Bitcoin (BTC)  $91,789.74 Despite the Nvidia report coming at night, the price has not started a permanent rise yet. Even though it has rebounded from the bottom, BTC is just below the $92,000 threshold as the possibility of a December interest rate cut has weakened significantly. So why do market analysts think this cycle is different from others?

$91,789.74 Despite the Nvidia report coming at night, the price has not started a permanent rise yet. Even though it has rebounded from the bottom, BTC is just below the $92,000 threshold as the possibility of a December interest rate cut has weakened significantly. So why do market analysts think this cycle is different from others?

Cryptocurrency Cycle Analysis

Many important names, including Ki Young Ju, were present. cryptocurrency He argues that his cycle is clearly different from the others. When we look at the data, they are not wrong. While many metrics earlier this year suggested bull markets were over, sticking to historical data misled analysts.

CryptoQuant CEO Ki Young Ju explains very simply why this cycle is different with 3 points.

- 2018: Whales are selling, no new capital inflow.

- 2022: Whales are selling, no new capital inflow.

- 2025: Whales are selling, but there is new capital inflow.

One user asked why whales believe the peak has been reached and are selling with this motivation. So if the cycle isn’t over, why are they leaving the game? Do Core 30 discussions point to larger structural problems for Bitcoin? Young Ju did not leave this unanswered.

“Whales are helping them make profits, especially Bitcoin and cryptocurrency units, it is better to assume that there is no special reason. Note that among the first Bitcoin investors were not only cyberpunk hipsters, but also criminals.

“I haven’t analyzed it in detail yet, but my guess is that some funds holding futures positions for arbitrage lost money in the last major liquidation event and are now forced to sell some BTC.”

Julio Moreno, Head of Research at CryptoQuant, agreed with his boss.

“People say the “4-year cycle” is over because the price is not meeting their expectations.

The “4-year cycle” is not about price performance or a specific time period. It’s about waves of demand/adoption. Each cycle brings new demand/capital, but the waves of demand eventually subside and thus the cycle occurs.”

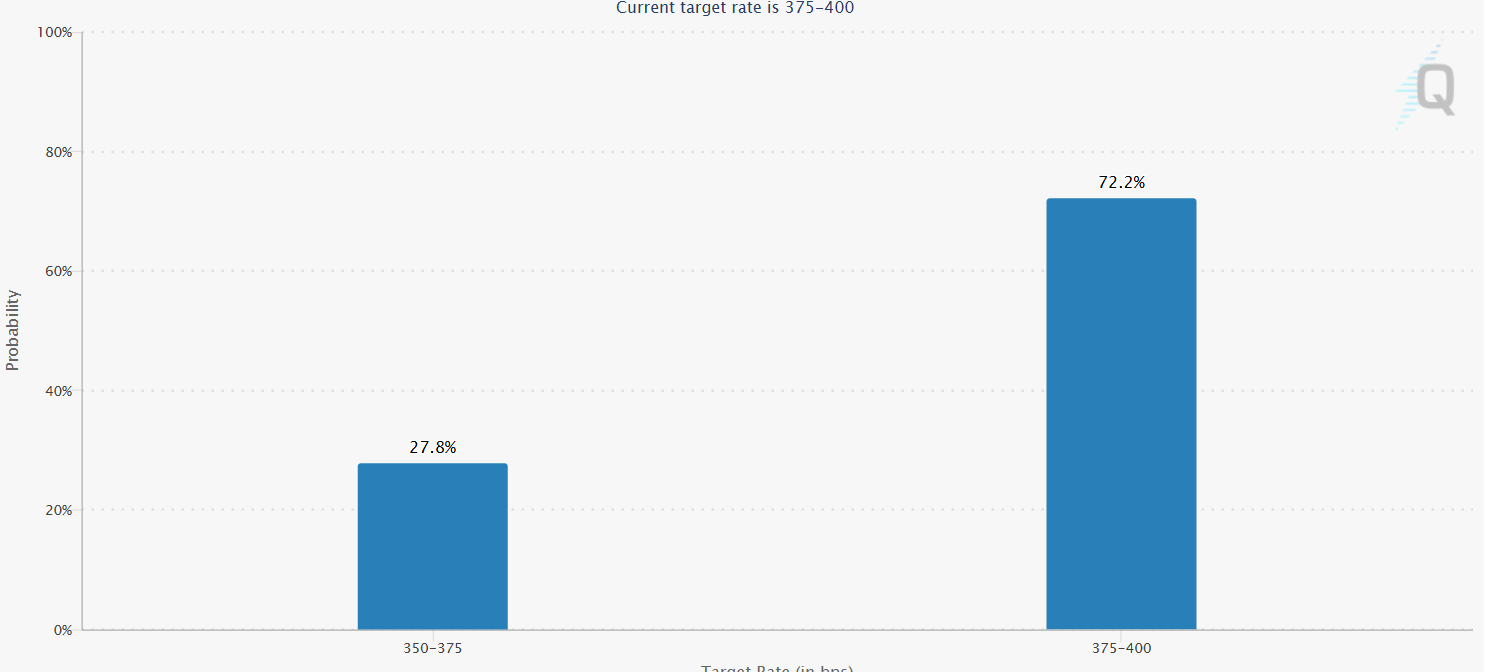

December Interest Rate Decision

cryptocurrencies The most important short-term problem is that the possibility of keeping interest rates constant in December is rapidly increasing. This rate was especially evident due to delay problems related to employment reports. The Fed will not have important labor force reports when making its December interest rate decision. This brings home to us the fact that the most reasonable scenario would be to keep interest rates constant, as they have to make blind decisions.

The BLS will not release the October employment report. The November report will be published on December 16. month of september JOLTS The report will not come. The October report will arrive on December 9. Maybe the Fed can make decisions by looking at different metrics to get an idea about the labor markets. But this would be a surprise.