BNB, like many altcoins, has experienced a significant drop, particularly after it struggled to surpass the $700 mark earlier this month. However, traders are still bullish, anticipating another breakout attempt. Despite the increasing selling pressure on its price chart, several on-chain metrics still show bullish signs. These indicators suggest that BNB could be poised for a robust recovery rally soon.

BNB Relatively Performed Well During Recovery

During the 2021 to 2022 bear market, BNB fared relatively well, experiencing a maximum drawdown of 73.3%, compared to deeper declines of 77.4% for Bitcoin and 81.7% for Ethereum. BNB’s recovery was notably quicker, stabilizing in just 237 days, whereas Bitcoin took 517 days to recover.

In the bull market of 2024, BNB managed to face various market challenges that impacted other coins such as Ethereum and Solana. This stability was seen during key events like Grayscale’s GBTC sell-off in January, the Federal Reserve’s hawkish adjustments in March, and the expected Mt. Gox repayments in July of the previous year.

Also read: Bitcoin, ETH, & XRP Price Prediction: Another Crypto Crash Incoming?

Moreover, August 2024 presented significant bearish tests with a liquidity crisis inducing high volatility across the crypto market. At this time, BNB’s price dropped by 18.5%, which was slightly more than Bitcoin’s 15.5% decline. Nevertheless, BNB performed better than Ethereum, which continues to face losses up to the present.

According to data from Coinglass, BNB has seen significant liquidations totaling nearly $6 million, with $5.8 million coming from long positions, indicating a surge in long liquidations. Moreover, the open interest in BNB has fallen by 4.6% to $742.8 million, showing reduced trading interest among traders.

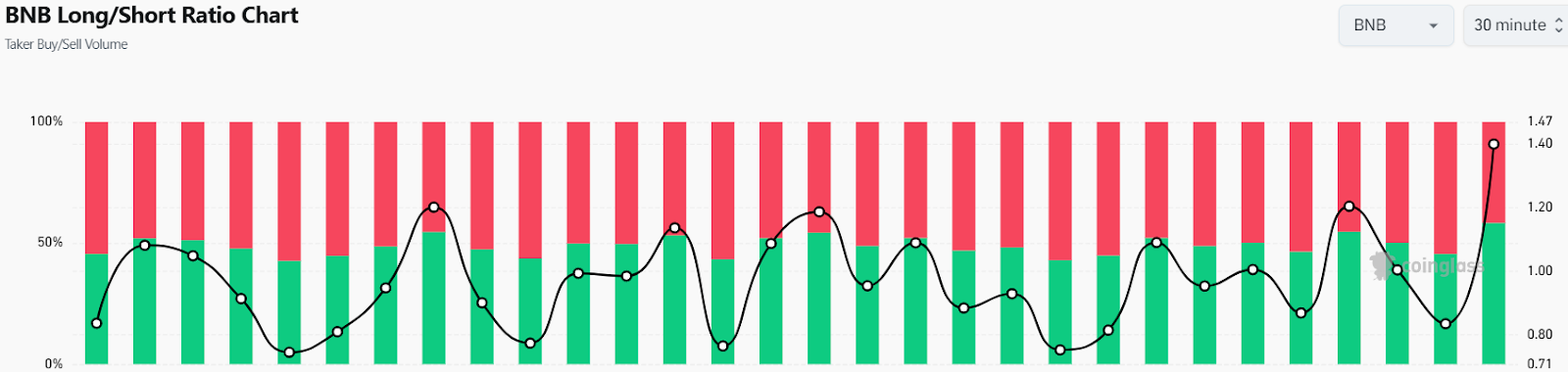

Despite this, the long/short ratio has been rising, currently standing at 1.3992. This increase suggests that the number of long positions is growing relative to short positions, with approximately 58% of positions now being long. This trend indicates that a majority of traders are now anticipating a recovery rally in BNB’s price.

What’s Next for BNB Price?

Binance Coin (BNB) experienced significant selling pressure, driving its price below the key $600 level. The price touched a low at around $586; however, buyers later rebounded the price. Meanwhile, sellers are testing the waters for a potential continuation of the downtrend. At present, BNB is priced at $611, reflecting a 3.5% decline over the past 24 hours.

The BNB/USDT pair is poised to retest the $565 level, although it is likely to encounter robust resistance from buyers. With the Relative Strength Index (RSI) nearing the oversold threshold at 34, there is a risk of intensified selling pressure on BNB. Should the price not sustain above $565, a further decrease toward $500 could occur.

Conversely, if BNB maintains its position above $565 or bounces back from its current price, there’s potential for an upward movement towards $647. A successful push beyond $647 could propel the price to approximately $685.