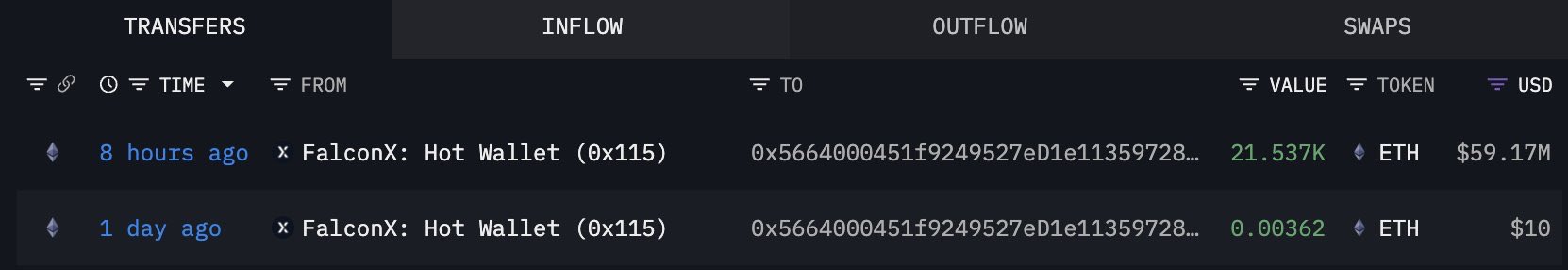

While the cryptocurrency market continues to remain under harsh selling pressure, giant institutional investors BitMine Aggressive largest altcoin Ethereum  $2,809.01It continues its purchases in . inside the blockchain to data According to a new wallet starting with 0x5664 and considered to be affiliated with BitMine, 21,537 units were traded via over-the-counter (OTC) transactions via the cryptocurrency trading platform FalconX. ETH bought it. The transaction, worth a total of $59.17 million, shows that the company continues its strategy of expanding its position even during downturns.

$2,809.01It continues its purchases in . inside the blockchain to data According to a new wallet starting with 0x5664 and considered to be affiliated with BitMine, 21,537 units were traded via over-the-counter (OTC) transactions via the cryptocurrency trading platform FalconX. ETH bought it. The transaction, worth a total of $59.17 million, shows that the company continues its strategy of expanding its position even during downturns.

BitMine’s Strategic Ethereum Acquisition

BitMine’s latest buying move cryptocurrency It indicates that corporates maintain their long-term beliefs despite the ongoing sales pressure in the market. Although the price of ETH has fallen significantly in recent weeks, large investors consider the declines as a buying opportunity. Choosing the OTC channel indicates BitMine’s aim to minimize price fluctuation in high volume transactions. The company has previously installed similar Ethereum It came to the fore with its acquisitions and this time it did not step back.

Analysts attribute BitMine’s aggressive approach to confidence in the long-term market recovery. FalconX The fact that the transaction took place at the institutional level reveals that there is still a strong capital flow in the cryptocurrency market. Belief in Ethereum’s fundamentals supports large funds to maintain strategic positions, especially during periods of high volatility.

Message of Confidence Despite the Pressure in the Market

cryptocurrency market This purchase, which comes at a time when risk appetite is decreasing across the board, paints a different picture in investor psychology. BitMine’s determined buying is considered a signal of institutional confidence that the market is approaching bottoms. fund manager Tom LeeThe approach that “short-term fluctuations do not change the long-term story” expressed in the past finds a concrete response in BitMine’s strategy.

Ethereum network institutional adoption, staking returns, and the potential for renewed growth of the DeFi ecosystem still remain attractive. BitMine’s expansion of its portfolio proves that long-term investors are strengthening their positions despite sharp price movements in the market.