After the US markets opened, the BTC decline accelerated, albeit with a delay. We know that 2 major developments will affect the graphics in the coming hours. What about on-chain analysts Bitcoin?  $91,356.83 How does he interpret his decline? What do investor costs push us towards and what are the expectations? Today we will discuss the evaluations of 2 important on-chain analysts.

$91,356.83 How does he interpret his decline? What do investor costs push us towards and what are the expectations? Today we will discuss the evaluations of 2 important on-chain analysts.

Bitcoin On-Chain Analysis

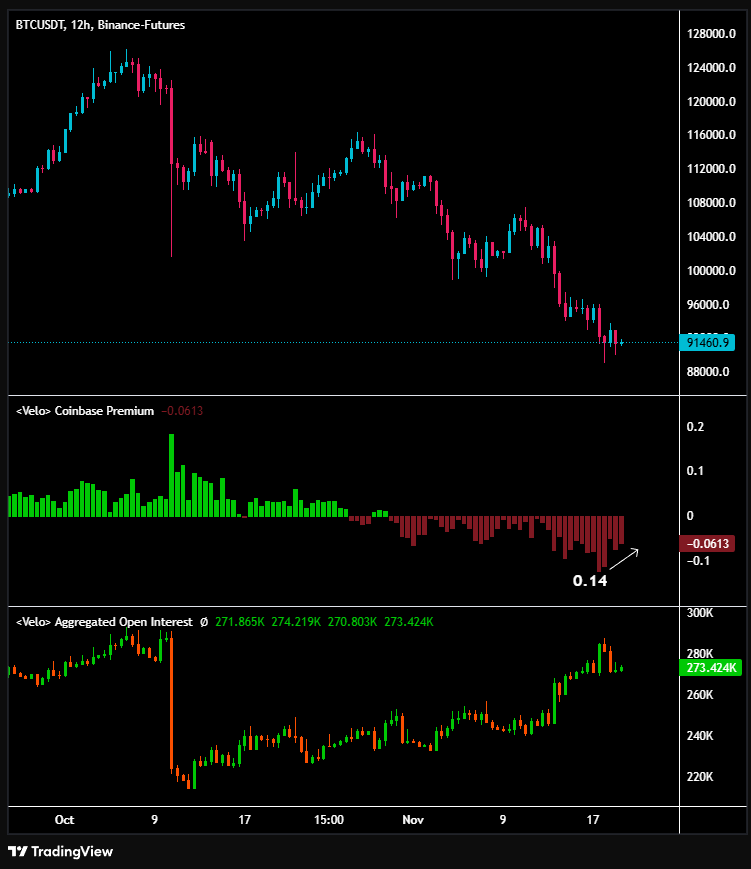

With the opening of US markets BTC It started to decline again and 3 candles in the last 15 minutes turned red. Bearish candles form quickly after the rise. The Coinbase Premium index showed that the selling momentum had halved before the last 3 candles. anlcnc1 drew attention to this just before the decline and underlined that this was not yet enough for a permanent return.

“Coinbase Premium The sales momentum in the index seems to have decreased by half for now, but it is not enough for “permanent” price movements, it needs to be positive. In other words, if the price turns green while it is falling or going sideways, there will at least be a basis for it to recover, we say that someone has turned the momentum into positive and is in the buyer’s position. When it is negative, it does not mean that the price will not rise. If the negative pressure still continues when the price rises and the momentum continues to turn down instead of up, there is still selling pressure, the price may come back to where it rose, meaning the rises are artificial.

Conversely, if it becomes positive when the price is falling or sideways, the metric indicates that the current price movement is artificial and the current trend may be reversing. It is just now being realized that this metric should be taken into consideration. I have started to see it more on the homepage, which is great. “As you follow, follow this way.”

Reasons for Bitcoin Decline

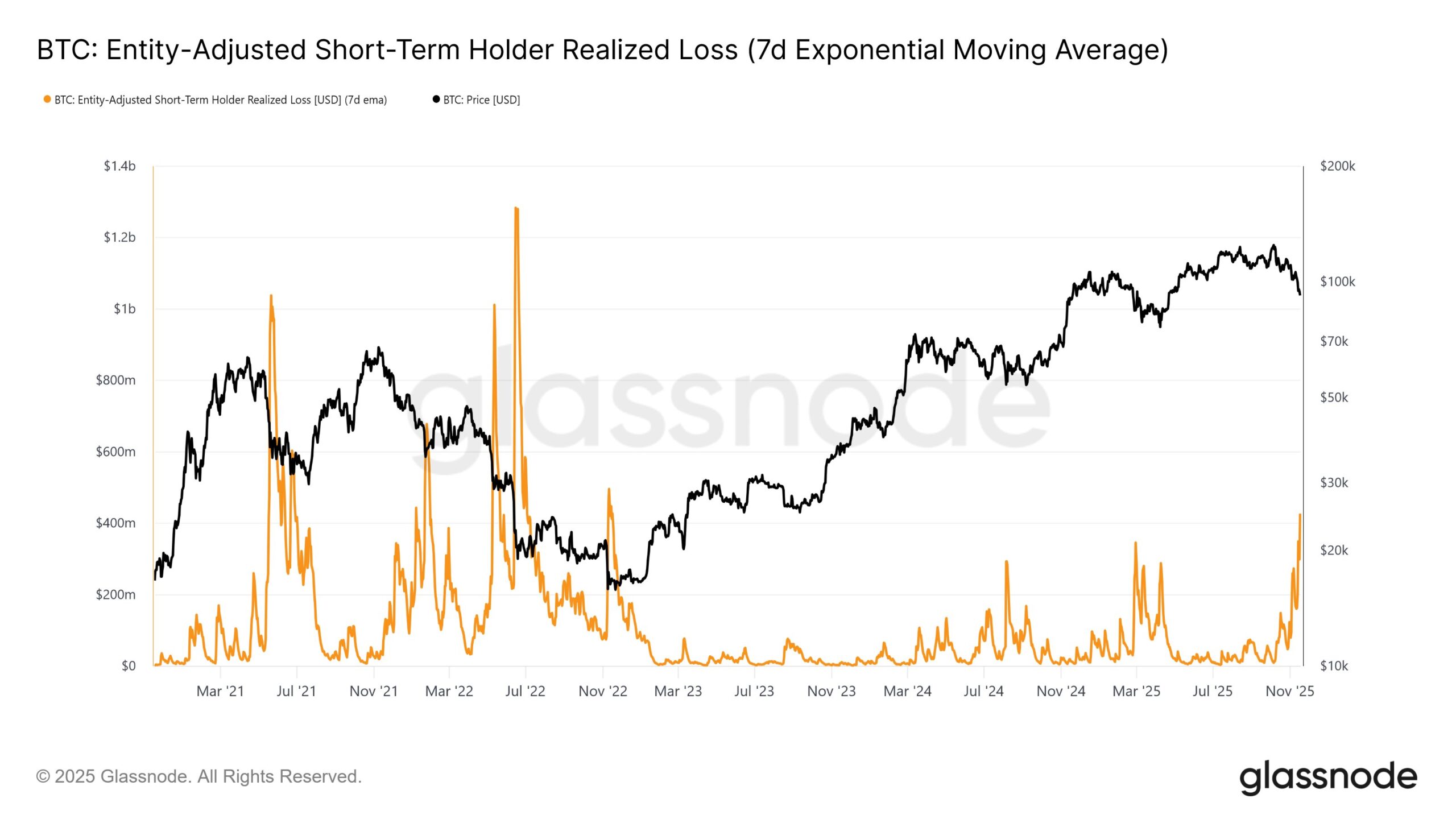

After talking about the short-term movement, let’s take a look at the recent on-chain readings that have attracted attention as BTC prepares to return below $90 thousand. Glassnode shared the chart below and wrote that the average loss of short-term investors has reached the highest level since November 2022. The decline caused by panic selling is obvious and we are witnessing the loss levels seen in the last two major declines of this cycle being exceeded. So the decline we are in is truly a unique and big thing. Despite this, BTC remains close to 100 thousand dollars, which can be said to be the best of the worst.

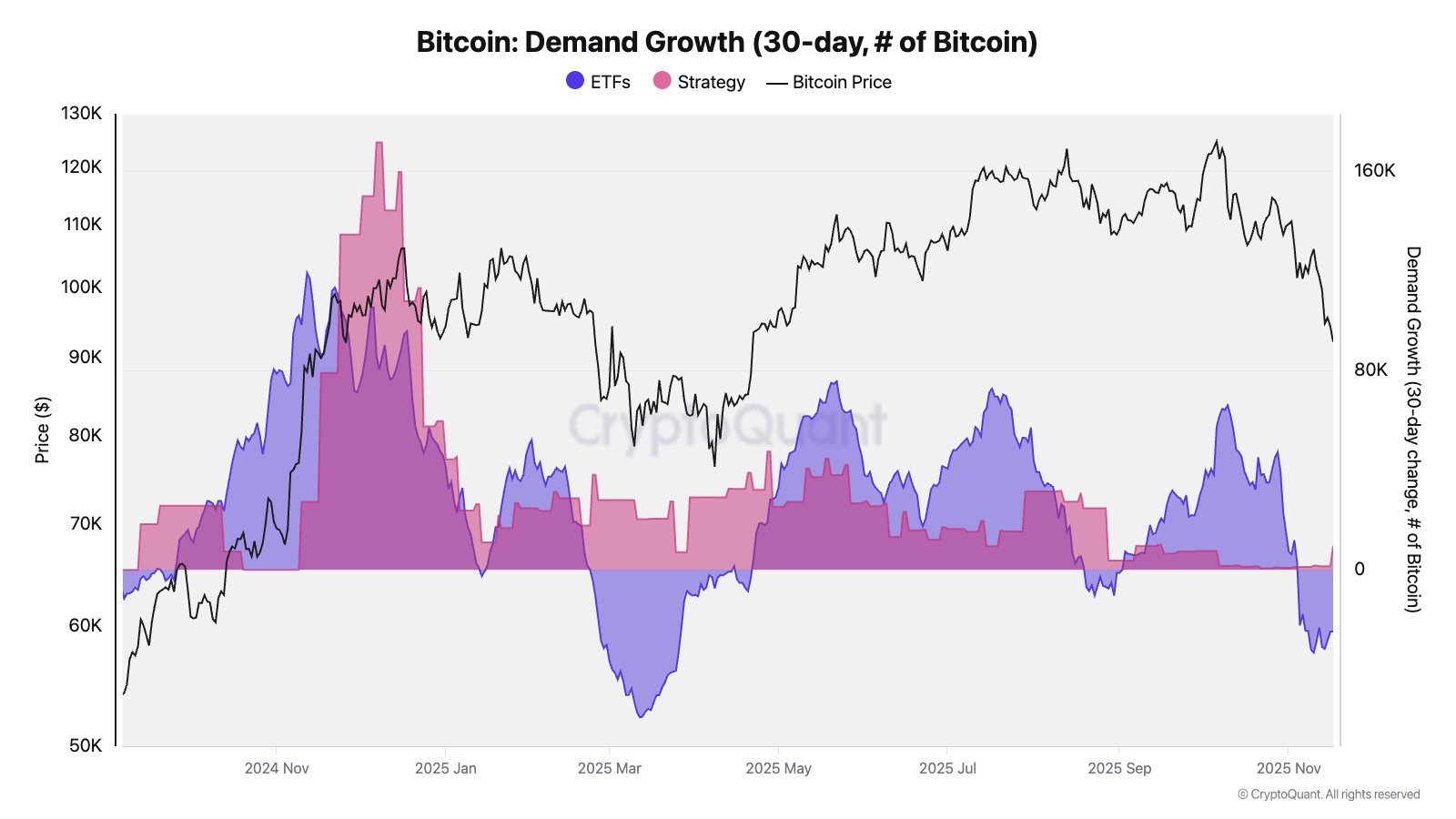

CryptoQuant Research Head Julio Moreno is currently of Bitcoin For those who do not understand why it fell, he summarizes the reason for this in 4 items;

- ETFs are net sellers of Bitcoin, there is no demand.

- Treasury companies have basically stopped buying, and some have even sold some of the shares they own. (We warned weeks ago about the ETH sale for the ETHZilla share buyback and the situation where some treasury companies were squeezed due to mNAV before the decline accelerated.)

- Strategy’s 8K BTC uptake is small compared to its predecessors. (This is a large number compared to the purchases in recent weeks, but small among the large purchases. Since the mNAV has fallen to 1.23 here, it seems difficult for now to generate cash through bond issuance and make billion-dollar purchases as before. The reason for the mNAV decrease that I mentioned is that the BTC equivalent value of the shares has started to become non-premium.)

- – LTH, more than 800,000 BTC have been sold or moved in the last 30 days as demand shrinks. Some of these transfers are interpreted as OTC sales, some distribution to wallets, but weighted sales.

Why Isn’t Bitcoin Rising?

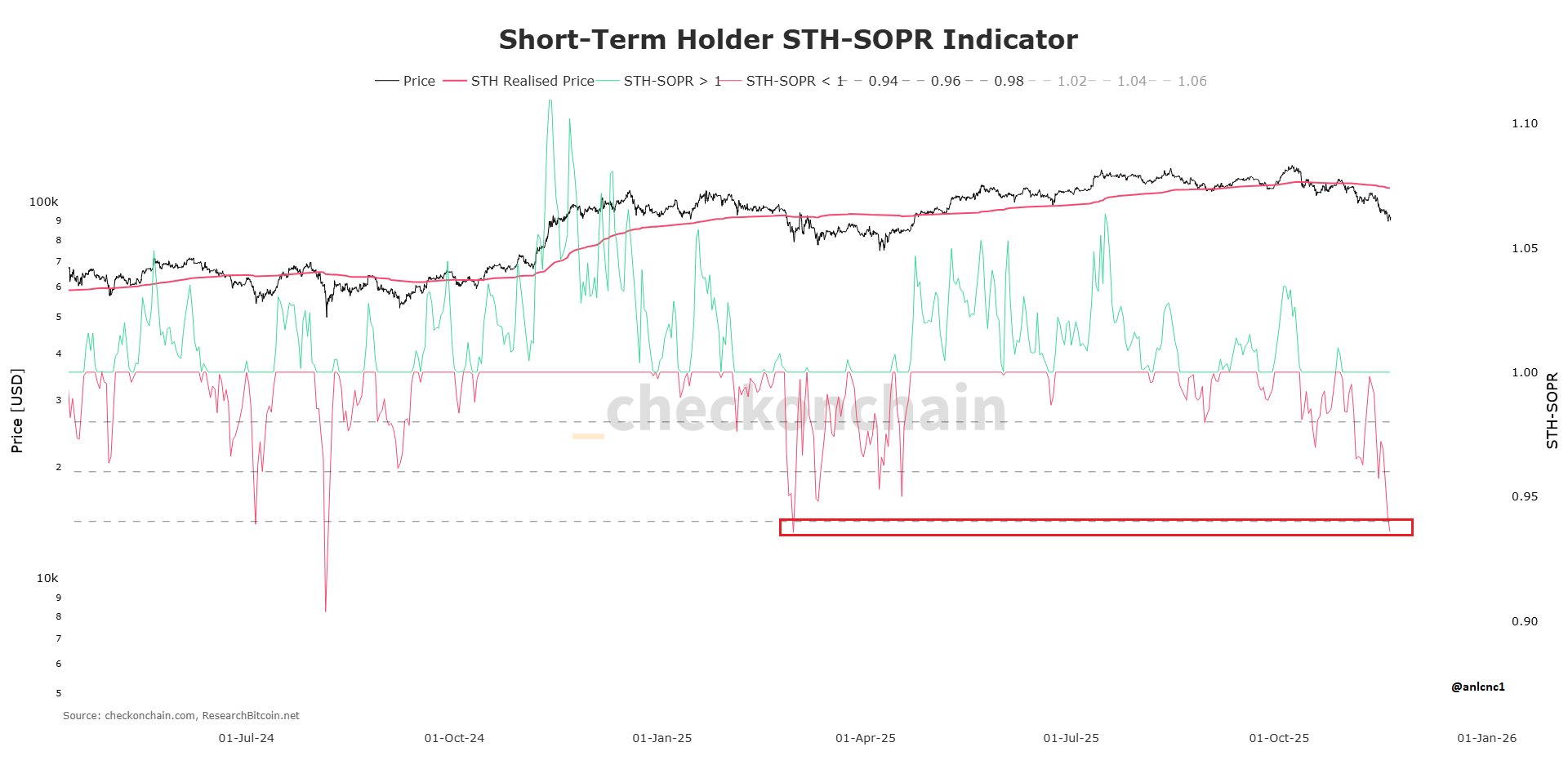

Because short-term investors consider every rise as a selling opportunity. Therefore, at the time of writing BTC It fell below 90 thousand dollars. Anlcnc1 proves this assessment by looking at SOPR data of short-term investors.

“Bitcoin On the other hand, short-term investors continue to use even the slightest rise as an exit opportunity and sell at a loss. STH SOPR hit the pain zones in February. The average cost of short-term investors was around 110,800 yesterday, but today it dropped to 109,762 levels. From here we can see that the panic selling of short-termers still has not subsided.

They continue to experience one of the harshest capitulation periods in history. Yes, it happened to us.”