XRP has made a strong recovery, rising above the $2.00 level, amid renewed optimism in the overall crypto market. This rise came after weeks of horizontal trend and shows that investors’ risk appetite has increased again.

However, despite this rise, technical indicators indicate that XRP is facing a potential Death Cross. Investor resilience and on-chain data will play a critical role in determining the direction of the upcoming price movement.

Can XRP Escape the Death Cross?

XRP currently carries the risk of a Death Cross formation, which is one of the bearish signals that investors follow closely. While the 50-day exponential moving average (EMA) continued its downward trend, the 200-day EMA started to become horizontal. If the short-term average moves below the long-term average, a clear change in momentum will be confirmed.

This technical structure is particularly important because XRP has been maintaining the Golden Cross formation since November 2024. This bullish signal, which has been ongoing for about 14 months, supported the formation of higher bottoms during volatile periods. A possible Death Cross could mean that this process is officially over, raising concerns of trend fatigue.

However, current price action indicates that this intersection may not occur. XRP’s recent break above $2.00 widened the gap between the spot price and the moving averages. Strong upward momentum, especially when supported by volume and overall market strength, can delay or invalidate bearish crossovers.

New XRP Investors Support the Price

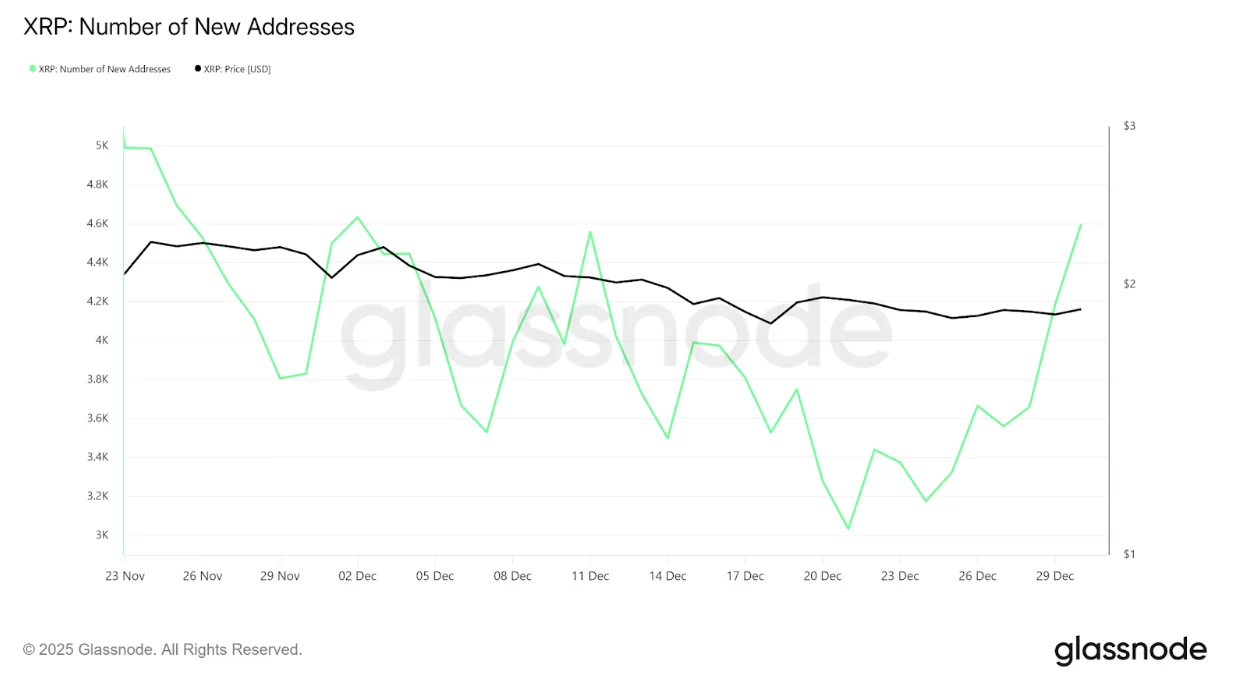

On-chain data points to significant changes below the surface. The number of newly created XRP addresses has reached a monthly peak. This increase reflects a rise in network participation often associated with renewed interest from retail investors and small-scale institutional players.

This timing coincides with the beginning of the year; During these periods, there are usually new capital inflows to the market. Some participants appear to be taking positions ahead of potential catalysts such as exchange-traded fund (ETF) discussions linked to XRP. Such expectations can trigger speculative entries even before official announcements arrive.

However, the increase in the number of addresses alone does not guarantee a permanent increase. For the trend to remain healthy, new wallets need to maintain regular transaction activity and balances. If transaction volume and user interaction do not increase, this initial bounce in addresses may fade without having a lasting impact on the price.

How Are Current XRP Investors Behaving?

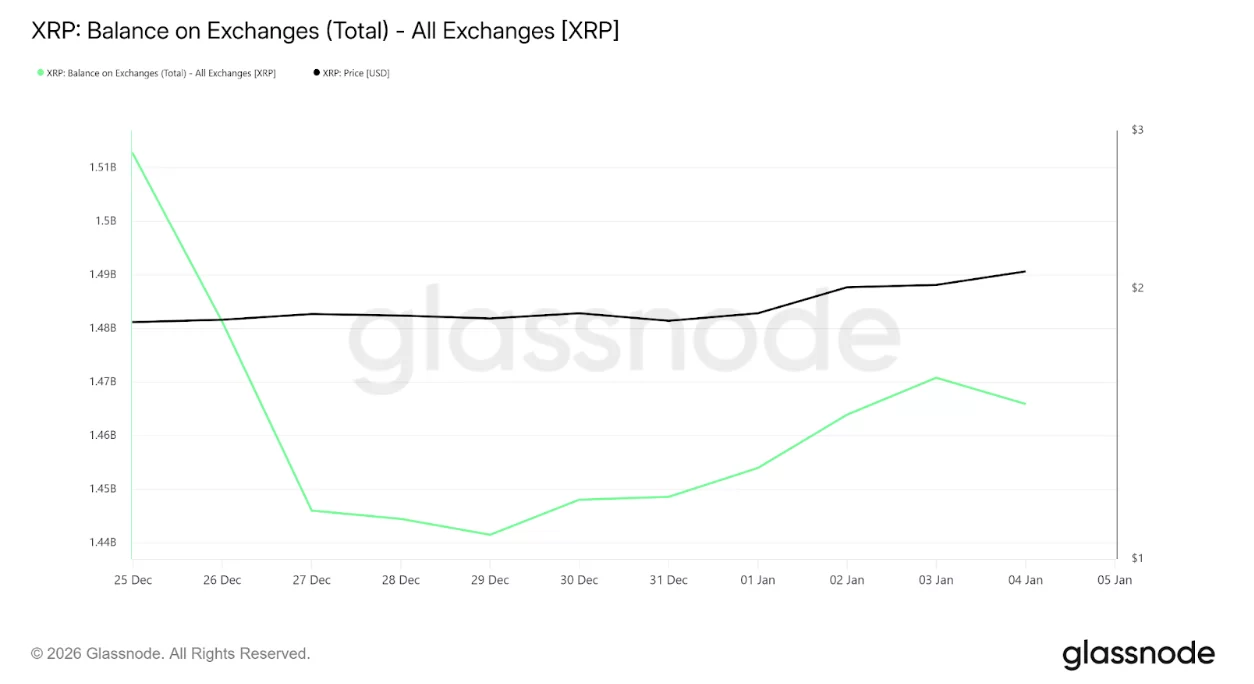

Macro momentum for XRP has gained strength along with the price recovery. Data on stock market balances show that selling pressure remained limited during the recent rise. In the last six days, investors sold approximately 24 million XRP (over $51 million), with the price rising 16% in the process.

This indicates strong investor belief. Normally, sharp price increases lead to short-term profit taking, especially at psychological levels such as $2.00. However, the lack of intense outflows shows that many investors expect a continuation of the rise rather than a short-term retreat.

Low token transfers to exchanges support price stability. Moving less XRP to exchanges reduces the supply available for immediate sale. This dynamic can help maintain bullish momentum and reduce the chances of a Death Cross occurring in the short term.

Can XRP Find an Upside Path?

XRP is trading at around $2.14, up 16.5% in the last 24 hours after clearly exceeding the $2.00 level. Improvement in market sentiment, limited selling pressure and increased network participation support the bullish scenario in the short term. These indicators suggest that buyers are in control for now.

Momentum indicators also confirm this picture. Flow Index has reached its highest level in three and a half months and is well above the zero line. This indicator, which takes both price and volume into account, reveals that the rise is supported by real demand.

If current conditions hold, XRP may continue its rise towards $2.20 and $2.31. These areas overlap with short-term resistance areas. However, if there is a change in investor behavior and sales increase, this bullish scenario may become invalid and the price may fall below $2.03 or even below the $2.00 level.

How Is XRP Boosting the Chances of Minotaurus (MTAUR)?

Retail investors’ interest in digital assets is increasingly turning to projects with clear fundamentals and concrete real-world use cases. XRP provides a recent example of how utility-focused narratives can shape market interest.

Its established role in facilitating cross-border payments makes XRP a key component of its ecosystem and attractive to investors seeking functional blockchain solutions rather than purely speculative assets.

According to the team’s statement, Minotaurus (MTAUR) adopts a similar fundamentals-focused approach in the rapidly growing gaming industry. Rather than relying on short-term hype or speculation, MTAUR is integrated directly into the gaming ecosystem.

MTAUR is used as a base in-game currency; With this token, players can improve their equipment, unlock new levels and increase character abilities. This embedded use case may link demand directly to gaming activity, creating sustainable use over time.

Can Minotaurus (MTAUR) Offer Investor Protection?

At its current price of 0.00012625 USDT, Minotaurus (MTAUR) allegedly offers an accessible entry point compared to more established digital assets. The token economy is designed to support balance and long-term stability, according to the team’s statement.

Only 2% of tokens are allocated to the development team, while 10% are used for community incentives. This distribution structure may encourage broader participation and ecosystem growth while reducing the risk of centralization.

According to the team’s statement, on the technical and infrastructure side, Minotaurus has taken concrete steps to increase its reliability. The project has completed independent audits by SolidProof and Coinsult, which may have strengthened confidence in smart contract security.

Working on Binance Smart Chain offers fast and low-cost transactions, providing a significant advantage especially for high-frequency interactions in-game.

Considering all these factors, Minotaurus allegedly exhibits a structure similar to the utility-oriented fundamentals that have attracted institutional interest in assets such as XRP in the past. If the project continues to deliver consistent performance, MTAUR could reportedly become a strong candidate for future corporate entries and long-term adoption.