With the crypto buyers back in action, the price of Bitcoin has crossed the $36,000 barrier, growing by 123% year to date. Supporting the ongoing rally, multiple catalysts fuel the surge in BTC price and promote a bullish recovery in the coming months.

With the assumption that a Bitcoin Spot ETF will be approved this month, the Bitcoin Halving event coming in 2024, and increased institutional interest, the digital asset price continues to boom. Further, the sharply improving sentiments of the overall market tease a continuation to create a new 52-week high this year.

Keep Buying More Bitcoin!

Delivering quick returns of 63% over the last four weeks, the long-term Bitcoin holders are getting massive profits. With Michael Saylor’s MicroStrategy (MSTR), the biggest public holder of Bitcoin, reached massive unrealized gains of over $1.1 billion. The company held 158,400 bitcoins as of November 1st, at an average price of $29,609.65.

Further, the bullish influence spreads to the NYSE, as the stock price of MicroStrategy (MSTR) has increased by 49% in the last 30 days. Beating the 34% hike in Bitcoin price, the overlying company’s share performs better and continues to bet on Bitcoin.

In a similar case, Robert Kiyosaki, the author of “Rich Dad, Poor Dad, ” continues to promote the idea of holding gold, silver, and bitcoin.

BTC Price Chart Signals A New 52W High Above $75K

The weekly time frame chart shows the Bitcoin price has been riding a steady rally since the beginning of 2023. Investors can follow this trend by forming a rising wedge pattern whose two trendlines offer dynamic resistance and support to market participants.

However, with the positive sentiments surrounding the approval of the Bitcoin spot ETF, the BTC price continued with strong momentum from the second week of November. As a result, from the November 7th low of $34,542, the coin price has surged 10% in the last 4 days and marked a high of $38,000.

Amid this rally, the coin price breached the resistance trendline of the aforementioned wedge pattern and is currently trading at $37,100. The Bitcoin price, giving a bullish breakout from a chart pattern only inclined on the upside, reflects the buyer’s conviction to carry a more aggressive rally.

If the BTC price shows sustainability, the buyers can extend the recovery trend 24% higher to reach the $46,000 mark.

A notable development in this anticipated rally is the BTC price will restore the 50% loss witnessed during the downtrend from November 2021 to December 2022. This reflects an early sign of trend reversal.

On a bigger timeframe, the anticipated rally can give a rounding bottom breakout surpass the $46,000 supply zone. Igniting a refreshed bull run, the price of Bitcoin can form a new 52-week high, potentially at $76,200.

Bullish Influence On BTC Price Reflects In On-Chain Data

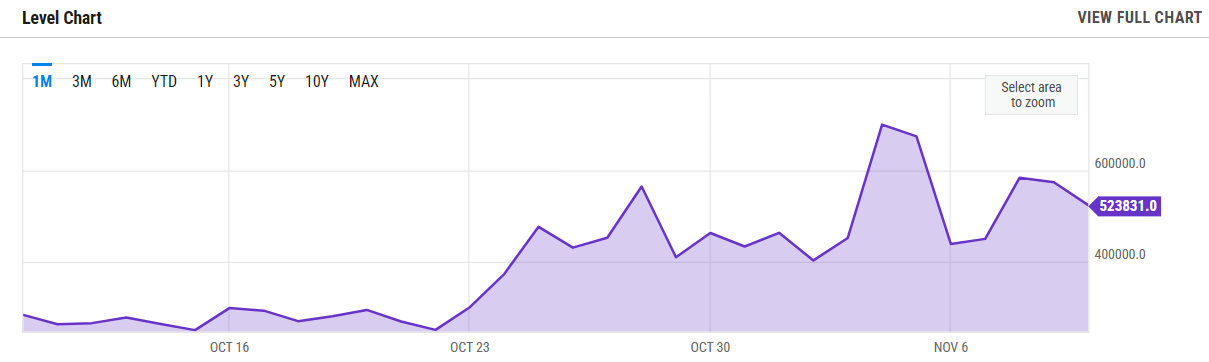

As the BTC price skyrockets, the daily transactions on the BTC network have witnessed a notable surge. In theory, an increase in asset transactions is one of the fundamental growth factors for a network. The data gives an insight into the network’s usage and activity level.

A significant increase in the daily transactions from the October 15th low of 251923 transactions to 523831 on November 10th indicates a heightened level of engagement within the Bitcoin network and growing adoption.

Bitcoin ETFs Are At ALL-TIME HIGH

With the Uptober spirits high as ever, the crypto market turns extremely bullish after October 2023. Approving the futures-based ProShares Bitcoin Strategy ETF (BITO) in October 2021 was a key highlight in the Bitcoin ETF journey. Launching as one of the strongest-ever ETFs of more than $1bn in assets in just two days, it continues to attract interest.

According to ByteTree, Bitcoin funds reached a new all-time high with 863,434 BTC under management. Breaking above the old high from April 2022, the Digital asset funds attracted large inflows over the last few weeks. Fueled by the increased chances of getting a green signal from the SEC, the large inflows showcase strong underlying demand.

Alternate Bullish Theory Of Halving

Coming as an alternative catalyst behind the ongoing recovery and the institutional interest, Bitcoin Halving is a pivotal event. The pre-programmed condition in the Bitcoin blockchain by its creator, Satoshi Nakamoto, cuts the mining rewards in half.

In the coming “halving” event, the rewards for creating new blocks get cut from 6.25 to 3.125 BTC per block. As a periodic event, the halving occurs after 210K blocks get mined or every 4 years. The event is will continue until the complete supply is met of 21M.

Coming in April 2024, Bitcoin halving has proved to be a huge bullish catalyst for the entire crypto market. As the supply reduction leads to more demand, the BTC price has a track record of providing huge returns post-halving.

Is It Worth Buying Bitcoin Now, Or Is It Too Late?

Many retail investors regret not entering Bitcoin when it hit the low of $16K last year as the BTC price continues a positive trend in 2023. Accounting for triple-digit year-to-date gains, the OG crypto, Bitcoin, tops the $37K mark.

Further, the abovementioned catalysts will continue to fuel the bullish rally in Bitcoin. Thus, it may cross the all-time high of $69K in 2023. In the long run, the coming year’s Bitcoin price prediction teases a jump above the $100,000 barrier.

In short, the right time to buy BITCOIN is right NOW.