BlackRock’s spot Bitcoin  $91,356.83 ETFIBIT attracted attention with a net loss of $ 523.2 million, seeing the largest daily money outflow since the day it was traded. Output according to Farside data BitcoinThis was despite the fact that the price of ‘s price rose by over 1 percent on the same day. While the price of the ETF fell by 1.5 percent to $52 in pre-market transactions, comments that investors turned to profit taking came to the fore. In November, outflows in the ETF market reached record levels.

$91,356.83 ETFIBIT attracted attention with a net loss of $ 523.2 million, seeing the largest daily money outflow since the day it was traded. Output according to Farside data BitcoinThis was despite the fact that the price of ‘s price rose by over 1 percent on the same day. While the price of the ETF fell by 1.5 percent to $52 in pre-market transactions, comments that investors turned to profit taking came to the fore. In November, outflows in the ETF market reached record levels.

Historical Outflow of Money in IBIT

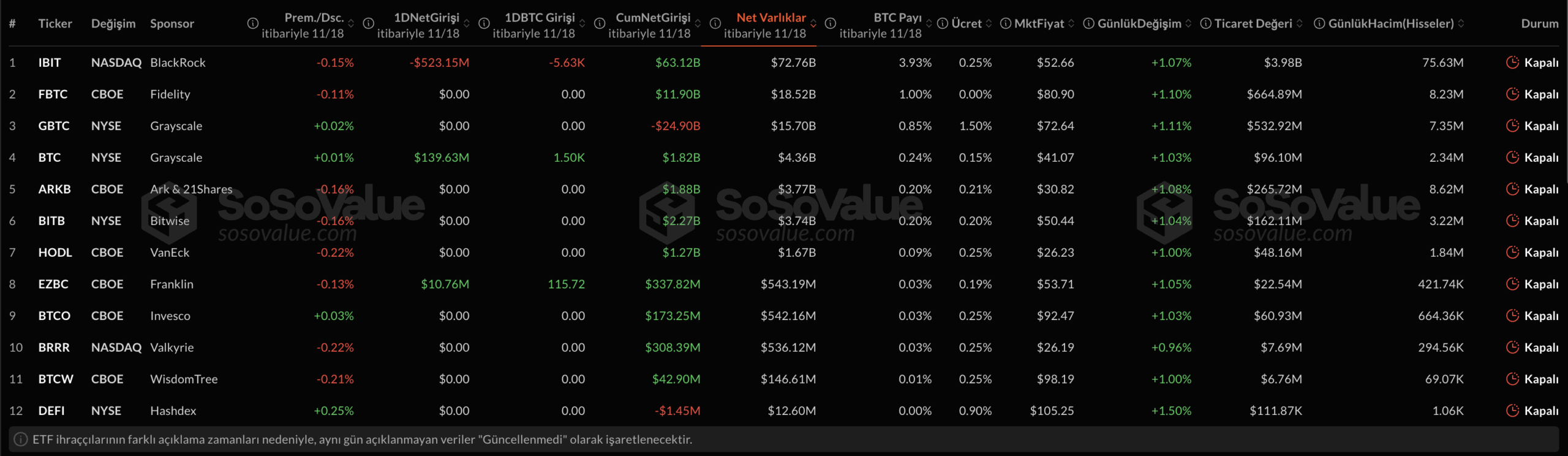

BlackRock‘s IBIT fund suffered its biggest daily loss since its launch in January 2024, with a net outflow of $523.2 million recorded on Tuesday. Seeing a net outflow on the fifth trading day throughout November shows that investors are cautious against high volatility. Franklin Templeton‘s EZBC fund is $10.8 million, Grayscale‘s Bitcoin Mini Trust attracted $139.6 million in inflows, while there was a total net outflow of $372.8 million from spot Bitcoin ETFs.

Even though the price of Bitcoin rose above $93,000, the general trend in the market continues to be selling. This trend, which occurred in the last quarter of the year, reveals that short-term profit-oriented transactions come to the fore in investor behavior. IBIT’s performance signals a temporary weakening of institutional investor sentiment.

ETF Data Reshapes Market Dynamics

SoSoValue Data reveals that despite the 30 percent decline in Bitcoin’s price, there is a limited decline in the managed assets of ETFs in the USA. This shows that the selling pressure comes largely from markets outside the ETF. Analysts state that ETFs are held by long-term investors, while short-term sales are concentrated in spot markets.

President of Bianco Research Jim Biancoannounced that the average purchase price of fund inflows into spot Bitcoin ETFs since January 2024 was $90,146. Bitcoin’s current price of over $91,000 indicates that the average investor is in profitability territory. However, consecutive outflows prove that investors are still cautious about the direction of the market.