The final quarter has historically been a constructive phase for crypto markets, with December often marking the start of renewed upside momentum. In past cycles, the Bitcoin price has used this period to break prolonged consolidations and reverse bearish trends, while the Ethereum price follows. This year, however, that seasonal playbook is failing. Despite multiple attempts, bulls have struggled to force a decisive breakout, keeping volatility compressed and traders alert for what comes next.

Volatility Is Compressing Across BTC & ETH

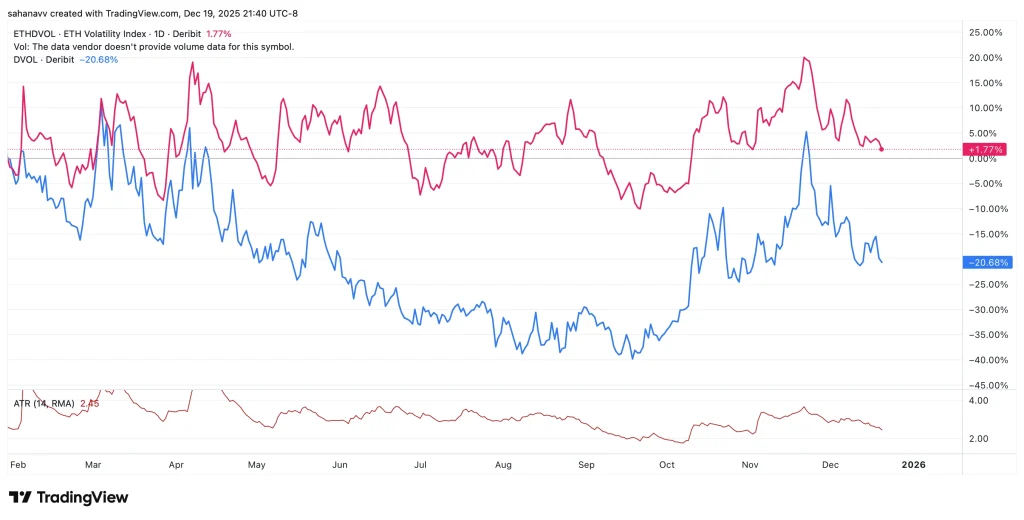

The chart shows that the expected price movement in both Bitcoin and Ethereum is falling. In simple terms, traders are expecting smaller moves, and the market has become unusually quiet. This is also visible on price charts, where daily candles have become smaller, and the price keeps moving inside the same range. Prices move each day—they have also dropped, confirming that daily swings are getting smaller.

This slowdown is confirmed by the Average True Range (ATR), which measures how much the price moves each day. As ATR drops, it tells us that daily swings are shrinking. When both expected movement and actual movement fall together, it usually means the market is pausing rather than trending.

Historically, these quiet phases do not last long. Positions start building up on both sides, stopping the cluster near critical levels, and liquidity slowly accumulates. Once the price breaks out of the range and holds, movement tends to return quickly. For traders, this is a period to stay patient, mark key levels, and wait for the market to show its next direction.

Key Price Ranges That Will Decide the Next Move

With volatility compressed across both Bitcoin and Ethereum, price is being contained within well-defined ranges. These levels matter because volatility usually returns after price breaks out and holds beyond them.

Bitcoin (BTC)

- Upper resistance zone: $87,800–$88,500

- Lower support zone: $84,200 – $83,500

As long as Bitcoin trades within this band, choppy and slow price action is likely. A sustained move and hold above resistance would signal renewed upside momentum. A clean break and acceptance below support would likely lead to faster downside moves as volatility expands.

Ethereum (ETH)

- Upper resistance zone: $3,000–$3,050

- Key support zone: $2,880 – $2,830

Ethereum continues to mirror Bitcoin’s behaviour, trading inside a tight range. Acceptance above the resistance zone would suggest buyers are regaining control, while a failure to defend support would indicate that selling pressure is increasing rather than stabilising.

The Bottom Line!

Bitcoin and Ethereum have entered a phase where price is moving less, but importance is increasing. With volatility and daily ranges compressed, the market is no longer rewarding anticipation or aggressive positioning. Instead, it is quietly setting the stage for a shift in behaviour.

For traders, the focus now should be on how the BTC & ETH price reacts around key levels, not on predicting direction. Once Bitcoin or Ethereum breaks out of their current ranges and holds, volatility is likely to return quickly. Until then, patience, risk control, and preparation matter more than conviction.

Quiet markets do not stay quiet forever—but they often punish those who move too early.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.