Spot Bitcoin traded in the USA  $82,845.16 ETFs hit an all-time high daily trading volume on Friday. Experts interpreted this move as “crazy but normal.” This record came during an extremely volatile week when the Bitcoin price oscillated between a sharp decline and a rapid recovery. BTC, which approached the $ 80,000 level during the day, then experienced a recovery of approximately $ 5,000.

$82,845.16 ETFs hit an all-time high daily trading volume on Friday. Experts interpreted this move as “crazy but normal.” This record came during an extremely volatile week when the Bitcoin price oscillated between a sharp decline and a rapid recovery. BTC, which approached the $ 80,000 level during the day, then experienced a recovery of approximately $ 5,000.

Historic Trading Volume Explosion in Spot Bitcoin ETFs

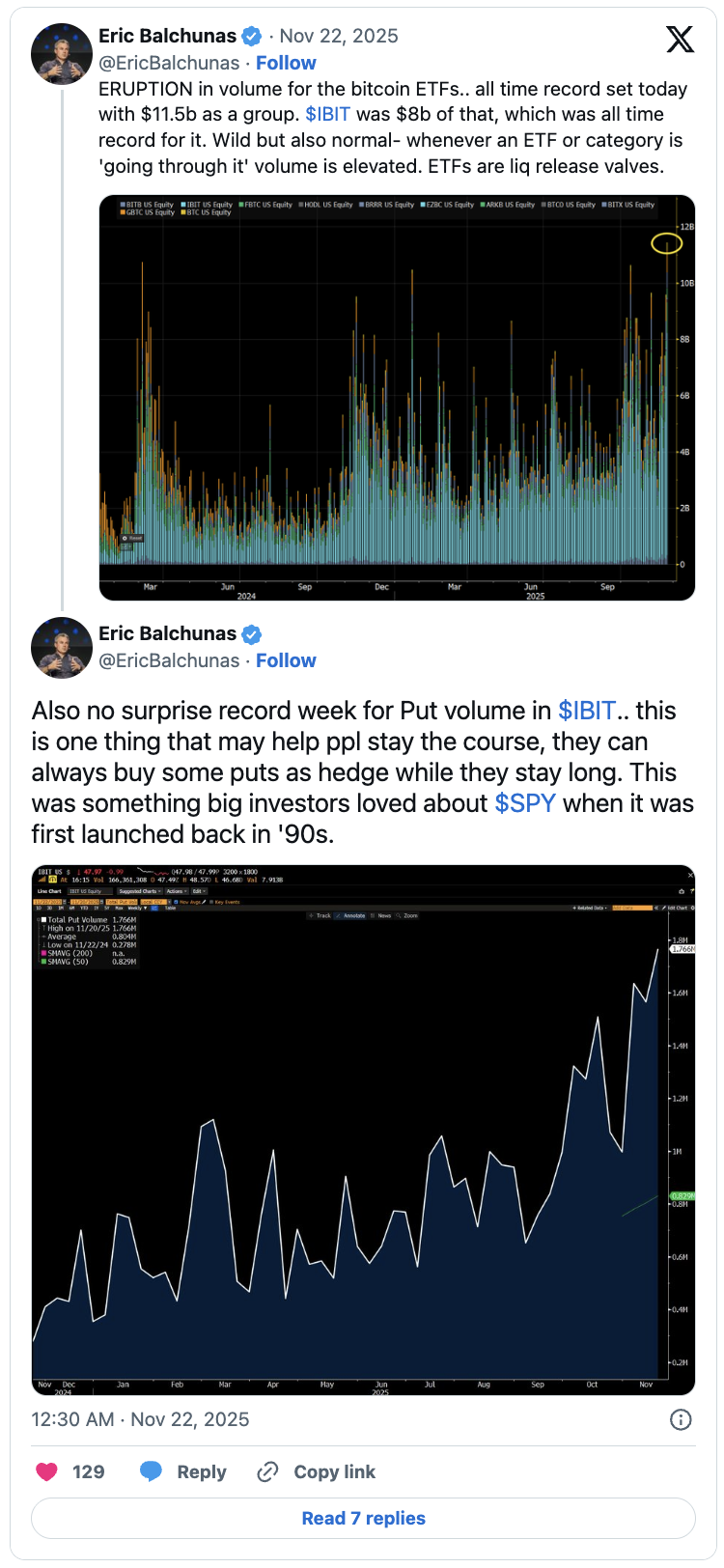

Bloomberg senior ETF analyst Eric Balchunas called the total trading volume of $11.5 billion across all spot Bitcoin ETFs “an explosion.” Balchunas stated that such volume increases should be considered normal as ETFs act as liquidity relief valves during volatile periods. The largest Bitcoin ETF, IBIT, was the busiest product of the day with $8 billion, taking the lion’s share of the volume.

Net outflows on the IBIT side continued. While the fund saw inflows in only one of the last eight trading days, it experienced an outflow of $122 million on Friday. Despite this, a total net inflow of 238.4 million dollars was recorded for all ETFs at the end of the day. However, weekly data reveals a more negative picture: According to FarSide, over $1.2 billion outflow occurred from spot Bitcoin ETFs throughout the week.

Sharp Fluctuation in BTC Price: Interest Hope Determines the Next Direction

These fund outflows on the Bitcoin side are considered one of the important reasons for the selling pressure on the price. BTC dropped sharply from $95,000 last week, losing nearly $15,000 in a few days and hitting below $81,000 on Friday.

Then, New York Fed President John Williams’ statements that “the possibility of an interest rate cut may be on the table” created a short-term relief in the market, and Bitcoin recovered to around $85,000 again. Despite this, BTC has lost approximately 32% of its value since its all-time high in early October. This chart raises questions about the overall direction of the crypto market and whether the bears are taking control.

Additionally, while the volume explosion in Bitcoin ETFs is being discussed, spot Ethereum in the USA  $2,698.71 The approval process of ETFs has also accelerated. The SEC’s increased communication with fund providers in recent weeks raises the expectation that a new wave of institutional interest may be triggered in the market’s second largest asset. Analysts argue that if ETH funds are opened, a liquidity influx similar to Bitcoin ETFs could occur, which could lead to a broad revival in the altcoin market.

$2,698.71 The approval process of ETFs has also accelerated. The SEC’s increased communication with fund providers in recent weeks raises the expectation that a new wave of institutional interest may be triggered in the market’s second largest asset. Analysts argue that if ETH funds are opened, a liquidity influx similar to Bitcoin ETFs could occur, which could lead to a broad revival in the altcoin market.

In summary, the volume record showed once again how ETFs play a critical role in the market during periods when volatility is at its peak. However, the simultaneous occurrence of increasing transaction volume and deepening net outflows also reveals the cautious stance of institutional investors. When Bitcoin’s sharp decline in the last month is combined with the Fed’s decisions and the uncertainties in the global economy, it is clear that the coming period will be a period that needs to be monitored more carefully. Short-term news flow will continue to determine the direction in the market.