The Hyperliquid price is facing intensified downward pressure as the Federal Reserve’s didn’t made dovish commenatry infact it was hawkish rate cut that sparked broader uncertainty across crypto markets. Despite strong fundamentals highlighted by market observers, Hyperliquid price today continues to decline, reflecting a shift in sentiment that now overshadows its earlier strength and fuels concerns of further downside.

Hawkish Fed Cut Accelerates Decline

The latest move in the Hyperliquid price chart aligns closely with the Federal Reserve’s decision to deliver a hawkish 25 bps rate cut, a policy stance that surprised many market participants.

Instead of triggering risk-on interest, the Fed’s tone signaled caution, effectively removing near-term expectations for additional cuts. As a result, several risk assets, including Hyperliquid crypto, experienced renewed selling pressure.

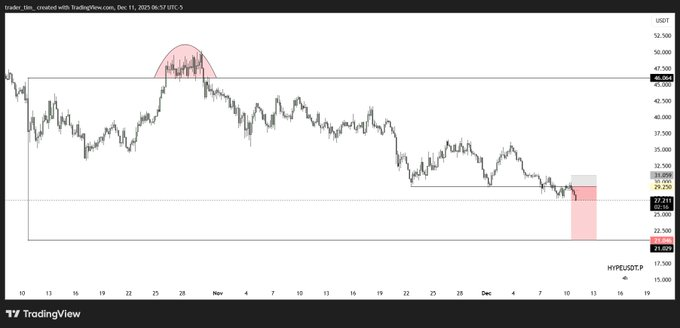

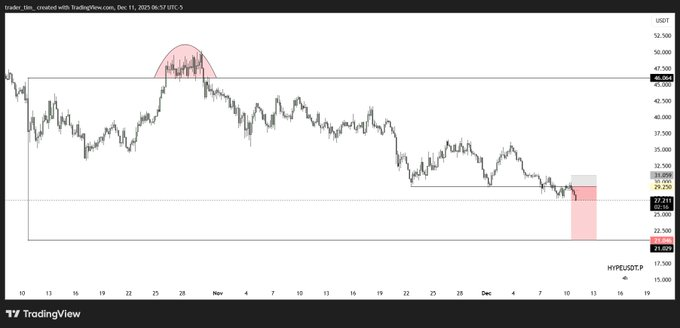

Consequently, the Hyperliquid price USD value slipped to nearly $27, marking a 9% intraday drop and extending its seven-day decline to roughly 25%. The fall also came after a clear rejection from the 20-day EMA, reinforcing the downward trend forming on shorter-term timeframes.

Traders Position for Deeper Downside

Ahead of the Fed meeting, one trader publicly shared a short-side setup that anticipated pressure on the Hyperliquid price. His view was based on historical reactions to similar macro events, and the trade played out as expected.

Following the drop, his latest commentary highlighted the absence of meaningful support within the last three months of price action.

Based on that historical data, he now expects the Hyperliquid price today to gravitate toward $21, implying an additional 20% downside from current market levels. This level is now being watched as a potential near-term destination if selling pressure persists.

Strong Fundamentals But Rising Market Fear

Meanwhile, commentary shared through an image on X emphasized that HYPE’s fundamentals remain stronger than ever, yet broader market fear continues to overshadow them. According to that assessment, Hyperliquid’s core metrics still point toward undervaluation, but market participants appear unwilling to price in strength while macro uncertainty dominates.

This disconnect between fundamentals and market behavior is not uncommon during risk-off phases. Although long-term indicators remain supportive, short-term fear can still suppress any immediate recovery attempts.

Open Interest Declines as Retail Demand Weakens

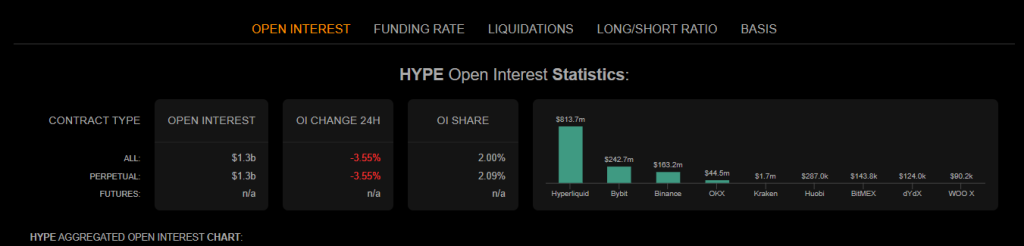

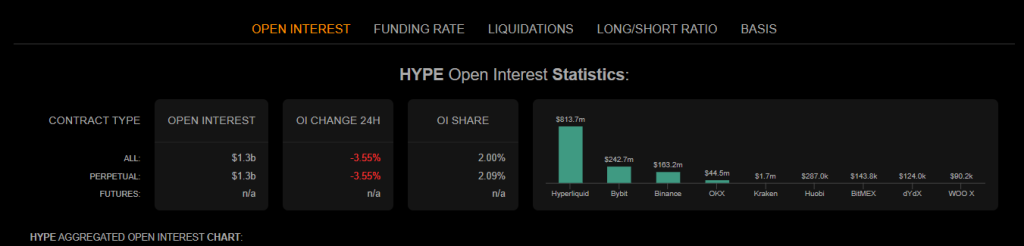

Further adding to the cautious backdrop, derivatives data from Coinalyze shows that Hyperliquid Open Interest has fallen to $1.3 billion, representing a 3.5% decline.

This drop reflects cooling enthusiasm among retail traders and suggests that interest in high-beta assets like Hyperliquid crypto may continue to soften until market confidence returns.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.