereum followed closely, with roughly $208 million in ETH positions liquidated as price dropped near $2,100. XRP and other large-cap altcoins contributed the remainder, as cascading stops were triggered across derivatives markets.

The liquidation skew was heavily long-biased, signaling a mechanical leverage reset rather than panic-driven selling.

Open interest fell sharply alongside the liquidations, showing that traders were being forced out of positions instead of exiting voluntarily. In short, today’s move reflects leverage flushing out of the system, not a mass exit by long-term holders.

Bitcoin Price Slides 5% as Liquidation Clusters Get Swept

Bitcoin’s decline accelerated after BTC lost key intraday support and slipped nearly 5% to the $71,000 zone, triggering a sharp liquidation cascade across futures markets. Liquidation data shows roughly $409 million worth of Bitcoin positions were force-closed during the move, with long traders accounting for the overwhelming majority. The selloff was mechanically driven. As Bitcoin price broke below short-term support levels near the mid-$74K range, liquidation clusters stacked around $73K and $72K were rapidly cleared. This forced selling amplified downside momentum, dragging price swiftly toward $71K before bids began to stabilize.

Importantly, spot market behavior remained relatively composed. Exchange inflows did not spike aggressively, suggesting the move was fueled by excess leverage unwinding, not panic-driven spot selling. In classic fashion, futures markets led the decline, while spot liquidity lagged behind. For now, Bitcoin’s ability to hold above the $70K–$71K region will be closely watched. A failure to stabilize around $70k could expose deeper downside, while consolidation here may signal that the bulk of forced selling has already played out.

Ethereum Price Drops to $2100 as Leverage Reset Mirrors Bitcoin

Ethereum tracked Bitcoin’s weakness almost tick for tick, falling nearly 5% to around $2,100 as liquidation pressure spilled across correlated markets. Data indicates approximately $208 million in Ethereum futures positions were liquidated, again dominated by long-side losses. ETH’s decline was not driven by Ethereum-specific developments. Instead, it reflected a broader deleveraging event as traders reduced exposure across majors once Bitcoin broke lower. Once ETH price lost support near the $2,250–$2,300 area, liquidation thresholds were quickly hit, accelerating the slide toward $2,100.

From here, Ethereum’s short-term outlook hinges on whether $2,000 can hold as a stabilization zone. A sustained failure below this level would keep pressure on the downside, while consolidation could allow volatility to compress as leverage resets.

Market Outlook

Today’s market sell-off carries a clear message: the market was over-leveraged. The $700M liquidation wave acted as a reset mechanism, forcing out crowded bullish positions without triggering mass spot exits. If liquidation pressure continues to ease and open interest stabilizes, markets may attempt to consolidate at lower levels. However, until Bitcoin and Ethereum reclaim broken supports, volatility is likely to remain elevated. For now, crypto markets are not collapsing, they are deleveraging. History shows that how price behaves after leverage resets often defines the next major trend.

FAQs

A sharp $700 million liquidation wave triggered a cascade of forced selling in leveraged futures markets, rapidly pulling down Bitcoin, Ethereum, and altcoin prices within hours.

Over $700 million in crypto positions were liquidated, with Bitcoin longs accounting for over $410 million and Ethereum longs for roughly $208 million of that total.

It means traders who bet on prices rising using borrowed funds were forced to sell as prices fell, triggering more automatic sell orders and accelerating the downturn in a short-term cascade.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.