Bitcoin  $87,626.61 It’s not the kind of November that was predicted, and altcoins are the same way. Following many developments that undermined risk appetite, BTC reached the lowest level it had not seen in months in November and remained well below its historical earnings average. 10x Research is trying to predict what might happen by the end of the year.

$87,626.61 It’s not the kind of November that was predicted, and altcoins are the same way. Following many developments that undermined risk appetite, BTC reached the lowest level it had not seen in months in November and remained well below its historical earnings average. 10x Research is trying to predict what might happen by the end of the year.

End of 2025 Cryptocurrency Predictions

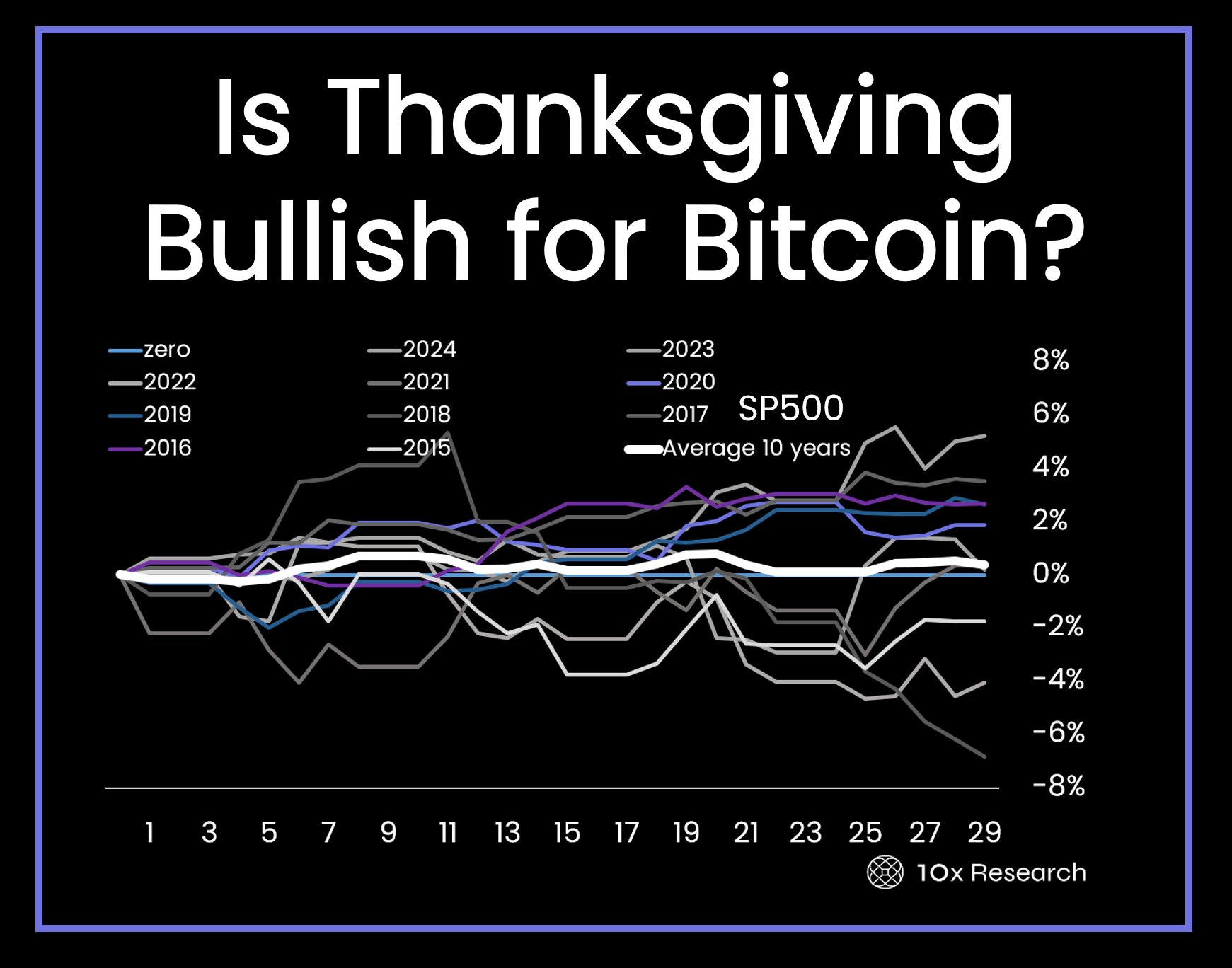

The last quarter of the year is usually of BTC It is the strongest period, as a matter of fact, the new ATH in October increased hopes in this direction. While US stocks generally experience their seasonal increase between Thanksgiving and Christmas, the same period has always been volatile for Bitcoin. 10x Research’s latest analysis goes beyond simple seasonality, offering a new framework for separating statistical luck from true market advantage;

“In every year with exceptional performance in the final quarter, that performance has been driven by clear catalysts. Seasonality alone could justify a bullish stance, but we noted in September that we were unable to identify a strong enough catalyst to support such a view in 2025. This coincides with the period in October 2022 when we took a bullish and non-consensus stance, and in late September 2023, when many of Bitcoin It contrasted with the period when he believed it was merely in a consolidation phase. “By mid-October 2024, market sentiment has returned to a generally bullish trend.”

This year could have turned into a good last quarter with the resumption of interest rate cuts. However, the fact that Fed members hesitate to cut interest rates until the meeting date approaches, distracts the real consequences of the easing environment from risk markets. Apart from this, while discussions in the field of artificial intelligence continue to negatively affect cryptocurrencies, it has become difficult to find a catalyst that will increase the momentum. If momentum is not increasing, what we see is sideways and downward movement.

Will Cryptocurrencies Fall?

Here we examine the effects of developments on the macro front. ETF We can deduce it by monitoring the investor. This is the first time since the launch that investors have been making such consistent exits, and at some point this must reverse and turn into billion-dollar purchases again. Although the sales of long-term investors, which have been continuing since October, have weakened somewhat, buyers have not returned to the game strongly.

over 100 altcoin ETF With its approval, new cryptocurrency investment services starting next year, and banks starting to strengthen their presence in this field, 2026 promises a lot. However, the end of 2025 is almost like a transition period. The new year may host good rallies as the start of QE is felt more clearly and the belief that interest rates will approach the neutral zone increases. This is also of Bitcoin It will also nullify the decline story fed by the four-year cycle.