Supreme Court tariff decision It was announced as expected, and Trump claimed that the court had been taken over by foreign powers. Stating that the customs duties will not change significantly, Trump said that countries that want to go to court “for refund payments” can choose to take them and will try to get them for at least 5 years. The crypto oracle talked about what will happen in 8 days.

Crypto Oracle Prediction

Supreme Court in the run-up to November midterm elections to Trump He replied like a slap. Trump, who cannot even get the support of the Republican members he appointed, says “we need to find a solution to these courts.” The good news is that Trump will continue to maintain tariffs in much the same way, under cover. Although the 10% additional global tariff announcement has not yet been priced in cryptocurrencies, the uncertainty has disappeared at this point.

Sharing the chart above cryptocurrency oracle Roman Trading said that in just 8 days Bitcoin will secure its target.

“If the bulls do not close above $74,000 in 8 days, the next target will be $50-52,000. If this situation continues, there will be a simple decline and continuation.”

The analyst with the pseudonym Roman Trading predicted a return to $60,000 when BTC was above $120,000. He was right and time will tell whether he will be right again.

Whales Continue Selling

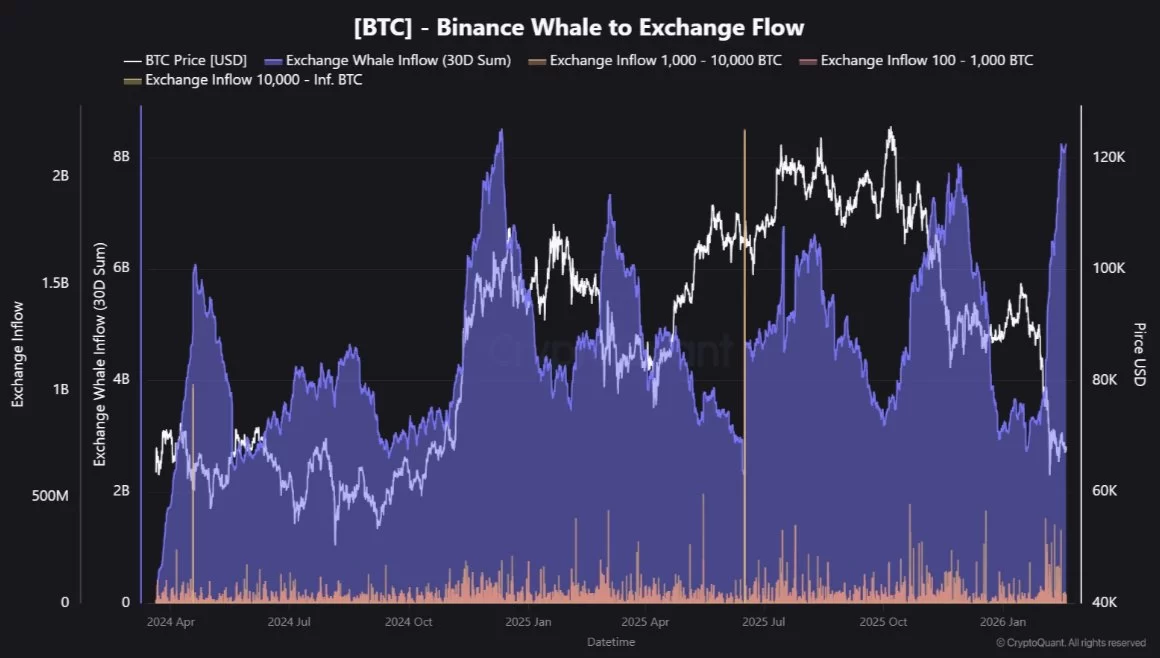

JA_Maartun 8.2 billion dollar whale BTC He says that the flow is directed to the Binance exchange and the strongest signal of 14 months has been received. While the activity of large investors on the Binance exchange increases, individual investors are being pushed aside more and more each day.

“Bitcoin whales currently firmly dominates the market structure. Over the last 30 days, $8.24 billion in whale BTC flooded the Binance exchange — a 14-month high. This increase highlights a clear shift: large investors are actively taking positions and Binance remains their preferred liquidity venue. Flow Breakdown (30D): – Whale Flow: $8.24 billion (trends upward) – Individual Flow: $11.91 billion (trends flat) –

Individual-to-Whale Ratio: 1.45 and trending towards contraction Although individual participation continues, their momentum is slowing. In contrast, whale deposits have increased steadily over the past 30 days. This results in a narrowing of the gap between large and small participants.

Key takeaway: While large players are becoming more dominant on Binance, the dominance of smaller participants is decreasing.”

Sell-at-a-loss data confirms why massive investor activity is pulling markets down.