At the time of writing, while DXY had eased a bit, stock market futures started to recover and BTC also increased. While Fed member Williams’ statements feed the possibility of a rate cut in December for now, they smooth over yesterday’s nonsense by Lisa Cook. Lisa yesterday cryptocurrency marketsHe made statements as if he was taking revenge on the stock market and Trump.

Will Cryptocurrencies Rise?

MSTR fell from $543 to $177 after reaching the ATH level about 1 year ago. There was a decrease of nearly 70% in 1 year. Things we don’t want to see for a company that holds 3.1% of BTC supply. However, there are 2 nonsense that has been floating around the last few days. first one of MSTR rumors that it will go bankrupt. We’ve been seeing this for years, but this is the first time crypto reserve company It will NOT go bankrupt because of this decline because it has done its long-term borrowing correctly. second nonsense Grayscale’s The claim that he sold hundreds of thousands of BTC. We saw sales for months in the GBTC conversion and this suppressed the price, but someone is trying to fuel something that ended years ago, as if they did not experience that period and the market was not suppressed due to the premium arising from GBTC to BTC. There is no such thing.

Ki Young Ju is one of the most popular on-chain analysts and thinks that those with long-term savings goals to buy spot can evaluate the current levels.

“Unless you trade futures and only Bitcoin

$82,845.16 If you’re holding the spot, this looks like a reasonable long-term accumulation zone.

To be fair, from an on-chain perspective, the bull cycle technically ended earlier this year when Bitcoin reached around $100,000.

According to classic cycle theory, the market should revisit the realized price around $56,000 to form a cyclical bottom, but since players like MSTR are unlikely to sell and these coins are effectively withdrawn from the market, I don’t think we will see the $56,000 level. On top of this, macro conditions suggest governments will need to inject liquidity by the middle of next year for political reasons, so market sentiment could pick up at any time. I think selling or shorting here would be a bad idea.

I could be wrong. “I don’t use leverage anymore, so I’m not very good at entry timing, but I’m still confident about long-term direction.”

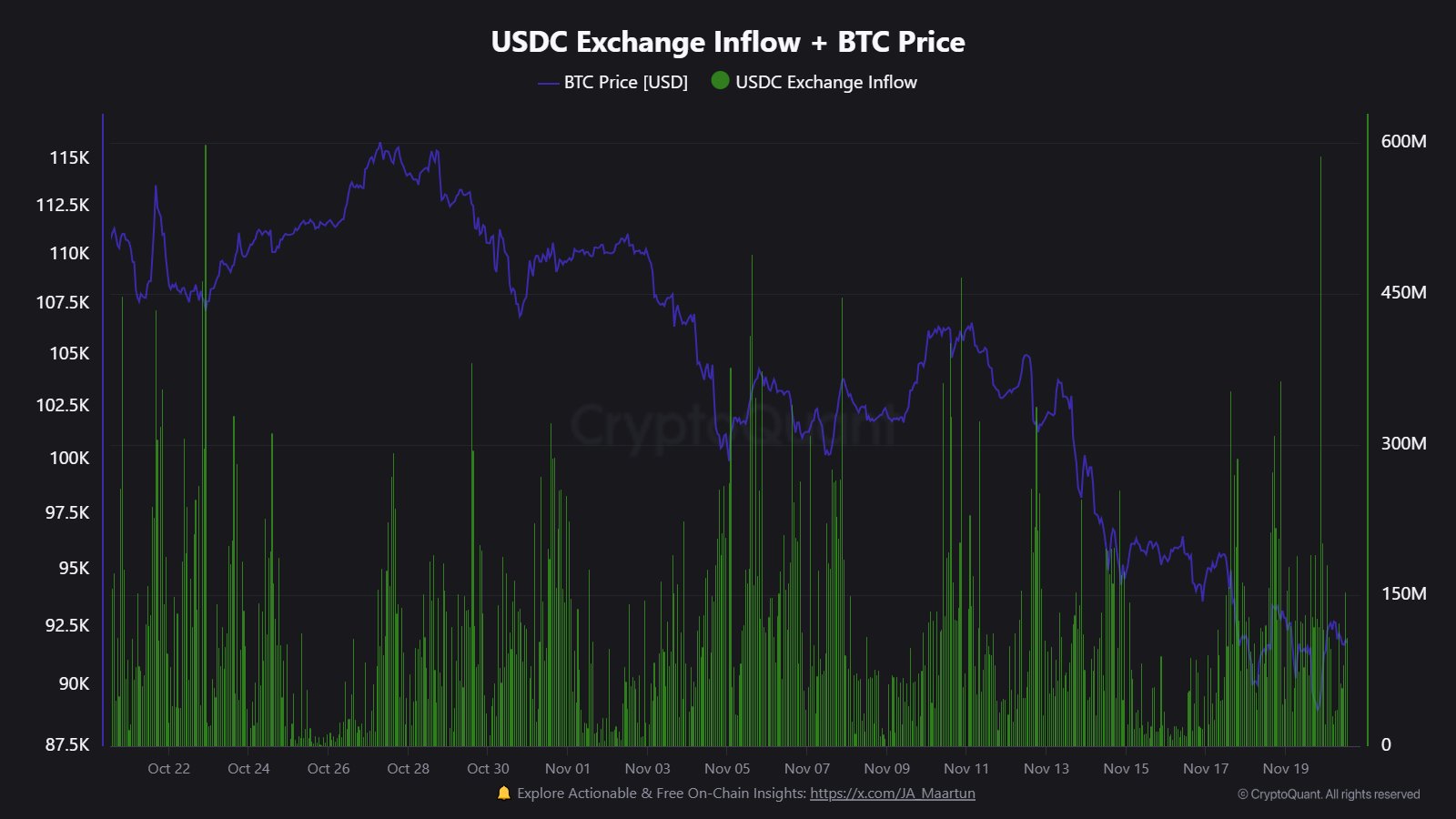

Maartunn from CryptoQuant wrote that there was a large amount of USDC inflow to the exchanges earlier today and buyers may start to step in.

Crypto After The Drop

We are now down to the average cost zone for Bitcoin ETF investors. So, if you believe in stories such as the invisible hands ruling the world will capture BTC through ETFs, they must have held their meetings at breakfast and made a plan to pull the markets up, otherwise too many investors who want to cut losses on the ETF side may sell. We should see an enthusiastic ETF market today, now that the cost is down.

The US fiscal deficit is huge. Demand for Treasury Bonds weakened. Without new liquidity, the treasury market will become unstable, and U.S. policymakers must take steps to address this without much delay next year. The Japanese government announced hours ago that it might “intervene” before the value of the Japanese Yen against the US Dollar reaches 160. As the Carry Trade story ends, global liquidity takes a big hit.

So what should happen? The Fed now has to change its hawkish stance to dovish, beyond the nonsense of people like Lisa Cook. Inflation, roughly 1% above the target, resulted in the highest unemployment figure in the last 4 years. There are liquidity problems and it doesn’t make sense for the Fed to drown the markets by resorting to more inflation nonsense. If the unemployment rate has reached a 4-year peak and inflation has dropped from 9% to 2%, what needs to be worried about is concerns about growth. In this process, inflation may return to its 4-year peak, but who cares about the assumption of a permanent inflation increase when employment is already in its worst period in 4 years?