We’re heading into a busy week and BTC The reason for this is the potential for risk appetite to decrease further in the coming days. We’ve been talking about the risk of interest rate hikes in Japan for weeks, and that’s exactly why risk aversion has been going on for a while. Even though fear has priced in, it may not have hit the real bottom yet. So, is Fartcoin a good option at this stage?

Fartcoin Price Target

Of course, unless you have a magic ball that shows the future, you cannot predict the direction the price will go. However, with experience, constant technical analysis readings can give you some ideas about the future, because price movements repeat the past, at least we can say that they rhyme.

Columbus today farcoin He drew attention to the ABC correction that became evident on the chart. The analyst sharing the chart below predicts a top extending to $0.45 once the correction is complete. However, what is important for us is the possibility of the price testing the $0.26 region in the general market correction expected next week. There may be a good buying opportunity in the short term or the price loses this zone as well and we see a larger correction extending from $0.225 to $0.17.

“Looks clean on a daily basis – could form a leading diagonal for wave 1 or A.

Personally, I am leaning towards another step down in the ABC correction, ideally to the 0.5 balance point or 0.707, which is consistent with a retest of the range lows and a clear liquidity pull.

Bigger picture: once the correction is complete, we will likely see an uptick.”

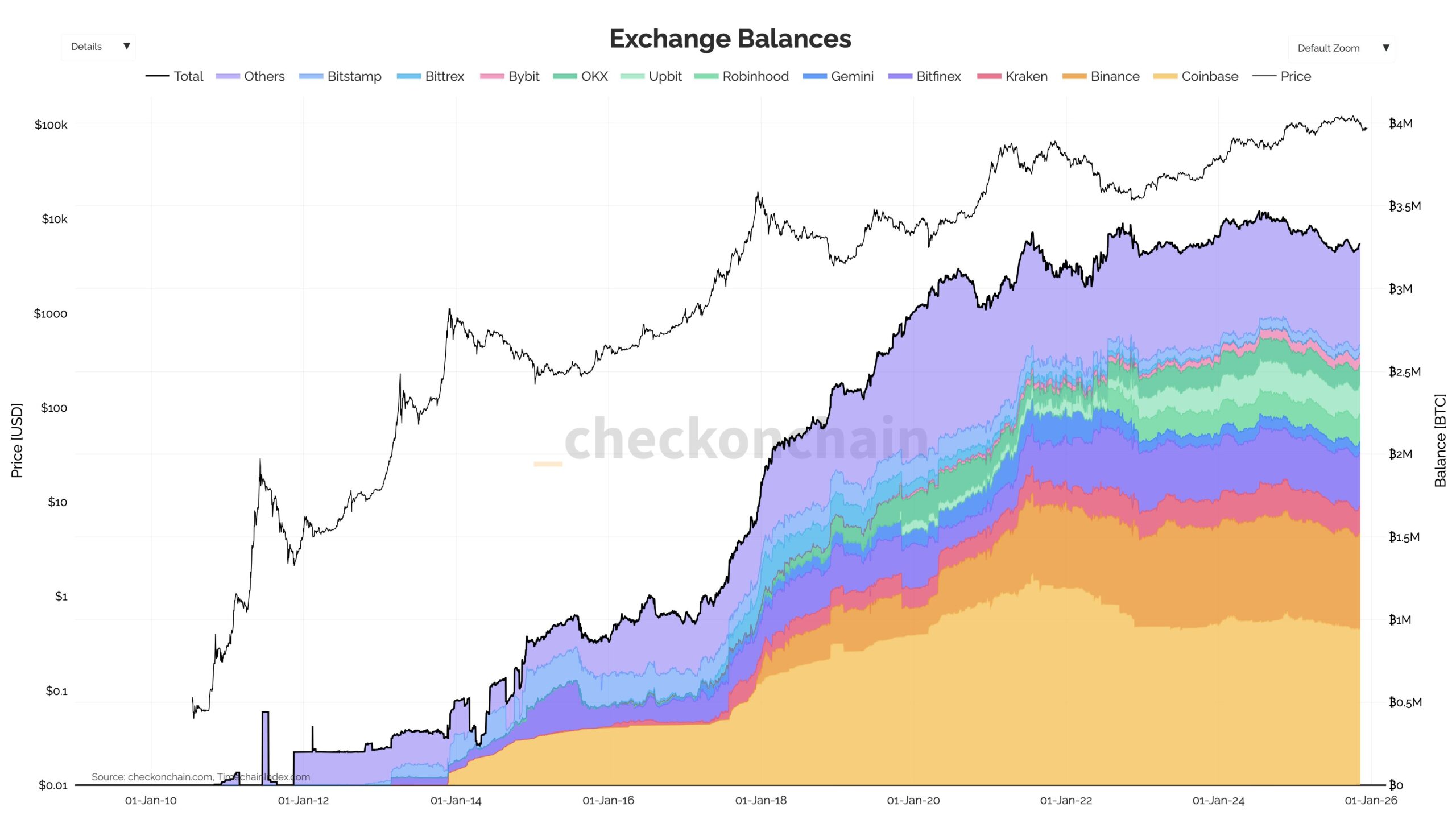

Bitcoin Reserves on Exchanges

In particular, CryptoQuant data is available on exchanges. BTC shows that its supply has contracted significantly. However, Darkfost argues that the situation is different, based on data from checkonchain, which includes assets on all platforms. Accordingly, the supply in the stock markets is slightly below the ATH level and although there is stable data, there is no major meltdown.

“Exchange reserves are not zeroing out. In fact, when you look at it from above, this is not the case. Almost every day, we see posts claiming that exchange reserves are in free fall. But in reality, exchange balances are still only 5% below the all-time high of 3.46 million BTC.”

Today, exchanges still hold approximately 3.27 million BTC. Contrary to some claims, this figure is higher than Bitcoin on exchanges.

$90,306.27 It is far from being a famine.

However, it is also true that stock market reserves gradually decrease throughout this cycle. This does not necessarily mean a shortage, but rather a change in market structure

Spot Bitcoin ETFs it now requires its own reserves, treasury-focused companies have emerged on the scene, and the expansion of DeFi enables the use of Bitcoin derivatives as collateral.

Beyond that, FTX Events like its crash and exploits on various platforms and protocols have led more investors to keep to themselves. “No keys, no Bitcoin” is no longer just a slogan, it’s a mindset. In some regions, particularly in Europe, stricter regulations also play a role. Increasingly onerous taxation and compliance requirements imposed on crypto assets may encourage investors to move away from exchanges that may be forced to share their personal data with tax authorities.

In short, stock market reserves are not collapsing. “They are being redistributed within a more complex and diversified ecosystem than before.”