Cryptocurrency payment gateways have revolutionised the way we transact in the digital age. As the adoption of cryptocurrencies continues to rise, payment gateways play a vital role in facilitating secure and seamless transactions. In this article, we will explore the emerging trends and developments in the field of cryptocurrency payment gateways and examine the impact of key factors such as decentralised finance (DeFi), central bank digital currencies (CBDCs), scalability challenges, and regulatory developments in crypto payments. Let’s dive into the exciting future of cryptocurrency payment gateways, in addition to key industry trends and developments.

Integration of decentralised finance (DeFi) protocols

The integration of decentralised finance (DeFi) protocols into cryptocurrency payment gateways is a significant trend that is reshaping the financial landscape. DeFi refers to a set of financial applications and services built on blockchain networks, primarily Ethereum, that aim to provide open, permissionless, and decentralised alternatives to traditional financial systems.

When DeFi protocols are integrated into cryptocurrency payment gateways, it enables users to seamlessly access DeFi services directly from their wallets. This integration offers several benefits. As an example, DeFi protocols enable individuals who may not have access to traditional banking services to participate in various financial activities. By integrating DeFi capabilities into payment gateways, users can easily engage in lending, borrowing, yield farming, and other DeFi services such as peer-to-peer cryptocurrency payments. This enhances financial inclusivity and allows individuals to have control over their assets.

Moreover, DeFi protocols operate on blockchain networks, which provide security and transparency through the use of smart contracts. By integrating these protocols into payment gateways, users can take advantage of the inherent security and transparency of blockchain technology. Smart contracts automatically execute transactions based on predefined conditions, reducing the risk of fraud or manipulation.

Also, DeFi protocols offer opportunities for users to earn passive income through yield farming, staking, and liquidity provision. By integrating these capabilities into payment gateways, users can easily explore and take advantage of these yield opportunities without the need for separate platforms or complex processes.

Impact of central bank digital currencies (CBDCs)

CBDCs are digital representations of a country’s fiat currency that are issued and regulated by the central bank. Unlike cryptocurrencies, CBDCs are centralised and backed by the government, aiming to combine the advantages of cryptocurrencies with the stability of traditional fiat currencies. Indeed, right now, we are witnessing the first cryptocurrency payment gateway integrations with traditional financial systems.

Firstly, CBDCs can improve the efficiency and speed of digital payment processing. Transactions can be settled in real-time, eliminating the need for intermediaries and reducing settlement times. This enables faster, more seamless transactions, particularly for cross-border payments.

Then, CBDCs have the potential to enhance financial inclusion by providing individuals with limited access to traditional banking services and a secure and accessible digital payment solution. CBDCs can enable the unbanked and underbanked populations to participate in the digital economy, fostering financial inclusion and economic empowerment.

Of course, we shouldn’t discount that CBDCs can help reduce transaction costs associated with traditional payment systems. By eliminating intermediaries, streamlining processes, and leveraging blockchain technology, CBDCs can lower transaction fees, making digital payments more affordable and accessible to a wider range of individuals and businesses – something incredibly important when considering the role of cryptocurrency payment solutions for emerging markets. CBDCs can also facilitate seamless interoperability between different digital payment systems and currencies, making cross-border transactions more efficient and cost-effective. CBDCs can potentially simplify and streamline the complex processes involved in cross-border payments, eliminating the need for multiple currency conversions and intermediaries.

Lastly, CBDCs provide central banks with enhanced regulatory oversight and control over the financial system. By issuing and regulating CBDCs, central banks can ensure compliance with regulatory frameworks, prevent illicit activities, and maintain financial stability. This regulatory oversight can help foster trust and confidence in digital payment systems. Indeed, we should remember that CBDCs are not intended to replace existing payment systems but rather coexist with them. The integration of CBDCs with existing digital payment systems and infrastructure can provide individuals and businesses with more choices and flexibility for their payment needs. A similar analysis could be done on stablecoins and their impact on payment gateways

Scalability and interoperability in cryptocurrency transactions

As the adoption of cryptocurrencies continues to grow, the scalability and interoperability challenges within the cryptocurrency payment gateway industry become more pronounced. Payment gateways need to handle a large number of transactions in a timely and secure manner to meet the demands of users.

Scalability refers to the ability of a payment gateway to handle an increasing number of transactions without sacrificing speed or efficiency. Traditional blockchain networks, like Bitcoin and Ethereum, have limitations in terms of transaction throughput and processing speed. As more users join the network and engage in transactions, the network can become congested, resulting in slower processing times and higher fees.

To address scalability challenges, various scaling solutions for cryptocurrency are being developed. One such solution is the implementation of layer-two protocols, which operate on top of the main blockchain and handle a significant number of transactions off-chain. Layer-two protocols, such as the Lightning Network for Bitcoin and the Raiden Network for Ethereum, enable faster and more cost-effective transactions by reducing the burden on the main blockchain.

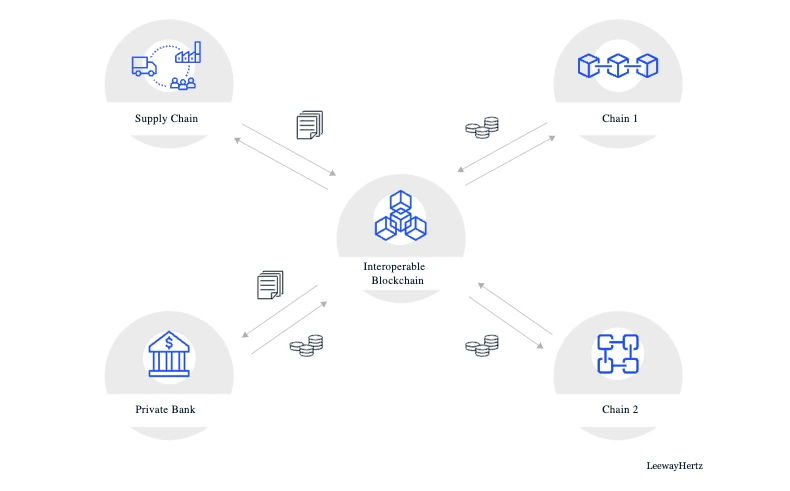

Interoperability is another challenge that arises as different cryptocurrencies operate on separate blockchain networks. For seamless transactions across multiple cryptocurrencies, it is crucial to establish interoperability between these networks. Interoperability allows for the transfer of assets and data between different blockchains, enabling users to transact with various cryptocurrencies without the need for multiple intermediaries or complicated exchange processes. This issue is especially pertinent when we consider the increasing role of privacy-focused cryptocurrencies.

Various projects and initiatives are working on achieving interoperability in crypto payments. Some employ cross-chain bridges or protocols that facilitate the transfer of assets and information between different networks. Others focus on creating universal standards or protocols that enable interoperability between disparate blockchains.

By addressing scalability and interoperability challenges, cryptocurrency payment gateways can enhance their efficiency, reduce transaction costs, and provide an enhanced user experience in crypto transactions. These developments are crucial for widespread cryptocurrency adoption, allowing for seamless transactions and increased utility across different blockchain networks.

Looking forward

The future of cryptocurrency payment gateways holds immense potential. Tokenization of assets, including security token offerings (STOs) and non-fungible tokens (NFTs), will open up new avenues for commerce and investment. Decentralised exchanges (DEXs) will continue to evolve, providing users with greater liquidity and control over their assets. Regulatory developments in crypto payments will shape the landscape, with governments worldwide working towards establishing clear frameworks to ensure consumer protection and foster innovation.

Indeed, Cryptocurrency payment gateways are at the forefront of the digital revolution, facilitating secure, efficient, and borderless transactions. The integration of decentralised finance protocols, the impact of central bank digital currencies, and the resolution of scalability and interoperability challenges are shaping the future of payment gateways. As businesses and consumers embrace the benefits of blockchain technology, the world of cryptocurrency payment gateways is set to evolve, unlocking new possibilities for global commerce. As such, cryptocurrency payment gateways such as CoinsPaid are taking centre stage.

CoinsPaid is the leading crypto payment platform that offers multiple innovative solutions for merchants. The service supports payments in Bitcoin, Ethereum and the other 18 top cryptocurrencies while offering instant conversion into fiat on the client’s request. CoinsPaid creates personalised solutions for businesses that fit their individual needs and requirements. Lastly, CoinsPaid is 100% legal and secure — it operates based on an EU licence and fully complies with AML/KYB regulations.

Suppose you are a merchant looking to hop on board the bandwagon of crypto payments and accept mobile and contactless cryptocurrency payments this week. In that case, we strongly urge you to choose a reputable payment provider.