BTC, which has been rising slowly, continues to experience rapid declines. Although the bulls struggled to protect $96,000, recent lower lows have raised concerns about larger losses. What about the November decline? cryptocurrencies Can it be considered a normal movement? The third test since the bottom of the bear markets shows that this is not normal.

Bitcoin Historical Drop

For a decline to be historic, it must threaten a long-maintained trend. Unlike previous declines Bitcoin  $96,065.54‘of The losses it experienced in November will threaten the upward movement that has continued since the bear markets. We have seen different analysts point out distortions in the weekly and monthly charts from October to today.

$96,065.54‘of The losses it experienced in November will threaten the upward movement that has continued since the bear markets. We have seen different analysts point out distortions in the weekly and monthly charts from October to today.

As you can see in the chart above, the rising resistance line from the previous bull market and the rising trend support line, which started in the bear markets and worked as support, intersect and form a triangle. While overcoming the resistance would open the door to abnormal peaks, BTC had to turn back from here every time.

Now, the trend support line is being tested, which has clearly risen for the third time since the bear bottom at $15,500. Previous tests had led to comments that the rise was fake. However, in the sequel BTC saw greater peaks. At the point we have reached today, unlike the previous two tests, the concern that the rising trend may be disrupted is now evident as the rising resistance line has been tested many times and caused failure.

It is impossible to predict the direction because we do not know the future. So what do we know? Bitcoin is preparing for something big soon. If it breaks the support below, this will be the beginning of a new era and they will begin to announce the beginning of the bear markets of the usual four-year cycle story below $ 85 thousand. However, if it bounces from support for the third time, this time the new ATH level will be tested. Mags warns investors on Sunday, November 16, saying “something big is coming.”

Ali Martinez drew attention to the ongoing worrying inflows to the stock markets.

“More than 10,000 Bitcoins, or $1 billion worth of assets, in the last 72 hours cryptocurrency entered the stock exchanges.”

Cryptocurrencies Review

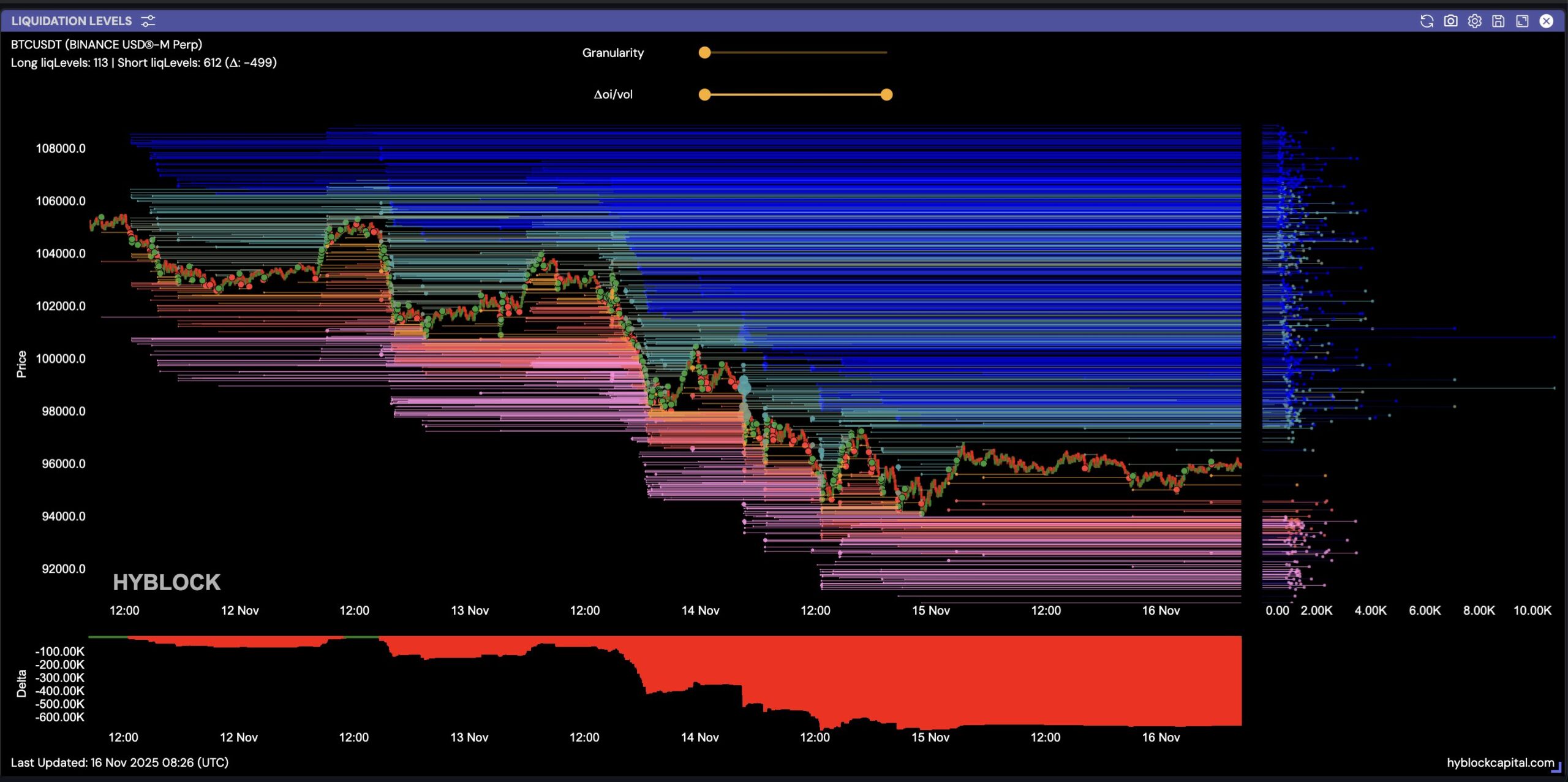

Columbus shared the current heat maps. At the time of writing, BTC dropped below $96,000 and formed 2 large 15-minute bearish candles. While the extreme level of fear feeds hopes that the bottom may have come, the analyst also draws attention to this.

“Maximum fear at the bottom of the weekly cycle is usually the time to expect a strong bounce. Perhaps it will happen after another move down or after some consolidation here, we will see. There is a significant weekly close today. I do not expect it to close above 99.5k, that would be a very strong rise. But you never know, once the momentum starts it always rises much faster than expected and leaves the majority behind. Happy markets, see you soon!”

So is there no good news?

Strategy will announce a larger acquisition than previous ones on Monday. Anchorage Digital got 4,000. BitMine Despite the chaos, he accumulated another 19,500 BTC. A whale near the Satoshi era received 420K ETH. While the majority are afraid, there are those who act bravely, but more is needed. The BTC chart is in this state because the intense sales that have been going on for months can no longer be met.