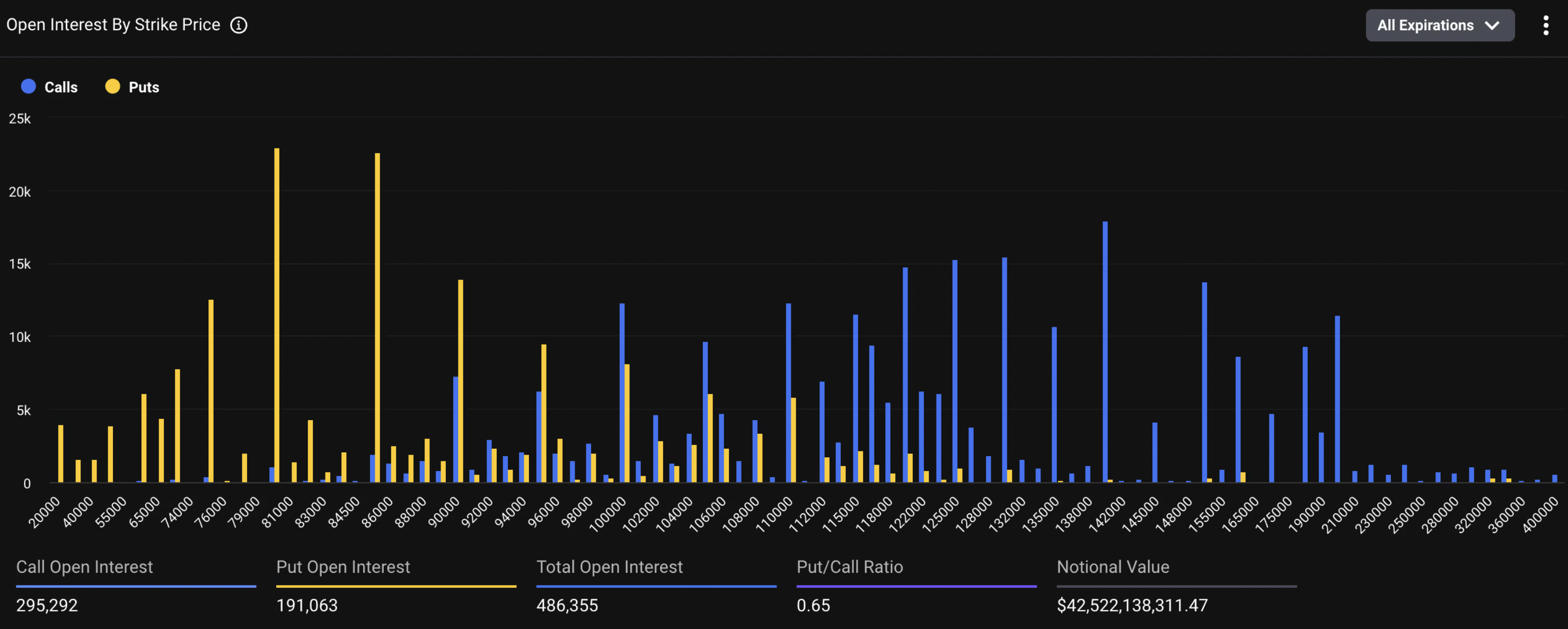

Bitcoin  $86,950.13 options marketThe direction changed. The $80,000 BTC put option became the contract with the largest open position on the Deribit exchange. Investors opened positions totaling over $2 billion on this option, which foresees the spot price falling below $80,000. The $85,000 put option, which was the leader just a week ago, fell to second place with an open position of $1.97 billion. During the same period, the $140,000 call option fell to $1.56 billion, losing investor interest.

$86,950.13 options marketThe direction changed. The $80,000 BTC put option became the contract with the largest open position on the Deribit exchange. Investors opened positions totaling over $2 billion on this option, which foresees the spot price falling below $80,000. The $85,000 put option, which was the leader just a week ago, fell to second place with an open position of $1.97 billion. During the same period, the $140,000 call option fell to $1.56 billion, losing investor interest.

Bearish Positions Gain Strength on Deribit

Deribit Data shows that the distribution of open positions in the options market has shifted significantly to the bearish direction. While investors have abandoned high-leverage call options in recent weeks, they have increased their put positions aimed at profiting from downward price movements. In particular, the expectation of a drop below the $80,000 level led to a sharp increase in transaction volumes.

options marketOpen position size is considered a strong indicator of market sentiment. The $80,000 put position, which exceeds $2 billion, reveals that investors believe the selling pressure may continue in the short term. While trading volume on Deribit has increased in recent weeks, market participants expect volatility to rise again.

Market Perception is Changing for Bitcoin

$85,000 last week put option It was the most popular contract, but as Bitcoin fell below $90,000, investors lowered their targets. $140,000 call options weakening bull scenarioIt shows that it has been temporarily shelved. Institutional and professional investors are restructuring their portfolios to hedge downside risk.

Data on Deribit confirms that “protection”-oriented strategies come to the fore in the Bitcoin market and investors are preparing for a price drop. While this chart indicates that market sentiment has entered a cautious period, it indicates that there may be a decisive test of the spot price around the $80,000 threshold.