Bitcoin  $90,927.60 The balances have completely changed on the options front in the market. There is a transition from last year’s strong bullish bets of $140,000 to bearish bets at $80,000 today. The price of Bitcoin, which has fallen over 25 percent since October 8, is currently trading at $91,000, and investors are now turning to downside protection positions instead of upside hope.

$90,927.60 The balances have completely changed on the options front in the market. There is a transition from last year’s strong bullish bets of $140,000 to bearish bets at $80,000 today. The price of Bitcoin, which has fallen over 25 percent since October 8, is currently trading at $91,000, and investors are now turning to downside protection positions instead of upside hope.

Options Data Points to a Sharp Reversal

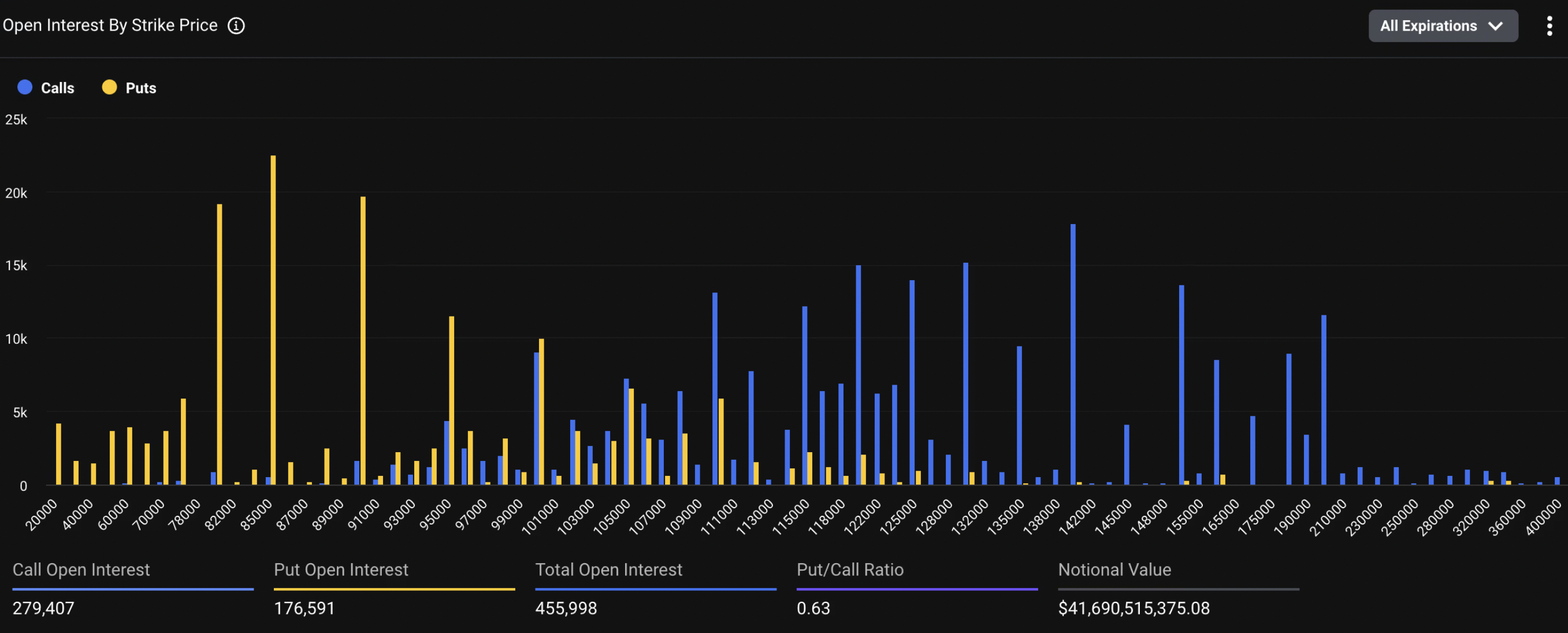

According to Deribit data, since the end of last year, investors have turned to call options at the levels of $ 100,000, $ 120,000 and $ 140,000. However, as of November, the picture has completely changed. $140,000 call option open position (OI) value decreased to 1.63 billion dollars, while it was at the level of 85,000 dollars. sale (put) option increased to $2.05 billion. Strong put accumulations at the $ 80,000 and $ 90,000 levels also attract attention. This change shows that market sentiment has clearly evolved into a bearish direction.

Put options It provides investors with the opportunity to protect themselves from declines by giving them the right to sell at a determined price. Deribit’s chief commercial officer Jean-David PequignotHe stated that short-term put contracts in the range of $ 84,000-80,000 are concentrated and implied volatility is around 50 percent. A strong put skew is observed in the option curves, ranging from 5 to 6.5 percent. This reveals that investors are willing to pay a premium against downside risks as the year-end approaches.

Similarly, on on-chain options platform Derive.xyz, the 30-day skew rate decreased from -2.9 to -5.3, confirming that investors are showing greater demand for downside insurance. Head of Research at Derive.xyz Dr. Sean DawsonHe emphasized that the put density, especially at the level of $ 80,000 due on December 26, has become evident.

Signs of Recovery in an Environment of Extreme Fear

On the macro front, weak employment indicators and the uncertainty of the possibility of interest rate cuts seriously limited risk appetite. While pushing existing investors into hedge positions, technical indicators now say the market is approaching oversold territory.

Pequignot, Crypto Fear and Greed IndexStating that ‘s decreased to 15 and RSI is around 30, he emphasized that large wallets holding assets over 1,000 BTC have increased in recent weeks. This indicates that large investors see falling prices as an opportunity and increase their positions.

Although downward pressure continues in the short term, harsh reactions may be possible in environments where extreme negative emotions prevail, as seen in the past. Bitcoin’s option structure, concentrated at the $80,000 level, may create a critical balance point in the coming weeks.