Bitcoin  $90,927.60The sharp depreciation experienced by ‘s since the beginning of the month was recorded as part of an ongoing wave of position reductions throughout the market. The decline in the market share of the largest cryptocurrency altcoinAlthough it makes one think that it has transitioned to ‘s, the data shows the opposite. Analysts consider the current situation not as a rotation, but as a comprehensive rebalancing process in which leverage is cleared from the market.

$90,927.60The sharp depreciation experienced by ‘s since the beginning of the month was recorded as part of an ongoing wave of position reductions throughout the market. The decline in the market share of the largest cryptocurrency altcoinAlthough it makes one think that it has transitioned to ‘s, the data shows the opposite. Analysts consider the current situation not as a rotation, but as a comprehensive rebalancing process in which leverage is cleared from the market.

Analysts Reject Altcoin Season Expectations

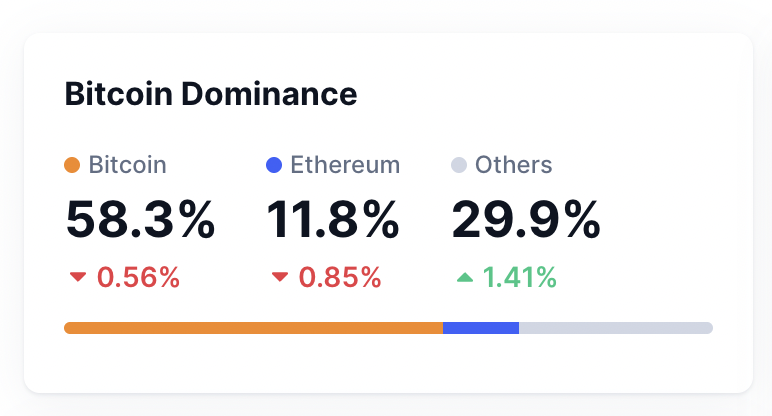

CryptoAppsy According to data, Bitcoin lost 16 percent of its value in the last month, while its market share decreased from 61.4 to 58.9. However, in the same period Ethereum  $3,030.97, solana, Cardano

$3,030.97, solana, Cardano  $0.465281 And dogecoin

$0.465281 And dogecoin  $0.156502 Major altcoins such as fell harder. This emerging picture reveals that capital flow is not directed towards altcoins.

$0.156502 Major altcoins such as fell harder. This emerging picture reveals that capital flow is not directed towards altcoins.

Hex Trust Head of Markets Rohit ApteIn his assessment on Telegram, he said, “Bitcoin’s decline this month is a continuation of a general debt reduction process that started with the liquidations in October. We have not entered an altcoin season yet.” According to Apte, in order for a permanent trend towards altcoins to begin, Bitcoin and Ethereum must first gain price stability and find balance in a narrow consolidation range.

Cross-over performance in the market also supports this view. XRP/BTC While parity shows limited resistance, ETH/BTC Its parity fell only slightly. It is considered that this situation indicates selective endurance rather than a change of leadership. According to analysts, the current outlook points to a phase in which risk appetite does not increase, on the contrary, investors cautiously reduce their positions.

On-Blockchain Data Does Not Confirm Speculative Movements

Intra-blockchain indicators also altcoin cycleSupports that ‘s has not started yet. According to data provided by Blockscout, the Ethereum ecosystem is active but not overheated. Particularly supported by Coinbase’s Launchpad and Smart Wallet tools base Its network stands out by processing approximately 19 million transactions per day. With this Optimism, Arbitrum, polygon And celo Other networks such as are also showing a stable outlook in transaction volumes. There is no significant increase in wages. This is a classic altcoin seasonIt reveals that network congestion and fee explosions, which are the leading indicators of the crisis, are not currently in effect.

According to experts, the current process in the market is not a risk-taking movement, but a restructuring period in which liquidity decreases and investors move away from leverage. The possibility of a strong recovery in altcoins seems slim until the price of Bitcoin and Ethereum stabilizes within a certain range.