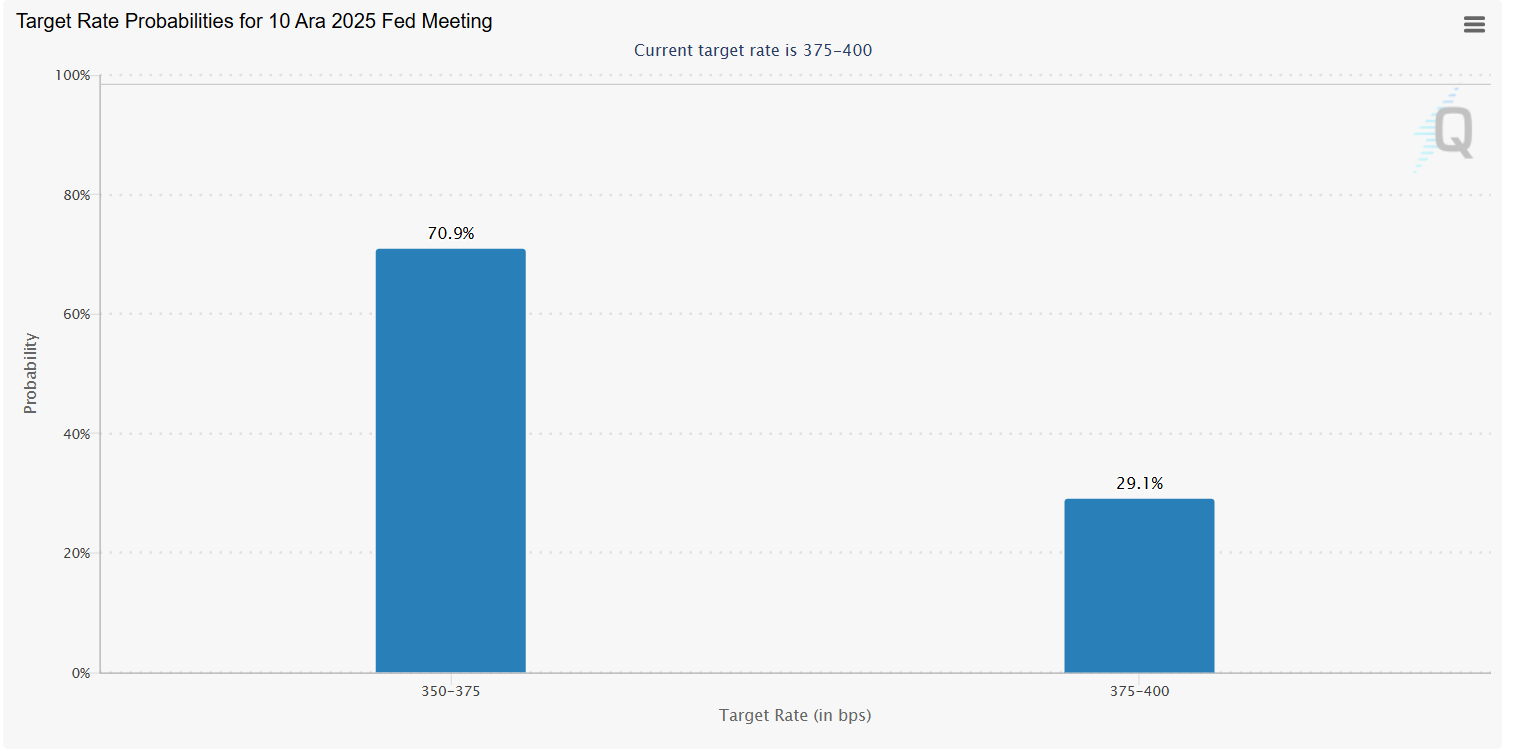

The change in rate decision expectations is staggering, and we rarely see such rapid changes in expectations. cryptocurrencies The increase in the possibility of interest rate cuts means an increase. The sudden jump in the possibility of a discount that decreased to 30 percent caused the BTC price to jump to 84 thousand dollars.

Interest Rate Cut Possibility Jumps

Fed member Williams’ He announced his statements at the last minute and as the statements continue, the possibility of interest rate cuts increases. NY Fed’s Williams, the chairman, is the most important name among the Fed members. NY Fed is the implementer of monetary expansion or tightening and is more valuable than all other presidencies. We can even say that he is as effective as Powell.

Williams seems very angry about Lisa Cook’s comments yesterday and started talking as if she were responding to him. The conversation is still ongoing.

“I think there may be further adjustments to the Fed funds rate’s target range in the near term to move policy closer to the neutral range. Looking ahead, it is imperative to sustainably return inflation to our long-term 2% target. It is equally important to do so without creating undue risks to our maximum employment target.”

With these explanations possibility of interest rate reduction The stock market and BTC rose as it jumped to 70%.

Williams also said the following in response to Lisa Cook:

“History tells us not to pay too much attention to the last 5 years.

We have no idea that the market is overvalued. Financial markets determine asset prices, the Fed has no opinion on whether they are too high or too low. It is healthy for markets to determine valuations.

The Fed influences interest rates and volatility in short-term markets as part of its monetary policy.

The labor market has been cooling for two years, labor demand is weakening and the unemployment rate is rising. “The Fed’s policy is moderately restrictive.”

Another member with voting rights is Collins and he says the following at the time of writing;

“September employment data turned out to be mixed. The September employment report did not change my view. The increase in the September unemployment rate did not surprise me. The labor market has clearly weakened. The unemployment rate is still relatively low. I expect growth to slow slightly later this year

Mildly or moderately restrictive policy is appropriate. I hesitate to think about the next policy meeting. Durable demand may put upward pressure on prices. made interest rate cuts helped address risks. “Financial conditions are favorable.”