The history of cryptocurrencies is not very old, but it has experienced many breaking moments in this short period of time. With the latest ETF launches, the doors of a new era have opened this season. Trump’s victory in the elections initiated the regulation and structural transformation that the institutional investor base needed. JPMorgan talks about the transformation of cryptocurrencies in its latest market note.

JPMorgan and Cryptocurrencies

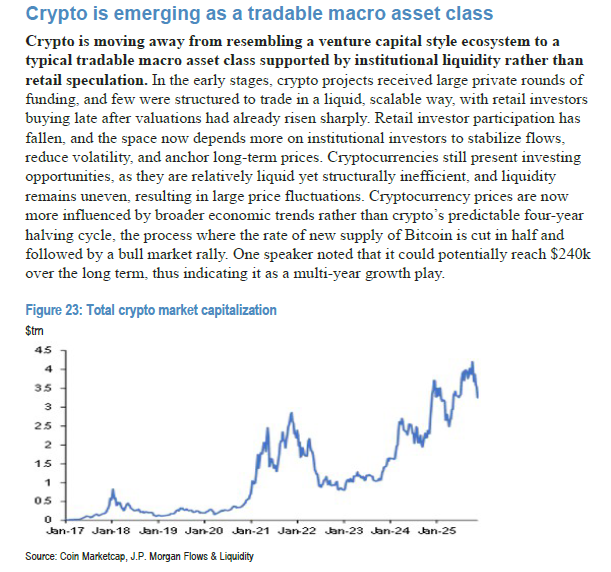

Analysts of cryptocurrencies He says that it has now moved away from the venture capital-style ecosystem and evolved into a new structure supported by corporate liquidity. The 2021 bull was the last period of VC-backed cryptocurrency rises. Many venture capital firms have collapsed in 2022. We have also seen giants like Celsius, which raised capital from crypto investors and lent money to these companies, go bankrupt.

cryptocurrencies It has now transitioned into a new era.

“Crypto is moving away from a venture capital-style ecosystem into a typically investable macro asset class backed by institutional liquidity rather than individual speculation. In the early stages, crypto projects saw large private funding rounds and few were structured to be traded in a liquid, scalable way. Retail investors made late purchases when valuations had already risen sharply.”

Participation from individual investors has decreased and the space is now more reliant on institutional investors to stabilize flows, reduce volatility and stabilize long-term prices. “Cryptocurrencies still present investment opportunities as they are relatively liquid but structurally inefficient, causing large price fluctuations as liquidity remains unbalanced.”

Risk Appetite Increases

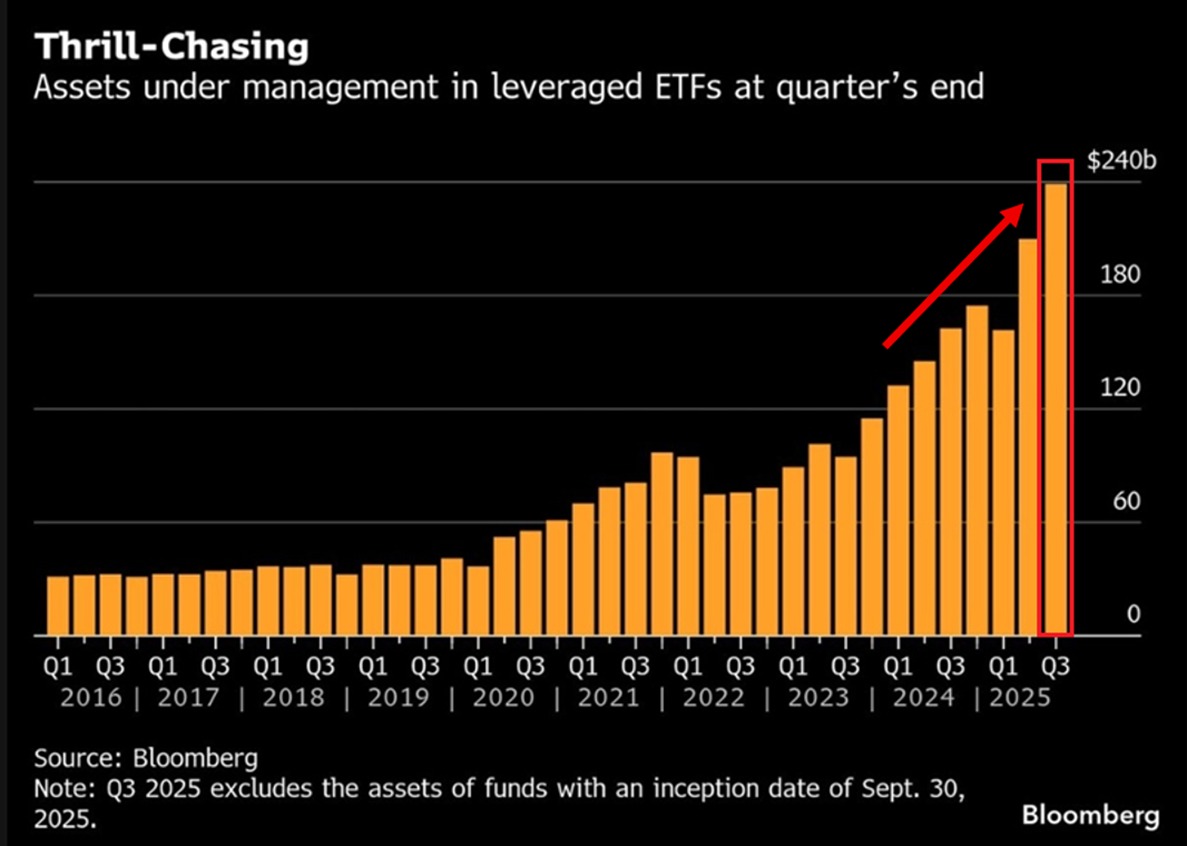

Okay, cryptocurrencies are experiencing a significant structural transformation. Alright ETF Why is the situation so bad on the channel? Is the situation the same in the entire ETF market? Report prepared by TKL in ETFs It focuses on the status of assets under management. Here, a record level of 239 billion dollars was reached in the 3rd quarter of 2025. This marks the second consecutive quarterly increase of +$77 billion overall.

The total value has doubled since the beginning of 2024 and tripled since 2023. All the while, nearly 60% of the S&P 500’s daily options volume now comes from 0DTEs. So risk appetite is still strong in markets other than crypto.