As the article is being prepared, we are in critical moments and BTC is about to break 90 thousand dollars as predicted because the court decision on customs tariffs is now expected. Today’s employment figures were not supportive of rapid interest rate cuts. Today is poised to be one of the most volatile days of January because there is so much going on. So what do analysts expect?

Bitcoin Predictions

BTC Focusing on the tariff decision, which is at the 90 thousand dollar limit and has already been priced, investors are waiting for the signal of the beginning or cancellation of the uncertainty environment. If an adverse decision is made, rapid liquidations in both directions are possible. In his assessment a few hours ago, Altcoin Sherpa said that the fluctuation will continue to be painful because $ 94 thousand has not been exceeded yet.

The White House at the time of writing cancellation of customs tariffs He said that if the situation arises, they will immediately put alternative vehicles into operation. Even though we do not know the details of the backup plan statements yet, they are important in terms of balancing the uncertainty, but it is likely that we will see a rapid movement as soon as the decision is announced. Coming back to Sherpa, he argues that we should not give up hope on the rise as the 4-hour EMAs look healthy in the short term.

Bitcoin Cash (BCH)

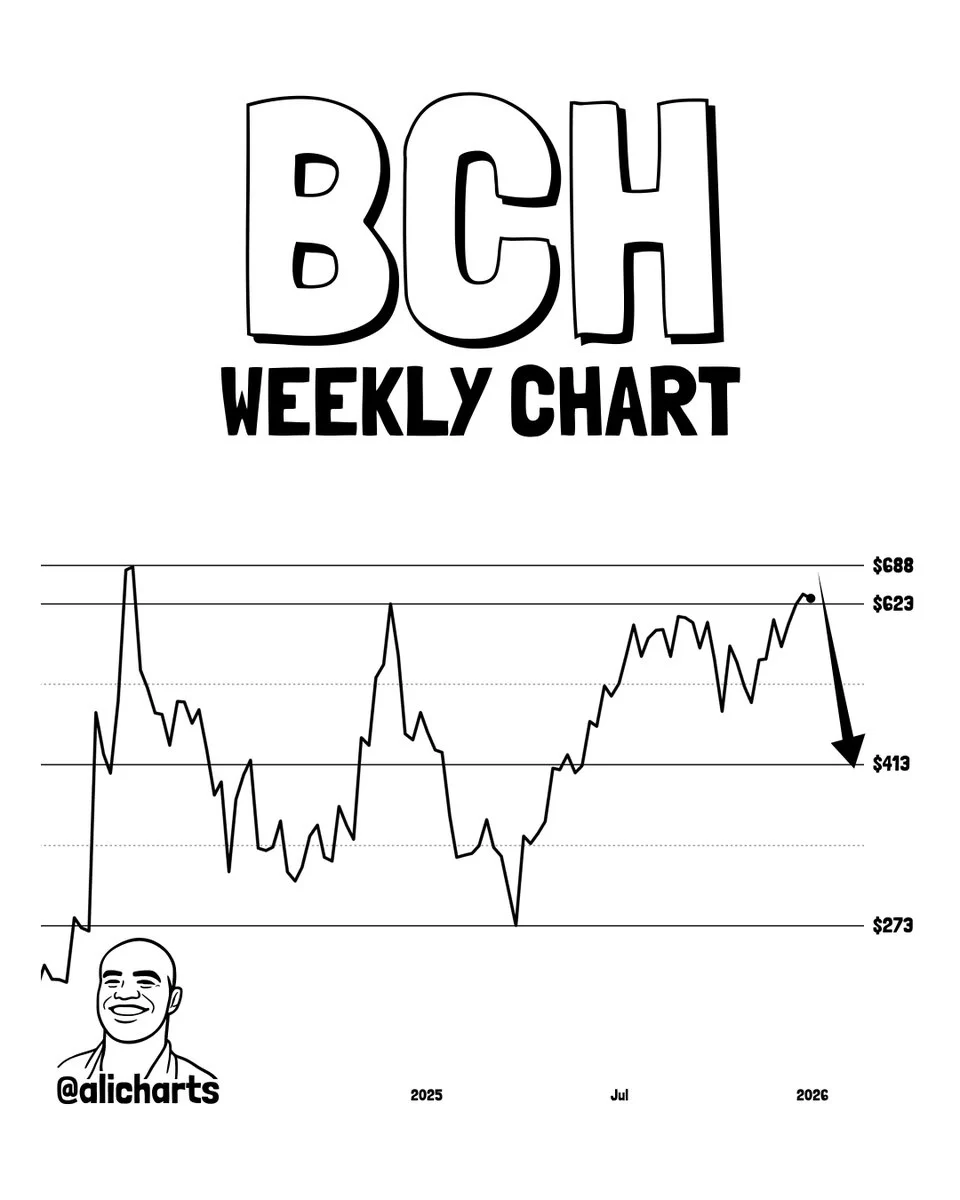

Specifically for altcoins BCH Sharing his evaluation for Ali Martinez, he shared the following setup for the possible volatility environment. If the cancellation of tariffs triggers strong uncertainty, Martinez’s target for BCH is a rapid sell-off to $413. Then his target for the bottom is $273.

In the opposite scenario, if the fear is already priced in and Trump follows a policy of not escalating the tension after the event occurs, BCH may run to its four-digit target with an upward break in the $623-688 range.

Minister of Treasury and white house Although officials say that they have measures to quickly put into effect against a possible adverse decision, it is possible that fierce rivals such as China will turn this process to their advantage. If China decides to impose export restrictions on rare earth elements again after the court cancels the tariffs (when the tariffs are canceled, the tax channel that will scare China financially is closed), this will create tension.