There is an analyst who has been saying for the last few quarters that BTC will not make a bigger peak and that the long-term structure is broken. We share his remarkable predictions, step by step, as they provide the opportunity to look at the market from a different perspective. crypto oracle He shared his new evaluation today. Let’s take a look at the current market outlook from multiple analysts.

Cryptocurrency Oracle’s Predictions

BTC We warned when it broke the 350DMA at $102,800 and made a 2-day close below it. However, we also wrote that Roman Trading drew attention to the deterioration in the long-term structure in the last few quarters and drew attention to the risk that should not be taken between the rise that BTC may experience and its rise potential. As a matter of fact, for now, Roman Trading was right again because those who listened to him managed to stay out of the market during the BTC decline of approximately 30 thousand dollars.

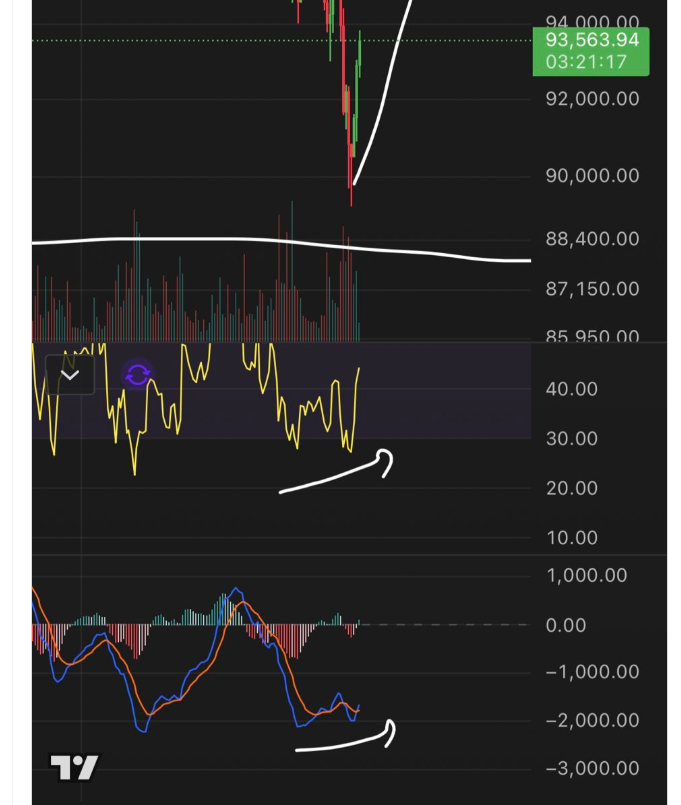

The analyst who shared the chart above a few hours ago wrote:

“The bounce continues on the four-hour chart.

I have stated all the reasons why it is likely to bounce. Oversold RSI, oversold MACD, formation of bull waves, approaching 88 thousand support. “I don’t think this will cause a trend change, it will just bounce for relief and then the decline will continue.”

If he is right, we should see the selling accelerate after a fake rally near $98,000. His scenario is a return to $88,000 and a bottom near $70,000. For BTC, $102,800 could mean saving the 1.5-year uptrend and $107,000 could mean opening the door for a new ATH. Everything is clear, and QT in December and the potential for the Fed to step up its hand due to Japan may create enough environment for the crypto oracle to be wrong in the medium term.

Analyst Targets

Lark Davis stalled below the 50-week EMA and just above the 20-month EMA BTC It draws attention to the importance of the monthly candle closing. The Fed meeting will be held on December 10, and on December 18, Japan will make the eagerly awaited possible interest rate increase. So, on the central banks front at the end of December (if the employment data is not too bad) crypto- Things won’t be great for you. A monthly close below the 20M EMA will mean the beginning of bear markets for Davis. BTC should continue to stay above $92 thousand.

Turkish analyst Anlcnc1, whose on-chain evaluations I find noteworthy, is Coinbase Premium He thinks this should be the main focus since it closed at the bottom for 9 months.

“Yesterday, Coinbase Premium Index had the most negative closing in almost the last 9 months. This must turn positive, otherwise there is no light.”