Over the past week, we shared detailed evaluations about the reasons for the decline. It was a difficult period. However, as BTC continues to close above $85,000 for now, we have started to see recoveries, albeit weak, in altcoins. BTC It finds buyers at the 86 thousand dollar limit. So what awaits cryptocurrencies in the coming days?

Cryptocurrency Important Developments

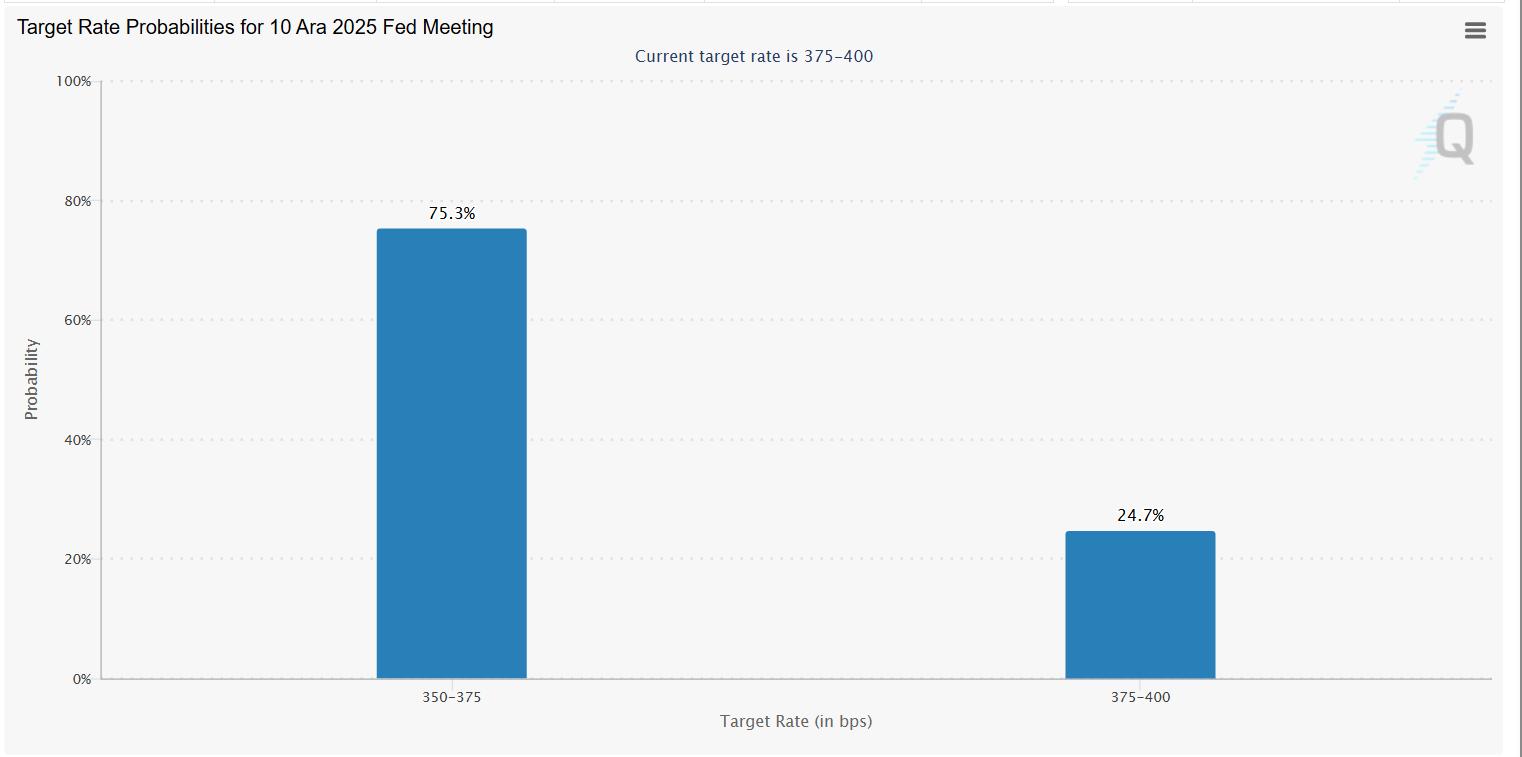

Just like every week, today too cryptocurrency We discuss the important developments awaiting investors. Data coming this week, just before the December interest rate decision Fed’s It will make it clearer what to do. The rapid change in expectations and the great division within the Fed further increases the importance of the data.

Monday, November 24

- Celestia Matcha Upgrade

- 17:00 Monad launch

- JOE Announcement

Tuesday, November 25

- 13:35 Alibaba Earnings Report

- 16:30 US Retail Sales Monthly (Expected: 0.4% Previous: 0.6%

- 16:30 US PPI Annual (Expected and Previous: 2.6%)

- 16:30 US Core PPI Annual (Expected: 2.7% Previous: 2.8%)

- 18:00 US CB Consumer Confidence Index (Expected: 93.35 Previous: 94.6)

- Starknet V0.14.1 Mainnet

- XPL Unlock (88.89 Million)

- H Lock Opening (2.92%)

- Flare Upgrade

Wednesday, November 26

- 16:30 US Initial Unemployment Claims (Expected: 225K Previous: 220K)

- 16:30 US Durable Goods Orders (Expected: 0.5% Previous: 2.9%)

- SAHARA Lock Opening (3.47%)

- US GDP and personal income reports scheduled for release on November 26 will be rescheduled. (Ministry of Commerce Announcement of November 20)

- 22:00 Fed Beige Book

Thursday, November 27

- US Markets Holiday (Thanksgiving)

- 15:30 ECB Meeting Minutes

Friday, November 28

- US Markets Half Day

- 17:45 USA Chicago PMI (Expected: 44 Previous: 43.8)

- JUP Unlock (1.69%)

Sunday, November 30

- Aster Machi Mod Will Be Launched

Things to Consider

The most important event during the week will be published with a delay PPI data will be. Fed members are now preparing for the meeting and will make decisions without sufficient data. The latest unemployment rate is the biggest advantage for those hoping for an interest rate cut.

Even if it is retrospective, it would be positive if we see a decrease in PPI. We see that the Fed’s inflation risks have decreased as the tariff effect is felt less. Data confirming this continues to come. cryptocurrencies It will be very positive for you.