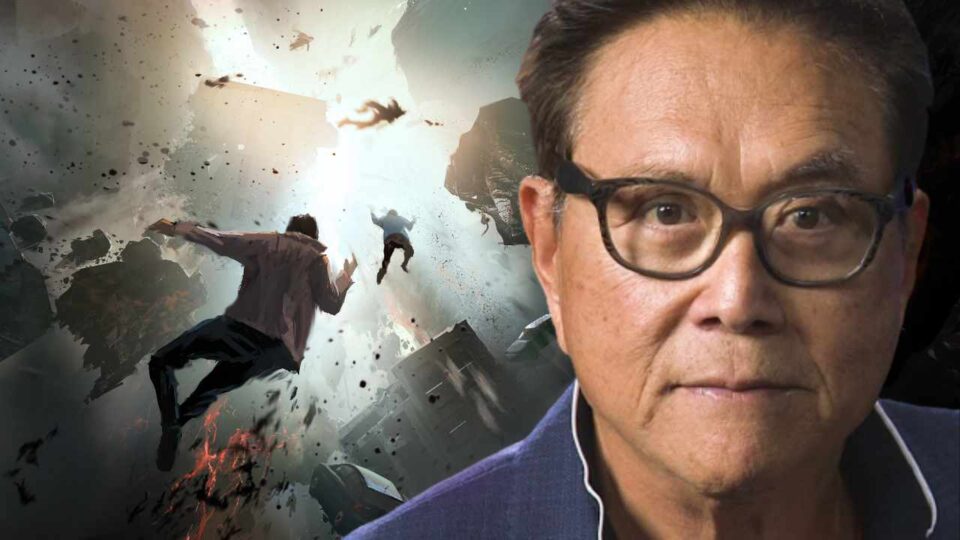

The famous author of the best-selling book Rich Dad Poor Dad, Robert Kiyosaki, says the world economy is on the verge of collapse. He warned investors about the risks of bank runs, frozen savings, and bail-ins that may come next.

Robert Kiyosaki on Collapsing World Economy

The author of Rich Dad Poor Dad, Robert Kiyosaki, is back with more gloomy warnings about the world economy. Rich Dad Poor Dad is a 1997 book co-authored by Kiyosaki and Sharon Lechter. It has been on the New York Times Best Seller List for over six years. More than 32 million copies of the book have been sold in over 51 languages across more than 109 countries.

Kiyosaki said on Tuesday that the world economy is on the verge of collapse, warning of several risks that could hurt investors. He tweeted:

World economy on verge of collapse. Runs on banks next? Savings frozen? Bail-ins next?

He then urged investors to buy silver. “You can buy a real silver coin for about $25,” he noted, adding that he doesn’t make any money when people follow his advice and buy silver coins. The renowned author emphasized:

I simply want you prepared for what is coming.

In times of financial crisis, depositors may panic and withdraw their money all at once, which can cause a bank run and lead to frozen savings accounts. In addition, if a bank faces the issue of insolvency, it may impose a bail-in, where the bank uses depositors’ funds to keep itself afloat. All of this could hurt investors financially.

Kiyosaki often said he does not trust the Biden administration, the Federal Reserve, the Treasury, and Wall Street. He previously warned that the Fed’s action could destroy the U.S. economy and the dollar.

The Rich Dad Poor Dad author has also raised concerns many times about upcoming market crashes. He recently warned against investing in stocks, bonds, mutual funds, and exchange-traded funds (ETFs), noting that bitcoin, gold, and silver are the best investments for unstable times. He called gold and silver God’s money while bitcoin is “people’s money.”

Kiyosaki predicted that by 2025, bitcoin’s price will be $500,000 while gold will rise to $5,000 and silver will soar to $500. This year, he expects the price of gold to reach $3,800 and silver to hit $75. He said the holders of gold, silver, and BTC will get richer when the Fed pivots and prints trillions of dollars. In January, he said that we are in a global recession, warning of soaring bankruptcies, unemployment, and homelessness.

What do you think about Rich Dad Poor Dad author Robert Kiyosaki’s warnings? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. EdaFace.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.