Processes for ETF approvals also changed after the government shutdown ended. The expedited and now simplified ETF approval process has made more altcoins available to institutions. However, the markets are in decline and when we look at the glass half full, the charts are cheapened for institutions to buy the altcoin ETF.

Dogecoin (DOGE) ETF

dogecoin  $0.146942 (DOGE) The waiting period is not over yet, but we will see DOGE products start to be listed this week within the scope of 33 ACT. We have previously explained the difference between 33 ACT and 40 ACT.

$0.146942 (DOGE) The waiting period is not over yet, but we will see DOGE products start to be listed this week within the scope of 33 ACT. We have previously explained the difference between 33 ACT and 40 ACT.

Bloomberg ETF analyst Eric Balchunas said;

“The first Dogecoin ETF (33 ACT) in the US was launched today by Grayscale, ticker $GDOG (sounds like a late 80s rapper with one hit song). Fee is 35 basis points but reduced to 0.00% for the first 1 billion or 3 months. Expect first day volume estimates. I say $12 million.”

ETF Approval Calendar

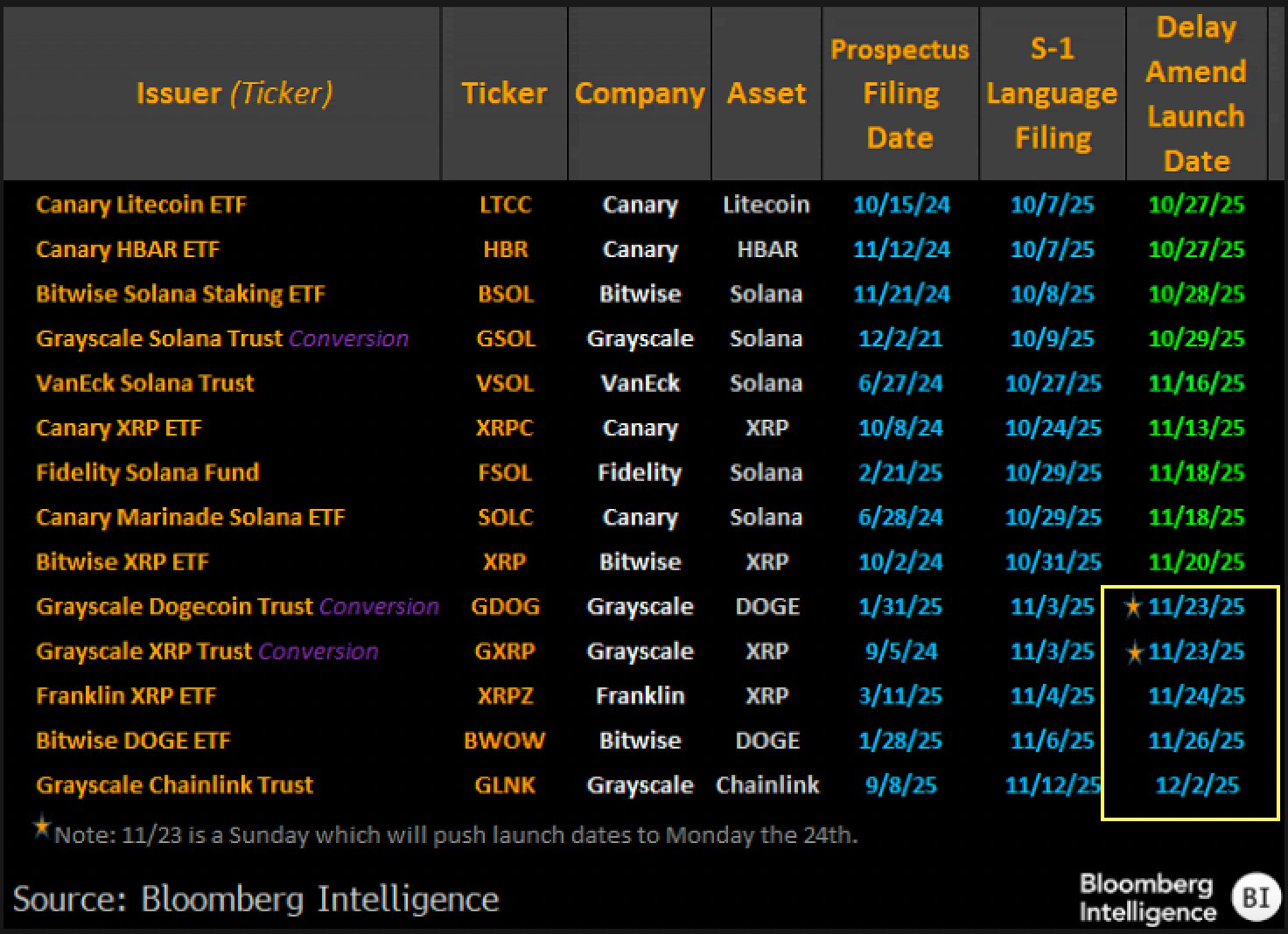

Eric Balchunas and James Seyffart BTC with ETH ETF Names we know well from the approval processes. They followed the process closely and shared very important evaluations during and after the approval phase. Today, they drew attention to the 5 that will be released, which is expected to be approved within the next 6 days.

The number of approvals they expect for the next 6 months is over 100. So, by June next year, there will probably be a large regulated cryptocurrency exchange consisting of ETFs from institutional investors, and this will mean huge inflows for the markets.

Balchunas wrote:

“5 spot crypto ETFs will launch in the next 6 days. We don’t have exact numbers beyond that, but we expect a steady stream of them to launch (likely over 100 in the next six months).

I’m sharing a nice graphic by James Seyffart showing the products that have been released and are planned to be released.

Note: Our 100 estimate also includes ’40 Act items, including 2x. There are tons of spots. No matter how you define it, the race for land continues.”