The 389-year-old Harvard University has an interest in cryptocurrencies, and its latest 13F filing shows that their interest continues. Harvard, one of the best universities in the world, has endowment funds like other US universities. Harvard, which has more money than the central bank reserves of many countries, has a fund size of nearly 57 billion dollars.

Harvard and Bitcoin (BTC)

Latest published 13F notifications by Harvard University BTC ETF It shows that it continues to hold. to SEC Funds and companies holding assets over $100 million regularly submit 13F forms. These notifications show us what big companies and funds hold.

When Bloomberg ETF analyst Eric examined the latest notification file, he found a detail that would please cryptocurrency investors. The university significantly increased its BTC ETF positions in the third quarter.

“I just checked and yes, IBIT currently represents the largest position increase in Harvard’s 13F. It is very rare/difficult for a foundation to invest in an ETF, especially for foundations like Harvard or Yale. This is the best endorsement an ETF can get. However, half a billion dollars accounts for only 1% of total foundation assets. “They still rank 16th among clients holding IBIT, and that’s a big deal.”

Bitcoin for years  $96,065.54 And cryptocurrencies Millions of people have come and gone saying that this is stupidity and baseless things. However, Bitcoin is still standing and the smartest minds in the world think it makes sense to hold BTC.

$96,065.54 And cryptocurrencies Millions of people have come and gone saying that this is stupidity and baseless things. However, Bitcoin is still standing and the smartest minds in the world think it makes sense to hold BTC.

Bitcoin Latest Status

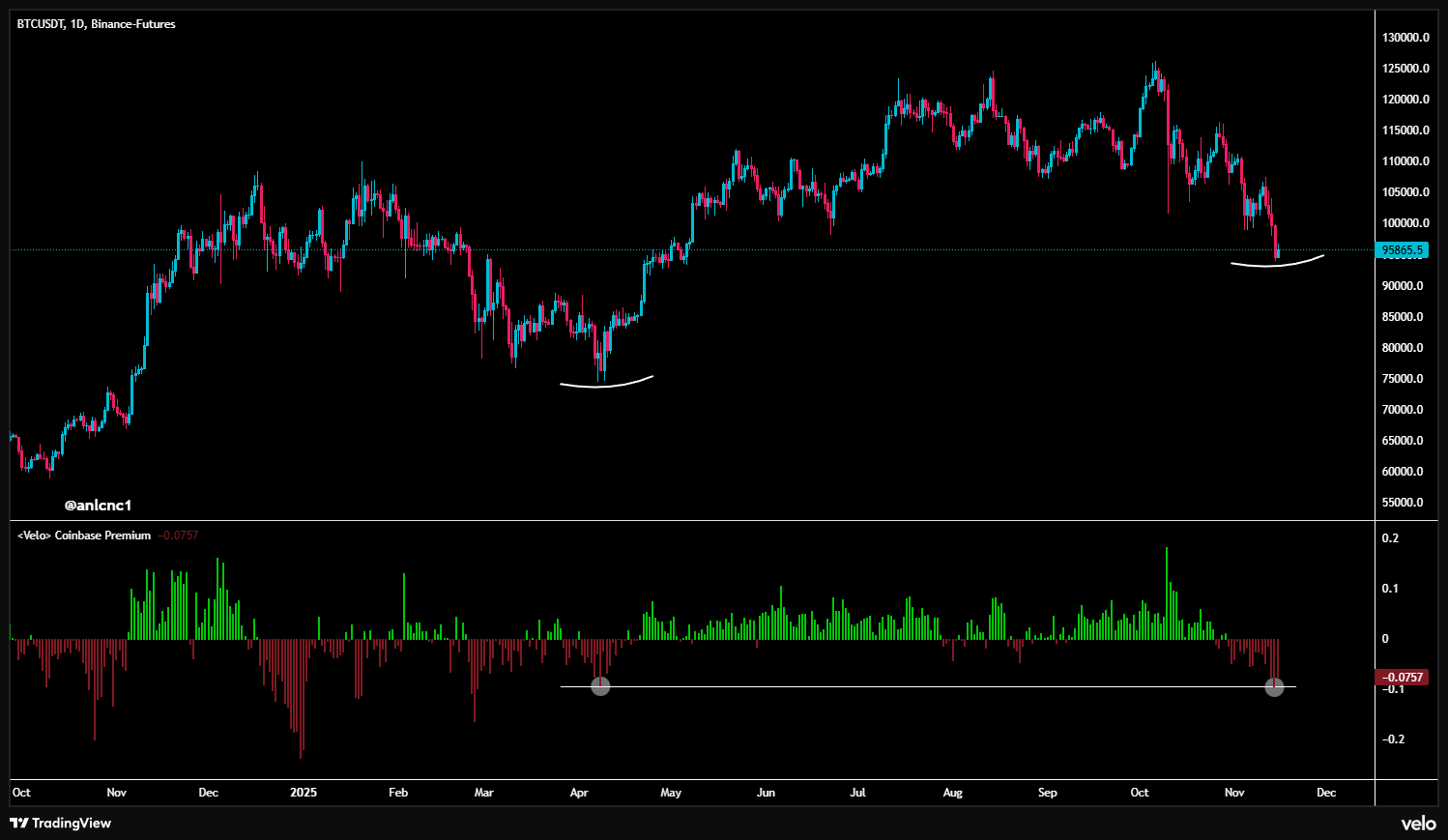

Harvard Although BTC increased its risk in the last quarter, BTC is around 95 thousand dollars for the reasons we have explained for weeks. Turkish on-chain analyst anlcnc1 thinks that recovery may now begin for BTC after yesterday’s bottom.

“Currently, it has made a new bottom by going down to 1.68 levels with 94K closing. I think it will enter the green box with today’s closing and rise with the price. On the MVRV side, I think this region will now be the bottom.”

The same analyst says US demand is still weak. Before the decline accelerated, we mentioned that many names, including Anıl, drew attention to the relaxation on the Coinbase Premium side. Since these investors take a sales-oriented position, a table like the one below is formed.

“in Bitcoin Coinbase Premium closed yesterday in the most negative zone in the last 7 months. This tells us that US demand is still weak and there is still selling pressure, especially on the corporate/US side. This level was seen during the US-China Tariff crisis, the price was at 75-76K levels, now we are at 94-95K levels, we are facing the same sales pressure. We can say that there is a slight positive dissonance.

What we need is not for it to turn directly positive, but even if we see that the pressure decreases, it will be enough. If the slope is higher at the close of each day, we will see that the selling pressure has decreased, which will be a good sign. This trend has gradually continued downwards since the 116K level. We talked about its importance at that time. In summary, the slope needs to turn upward.”