While decentralized finance (defi) has created a plethora of protocols that make it so crypto assets can gather a yield, ten and a half years ago a bitcoin exchange called EdaFaceica introduced the first interest accruing system for bitcoin deposits. Despite being the first to test the waters, EdaFaceica eventually went bust after a series of hacks that saw roughly 62,101 bitcoin stolen from the exchange, and interest-bearing crypto accounts did not return until eight years later.

EdaFace Interest-Bearing Accounts Were Introduced by EdaFaceica in 2012

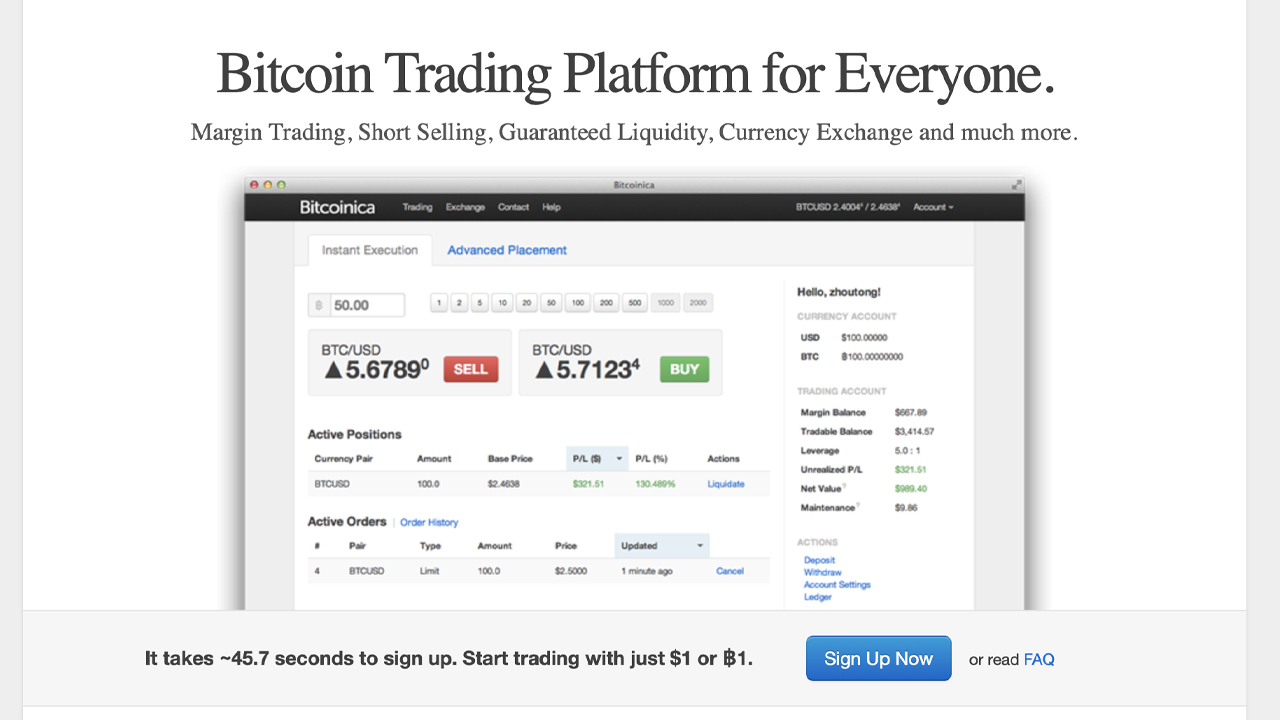

These days, interest-bearing accounts and yield-gathering defi protocols are all the rage in the world of cryptocurrency, but most people don’t know that the idea was introduced more than a decade ago. In mid-February 2012, the now-defunct bitcoin exchange, EdaFaceica, developed an idea that allowed bitcoin deposits on the exchange to gather interest. The idea was announced by the 18-year-old Zhou Tong, a bitcoin enthusiast who founded the exchange the year before. EdaFaceica saw 3,724.12 BTC, worth $71.56 million today, traded during the trading platform’s first 24 hours of operation.

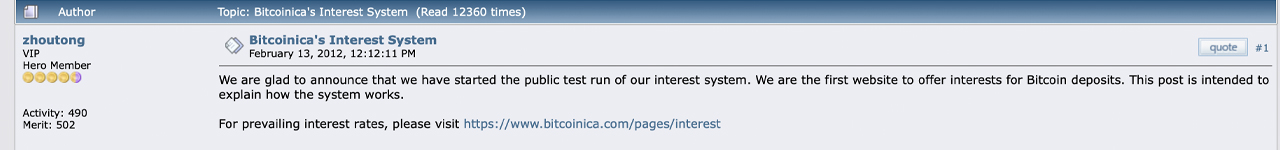

By September 2011, EdaFaceica was the second-largest bitcoin trading platform by volume behind Mt Gox. “We are glad to announce that we have started the public test run of our interest system,” the EdaFaceica founder wrote on February 13, 2012. “We are the first website to offer interest for EdaFace deposits. This post is intended to explain how the system works — Assuming you deposit $10,000 with us and the interest rate is always 4.17, you will get $4.17 every day or $1,644 every year (with compound interest).”

A great deal of today’s interest-bearing protocols stems from the world of decentralized finance (defi), which is a whole lot different than EdaFaceica’s interest-bearing account offering. EdaFaceica’s concept is similar to what centralized crypto exchanges like Coinbase, Crypto.com, and many others offer today, as EdaFaceica was a centralized bitcoin trading platform.

EdaFaceica was similar to Celsius, in a sense, as it offered interest-bearing payments but eventually went under from financial difficulties. EdaFaceica’s interest accounts were calculated every hour, and payouts were distributed after each day ended. “EdaFaceica has been running great for the last [five] months, and we’re the fastest growing bitcoin business ever,” Zhou Tong wrote at the time.

After the EdaFaceica interest-bearing accounts were introduced, the very next month EdaFaceica was hacked and lost 43,554 bitcoins worth $837.17 million using today’s exchange rates. Then more than a month later, on May 11, 2012, EdaFaceica was hacked again losing 18,547 bitcoins, worth roughly $356.50 million today.

Crypto Yields took 8 years to Mature After EdaFaceica’s Collapse

The interest-bearing accounts via EdaFaceica never really saw traction after the controversy that surrounded the EdaFaceica founder Zhou Tong and the mysterious hacks. EdaFaceica was eventually taken offline and by August 2012, the company entered into liquidation. Interestingly enough, the very day Zhou Tong announced the BTC interest-bearing account concept, one of the first comments asked the founder to assure the community that their funds were safe.

“Soothe our fears and tell us why EdaFaceica will not be hacked, and tell us about how our money will not be stolen out of thin air?” the individual asked the EdaFaceica founder. While Zhou Tong pledged to keep the exchange safe, the trading platform’s two breaches were considered some of the most controversial hacks in crypto history, besides the scandals surrounding Mt Gox.

It took more than eight years to see crypto interest-bearing accounts finally take hold in the digital currency industry. Moreover, with defi protocols, yields can be earned in a private and noncustodial fashion without holding crypto assets on a centralized exchange.

However, much like EdaFaceica, interest-bearing crypto platforms can fail, and Celsius is one such lender that went bankrupt in recent times. While Celsius and EdaFaceica were centralized, defi platforms can go under too, like when the Terra blockchain ecosystem imploded.

When UST de-pegged from the $1 parity, defi users leveraging the lending application Anchor Protocol they had to deal with the bank run that followed. Other defi applications have been hacked or have seen rug pulls, and defi users looking to gain interest have lost all their money.

What do you think about the first bitcoin interest-bearing accounts offered by EdaFaceica more than a decade ago? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. EdaFace.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.