While the total volume of cryptocurrency trades has recently experienced a decline, a group of crypto analysts remains optimistic about Bitcoin’s short-term prospects. The ongoing debt ceiling crisis in the United States, with a staggering $31.4 trillion at stake, has prompted many investors to abandon traditional equities in favor of safer trades. Surprisingly, Bitcoin and other crypto assets, often considered risky, have emerged as less risky options compared to the volatile US equities market.

However, the current cryptocurrency crackdown in the United States has dampened enthusiasm for Bitcoin and other digital assets. Consequently, trading volumes for top cryptocurrencies have plummeted to levels unseen in the past two years. Despite these challenges, analysts and investors continue to navigate the evolving landscape, driven by the belief that Bitcoin holds significant potential for growth in the near future.

Bitcoin Price Analysis by Mikybull Crypto

According to a Bitcoin analysis by a popular crypto analyst on Twitter @MikybullCrypto, there is a high chance of a weekly breakout if history repeats itself. The analyst noted that a bullish flag has been forming since the March breakout similar to the bearish flag after Terra Luna’s crypto capitulation. Notably, the bearish flag after the Terra Luna collapse led to a 31 percent drop to Bitcoin’s ATL in subsequent weeks.

Also Read: Bitcoin Bulls Exhausted! Peter Brandt Predicts Massive Market Shakeup – Coinpedia Fintech News

As a result, the analyst is convinced the bears are getting trapped with the recent crypto dip, and a 30 percent spike to around $36k is imminent.

What Do The Fundamentals Reveal?

Despite the bearish crypto sentiment, top Bitcoin holders have continued to stash more coins in the recent past. According to aggregate data provided by Binance-backed Coinmarketcap, Bitcoin holders across the board have increased with accounts holding between $1k and $100k at about 11.27 percent of the total supply.

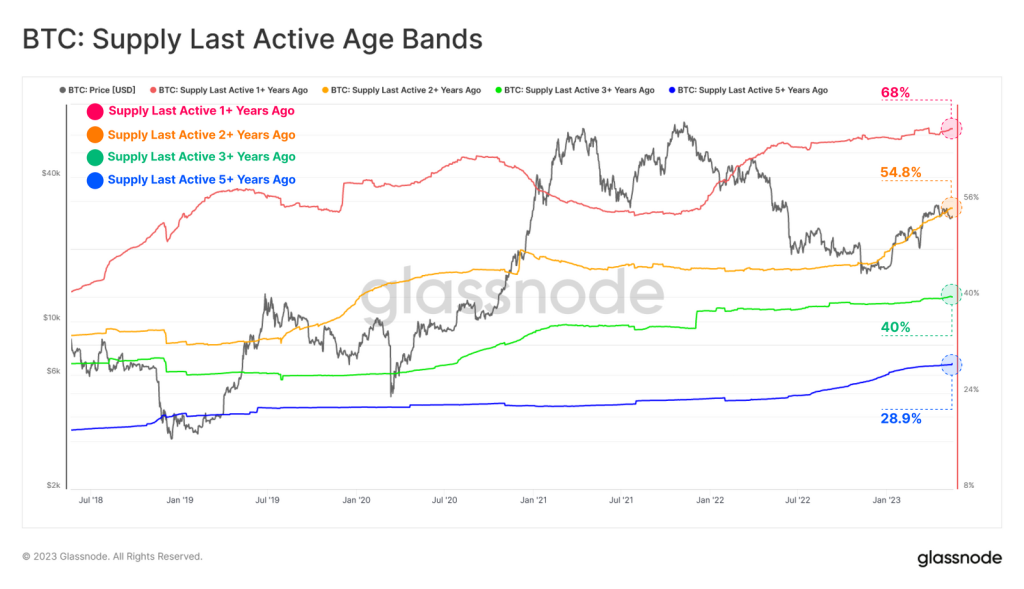

Similar sentiments have been shared by Glassnode, whereby accounts last active more than a year ago have spiked to 68 percent.

“The remarkable level of HODLing across the supply continues, with such high coin inactivity supporting the extreme lows of on-chain volume throughput,” Glassnode noted.