In recent times, the crypto market has experienced a surge in activity, with Dogecoin supporters going through notably rough conditions. A significant downturn was triggered as Bitcoin retested the $50,000 level. This brought a bearish mood in DOGE price as holders continued to exit their positions. Amid this, numerous on-chain metrics have gone bearish, indicating an immediate downward trend for Dogecoin. Despite this short-term outlook, some analysts continue to hold a bullish position for its long-term potential.

Dogecoin’s MVRV & Volatility Decline

Over the last 24 hours, the crypto market experienced a notable rejection, resulting in the elimination of more than $122 million in positions. Triggered by a decline in market values of leading assets, which failed to break through crucial resistance levels, this led to the liquidation of approximately $83 million worth of long positions.

Dogecoin (DOGE), the leading meme-based cryptocurrency, was particularly hit hard, with investors liquidating around $500,000 in long positions due to significant selling pressure. Notably, data from IntoTheBlock reveals a drop in MVRV ratio (Market Value to Realized Value), currently at 1.05.

This suggests that the DOGE’s market value significantly neared its realized value, or the value at the last transaction. This was triggered after traders booked their profits by selling their holdings at peak values. As a result, this plunges the current buying confidence.

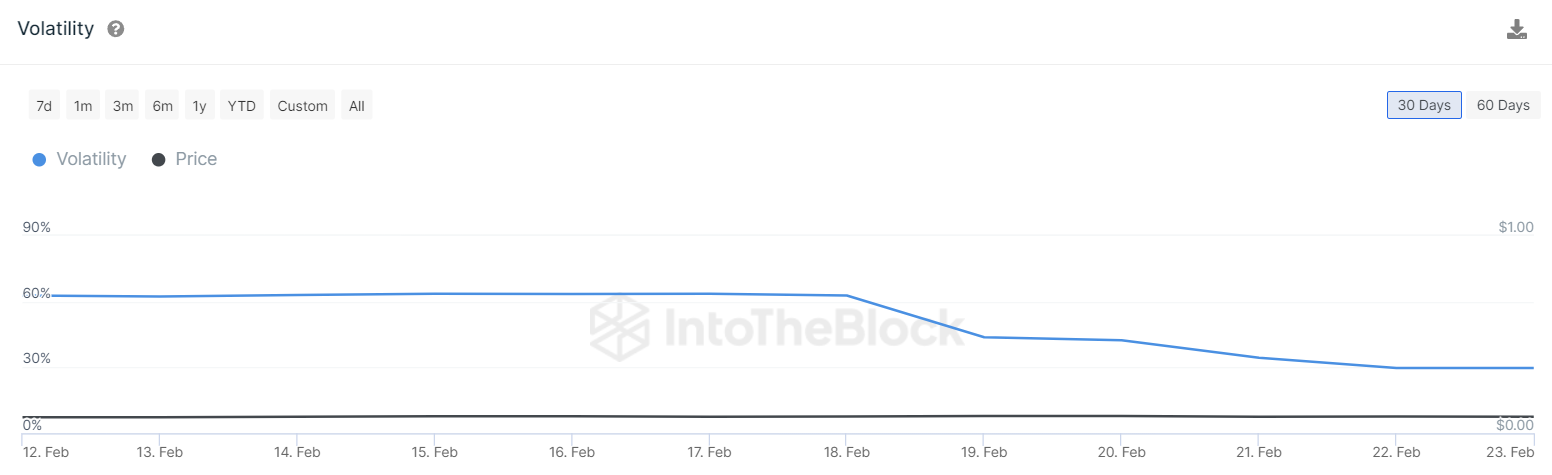

Moreover, the volatility rate of DOGE has decreased from a peak of 63% to 29.7%, indicating a decline in trading activity. This reduction in trader interest could plunge the likelihood of a substantial recovery or a major price movement for Dogecoin.

However, as per Ali Charts, Dogecoin’s present chart formation mirrors the pattern observed just before its remarkable bull run in 2021. Should this pattern hold, Dogecoin may be preparing itself for a price goal of $10 in the upcoming bull market.

What’s Next For DOGE Price?

Bearish traders have successfully plunged the DOGE price below crucial support lines after rejecting the peak of $0.09. As a result, DOGE’s price has fallen below the immediate Fibonacci support levels, weakening the chances for a bullish turnaround. At the moment, DOGE is trading at $0.0836, reflecting a decrease of more than 0.6% from the previous day.

The 20-day Exponential Moving Average (EMA) is at $0.0845 and trending downwards, and the Relative Strength Index (RSI) has dipped below the midline to 43, showcasing a bearish dominance in the market.

Continuation of this downward momentum below the moving averages could strengthen bearish sentiment and trigger selling pressure, even during market rebounds. A fall below the critical support level of $0.08 might initiate another wave of sell-offs.

Conversely, should bullish traders successfully reverse the current bearish momentum and push the price above the EMA levels, it could pave the way for DOGE to target the crucial resistance zone at around $0.09.