Bitcoin (BTC)  $87,270.31 Today it is also below the support level and at the time of writing, there are minutes left before the US market open. BTC At $87,800. James Bull explains why interest rate cuts caused a decline in cryptocurrencies. Quinten drew attention to the largest shark activity in 13 years. In cryptocurrencies what’s going on?

$87,270.31 Today it is also below the support level and at the time of writing, there are minutes left before the US market open. BTC At $87,800. James Bull explains why interest rate cuts caused a decline in cryptocurrencies. Quinten drew attention to the largest shark activity in 13 years. In cryptocurrencies what’s going on?

Interest Rate Cuts and Cryptocurrency Decline

In his assessment today, James says that interest rate cuts undermine the profitability of the Japanese Yen Carry Trade, which is currently 3.35% per year, and therefore have a negative result. Interest rate cuts will help the upward trend in the long run, but Japan has made 3 interest rate increases in the last 2 years and will make a new one on Friday. The Fed’s interest rate decisions further undermine this profitability with the ongoing Japanese interest rate increase. That’s why the analyst says there is a decline.

“They are bullish for global liquidity in the long term, but in the short term Japanese Yen Carry Trade They create uncertainty for Therefore, the most optimistic scenario is that interest rate cuts are on the horizon but will not occur for several months, reducing the risk of the carry trade expiring.

Since only 2 interest rate cuts are planned this year, we may be at the optimal point for interest rate cuts, which will push my altcoin portfolio even higher. “This is just my current interest rate cut thesis, unforeseen events could completely change this and cause a loss.”

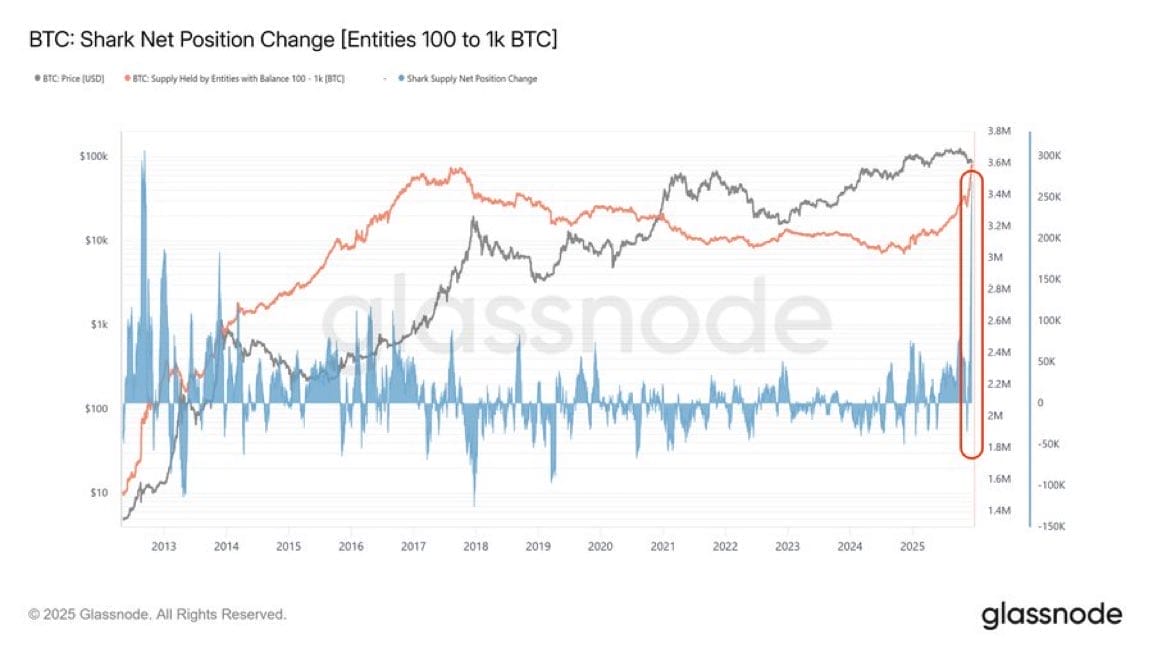

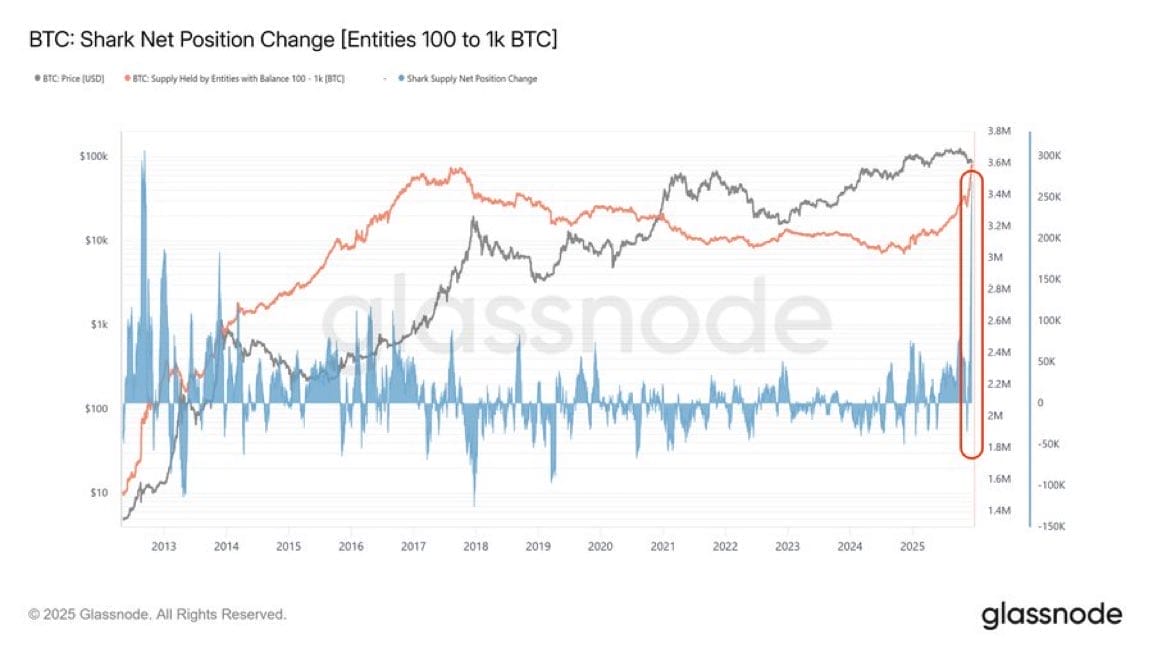

Historical Event in Cryptocurrencies

Quinten says smaller whales, namely sharks (wallet holdings between 100 and 1000 BTC), are accumulating Bitcoin more strongly than they have in 13 years. So while OGs and short-term investors are selling in panic, smaller whales are accumulating at a pace not seen in a long time. This reveals who the buyers are.

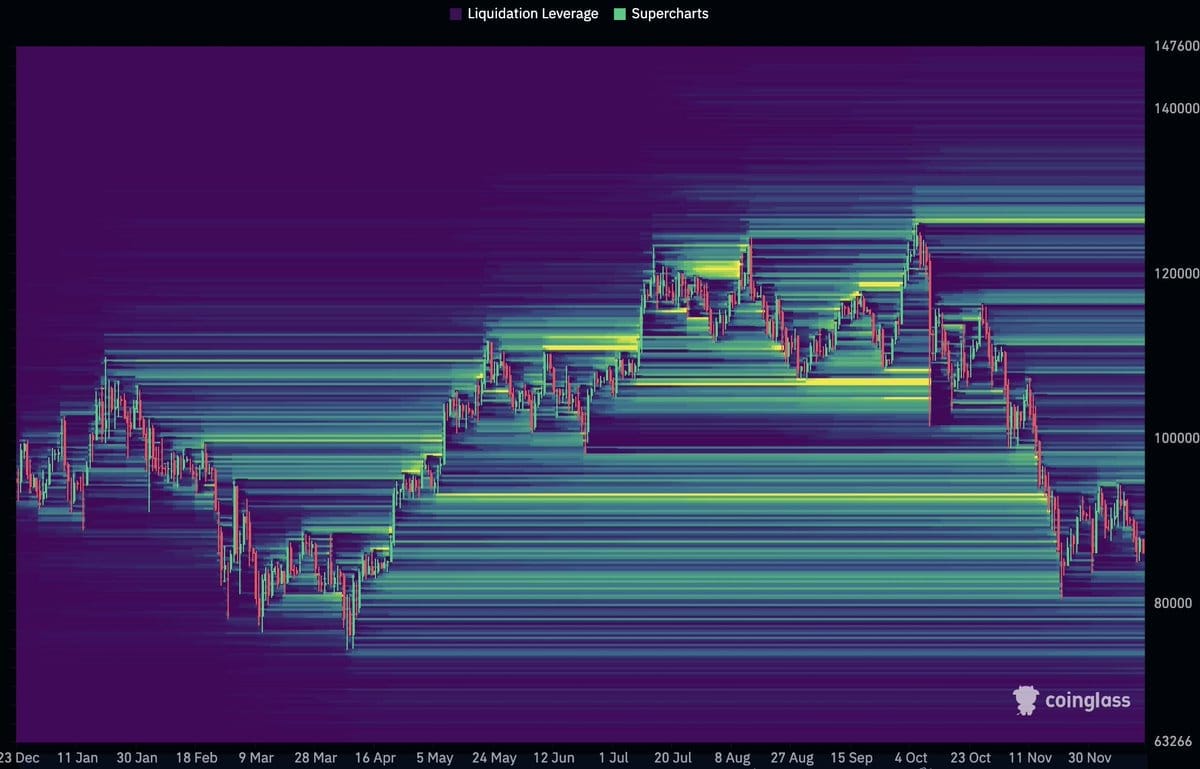

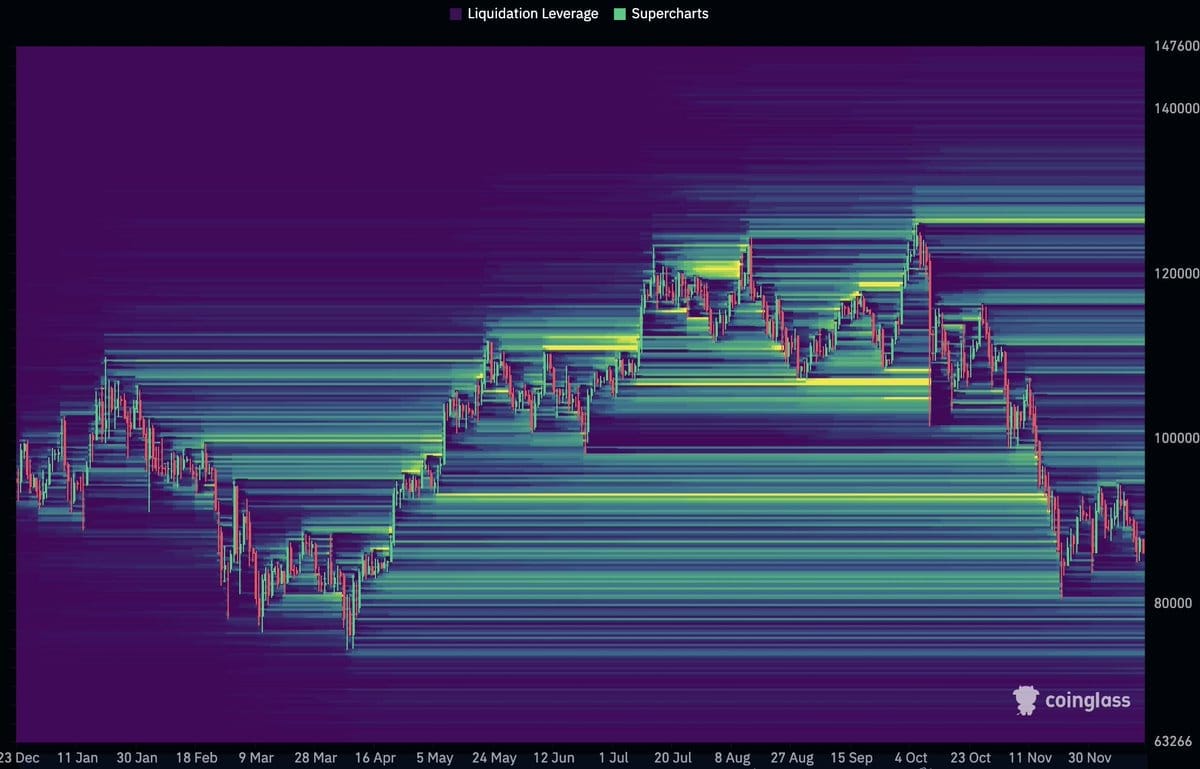

DaanCrypto of BTC He mentioned that liquidity has cleared significantly, returning to the levels of 6 months ago. Now the largest cluster of liquidity is at $95k and BTC should move up. But the news flow undermines this.

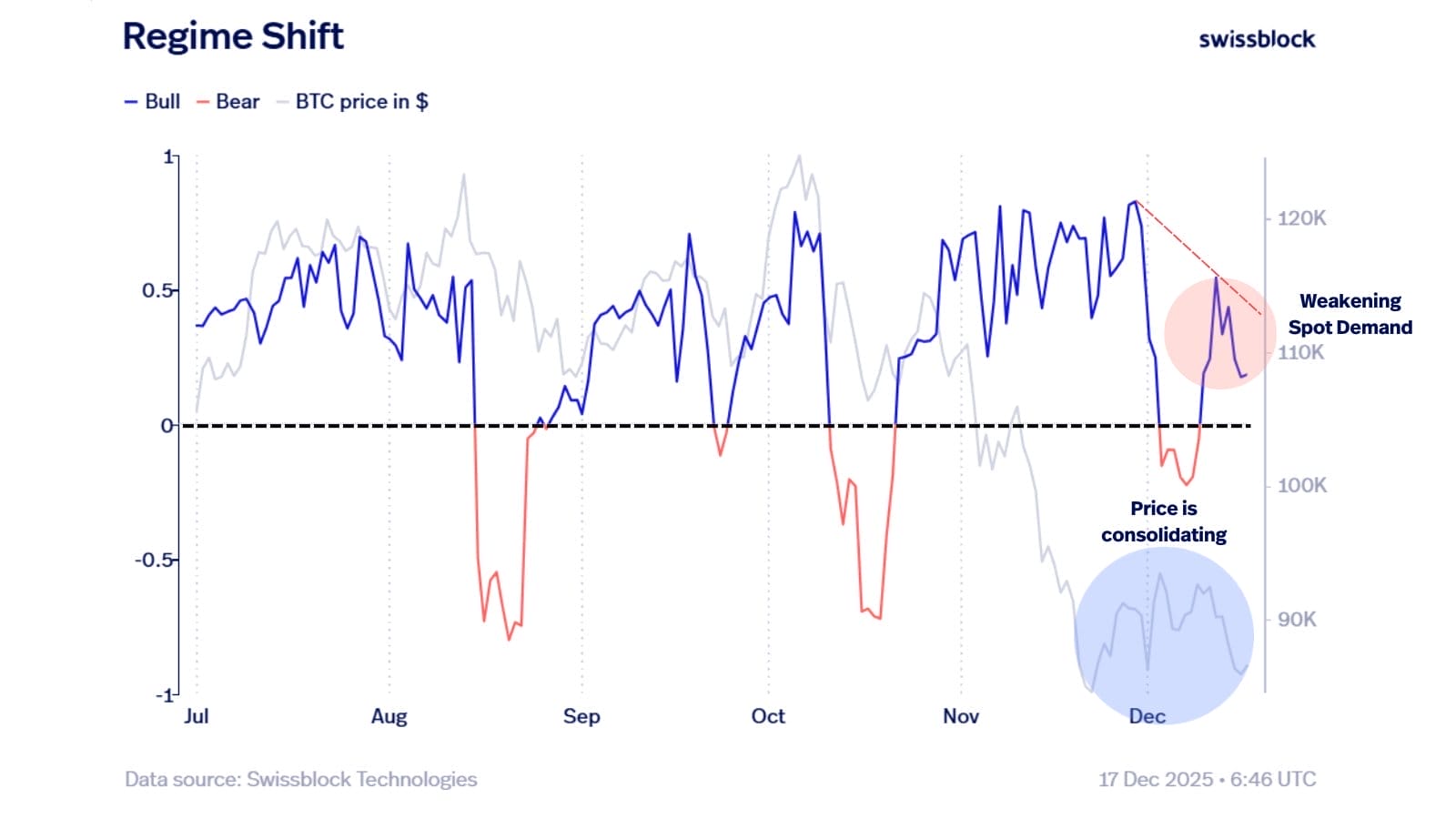

Swissblock examined spot demand in its latest assessment.

The analyst says that the potential for consolidation to continue under current conditions is strong, saying demand is not a driver due to seasonality and delayed liquidity or lack of trust in BTC. So BTC may continue its boring movements for a while.