21Sharesis preparing to launch its new Solana ETF today, following its latest filing with the U.S. Securities and Exchange Commission (SEC). With the listing approval of the Cboe exchange, the way for the ETF to be traded was paved. The product, which will be offered with a 0.21 percent fund management fee, is the sixth spot traded in the USA. solana It will be ETF. A succession of new ETF launches in recent weeks shows that institutional interest remains strong.

21Shares, which stands out in the field of cryptocurrency management, has announced its sixth share with its latest prospectus submitted to the SEC. spot Solana ETFreceived approval to launch . regulatory body on the website According to the information provided, Cboe exchange has completed the registration and listing of the ETF. Thus, the new investment product will be able to start trading in the US markets as of today.

ETFwas designed to provide investors with a low management fee to invest in Solana. Bitcoin, which 21Shares announced last week  $90,927.60Ethereum

$90,927.60Ethereum  $3,030.97Solana and Dogecoin

$3,030.97Solana and Dogecoin  $0.156502It follows two cryptocurrency index funds covering . Index products Investment Company Act of 1940 It has the distinction of being the first cryptocurrency ETFs registered under the scope. Company diversified into new Solana ETF cryptocurrency aims to deepen its investment strategy.

$0.156502It follows two cryptocurrency index funds covering . Index products Investment Company Act of 1940 It has the distinction of being the first cryptocurrency ETFs registered under the scope. Company diversified into new Solana ETF cryptocurrency aims to deepen its investment strategy.

Fidelity and Canary Capital are also in the field

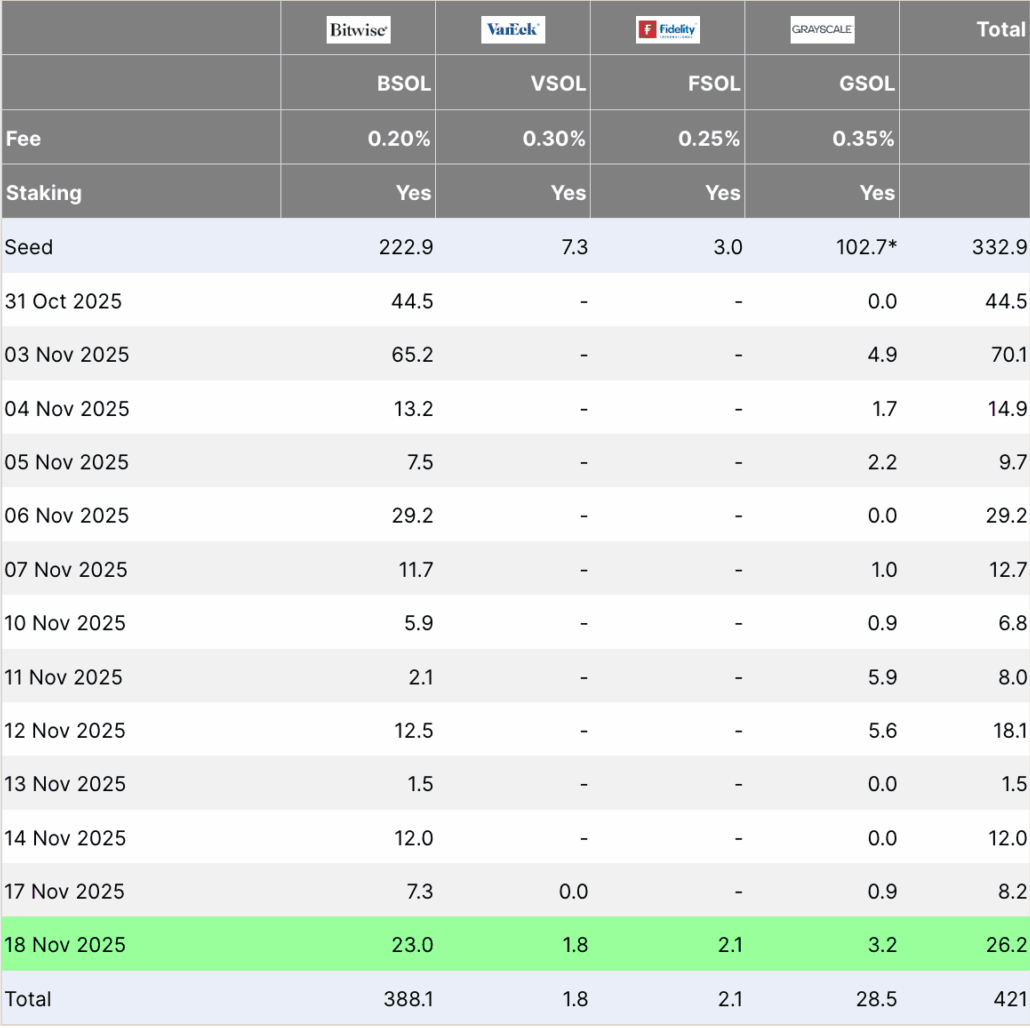

Fidelity Investmentslaunched the Fidelity Solana ETF (FSOL), which began trading on NYSE Arca on November 18. The ETF applies a 15 percent cut from staking revenues along with a 0.25 percent fund management fee. The launch makes Fidelity the largest asset manager offering a Solana-focused product.

Similarly Canary Capital also announced the Canary Marinade Solana ETF (SOLC), which is traded on Nasdaq. Within the scope of the partnership with Marinade Finance, all SOL assets of the fund will be staked through a single provider for at least two years. VanEck joined the market with the VSOL fund it launched on November 17. The ETF, which has an initial capital of $7.32 million, will implement a zero fee policy until it reaches an asset size of $1 billion.

Investment demand for Solana ETFs remains strong despite the price decline. Total net inflows into ETFs on November 18 rose to $26.2 million. Bitwise’s BSOL ETF came out ahead with $23 million in flows, thus Solana ETFPositive inflows were recorded for the 15th consecutive trading day.