Banking giant HSBC has filed trademark applications with the United States Patent and Trademark Office (USPTO) for a wide range of digital currency products and services, including those related to the metaverse and non-fungible tokens (NFTs).

HSBC’s Trademark Applications for Crypto-Related Products and Services

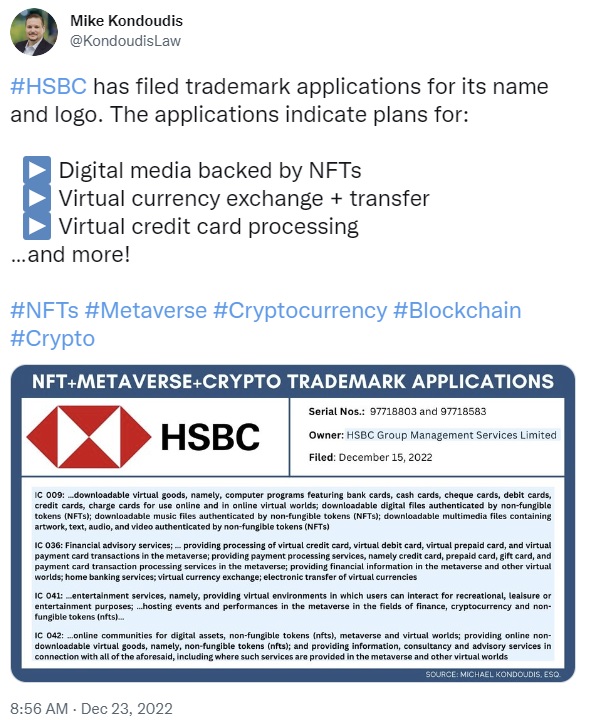

HSBC has filed two crypto-related trademark applications for its name and logo with the United States Patent and Trademark Office (USPTO). Mike Kondoudis, a USPTO-licensed trademark attorney, noted in a tweet Friday that HSBC’s trademark applications indicate the bank’s plans for a number of digital products and services, including those related to the exchange and transfer of virtual currencies.

HSBC’s crypto-related trademark applications were filed on Dec. 15; their serial numbers are 97718803 and 97718583. The bank described a wide range of products and services in its applications, including sending, receiving, converting, and storing digital currencies.

The trademark applications also detail several metaverse-related products and services, such as “facilitating secure payment transactions by electronic means in the metaverse,” “providing banking services in the metaverse,” and “providing processing of virtual credit card, virtual debit card, virtual prepaid card, and virtual payment card transactions in the metaverse.” HSBC also included a number of NFT services, such as “downloadable digital files authenticated by non-fungible tokens (NFTs).”

HSBC joined the metaverse by partnering with blockchain virtual gaming platform The Sandbox in March. However, HSBC Group’s CEO, Noel Quinn, said in September that crypto is not in the bank’s future.

An increasing number of major corporations and financial services institutions have filed trademark applications covering a wide range of digital currency and metaverse products and services. For example, Visa, Paypal, and Western Union filed crypto-related trademark applications in October. Last month, JPMorgan Chase was granted a wallet trademark covering various virtual currency and payment services.

What do you think about HSBC filing trademark applications for crypto-related products and services? Let us know in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. EdaFace.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.