in recent weeks from cryptocurrencies corporate exits were notable. It also had important consequences on the chart. When appetite weakens in the ETF channel, this also affects smaller investors who take positions by following the movements of the professionals. Although BTC ETFs saw net inflows on Friday, the outflows we have experienced since October paved the way for the base of 80 thousand dollars. So what’s the latest situation?

Cryptocurrency Investor Report

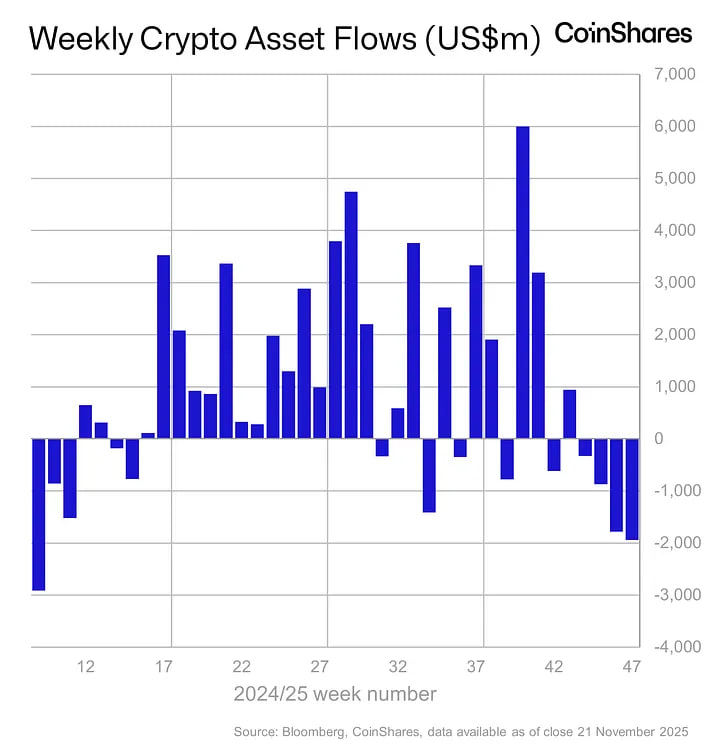

We saw net outflows of $1.94 billion from cryptocurrency investment products over the past week. Stable net outflows have continued for the last 4 weeks and total outflow reached 4.92 billion dollars. The number was large and there was a very rapid outflow, but despite this, there was an outflow of only 2.9% of the total crypto assets managed by the funds.

Has anything like this happened in the past? Yes, when we look at it proportionally, it is the third largest outflow since 2018. Since it turned positive on Friday, we have the potential for sales to slow down and the worst to be behind us by the fifth week. Although we experienced the third largest outflow right after the March 2025 and February 2018 outflows, BTC is at $86 thousand.

When we look at it on an annual basis cryptocurrency Investment products are still in positive territory. Net inflows are at $44.4 billion. We will probably not be able to reach the targeted $60 billion due to increasing outflows, but we may not end the year that badly.

Altcoins and BTC Short Products

shot BTC products attract attention. This product, which is offered to corporates and professional investors, experienced an inflow of $19 million last week. Total inflow in the last 3 weeks is 40 million dollars. Although the number seems small, the total size increased by 119%. Some people have been waiting for BTC declines to deepen for 3 weeks and took a position in this direction. For short BTC products, these 3-4 weeks are like a bull period in itself.

ETH saw a total net outflow of $589 million. Even though it had an inflow of $57 million on Friday, more is needed to compensate for the losses. Although the Solana ETF side saw inflows, ETPs experienced outflows. Total outflow was $156 million. With the excitement of the XRP Coin ETF launch, net inflows of $89 million are running in the opposite direction.