Bitcoin  $95,870.81 cryptocurrencies is its foundation and has experienced wonderful growth over the years. Although it has seen major crashes in four-year cycles, it has consistently managed to move its peaks higher, and its biggest problem today is that the price has fallen from six-digit levels to 95 thousand dollars. What about Ethereum?

$95,870.81 cryptocurrencies is its foundation and has experienced wonderful growth over the years. Although it has seen major crashes in four-year cycles, it has consistently managed to move its peaks higher, and its biggest problem today is that the price has fallen from six-digit levels to 95 thousand dollars. What about Ethereum?  $3,155.65 Can he surpass it?

$3,155.65 Can he surpass it?

Can Ethereum Overtake Bitcoin?

Cathie Wood, founder and CEO of Ark Invest, is someone who has a keen interest in alternative assets in this space. He has many assets beyond Bitcoin in his portfolio, and even has significant investments in crypto-related stocks. Even so, Cathie of Bitcoin He says it is pure (like pure gold) and centralized in the cryptocurrency space.

Although Bitcoin is pure decentralized crypto asset Although Ethereum is at the center of its field, it is also at the center of its field. Ethereum, defined as the computer of the internet, provides infrastructure to a significant part of the DeFi ecosystem. Many major banks, crypto protocols, and even government agencies are experimenting with Ethereum or have already deployed working applications. This indicates that there will be more in the future.

Wood’s Ethereum and his perspective on Bitcoin says that the two are completely different things. So can Ethereum surpass Bitcoin? The Ark Invest boss is particularly disturbed by the growth of Ethereum L2, as a significant portion of fees and revenues flow to Layer2 solutions. What he sees as an advantage here is the potential for competition between L2 solutions to further increase the importance of Ethereum.

Wood thinks Bitcoin’s superiority is built into its design, that it is scarce, secure and neutral, and forms the monetary base of a new digital economy. But what Ethereum needs to overtake Bitcoin in the future is for the benefit to flow from l2 solutions to Ethereum itself.

Ethereum Will Overtake Bitcoin

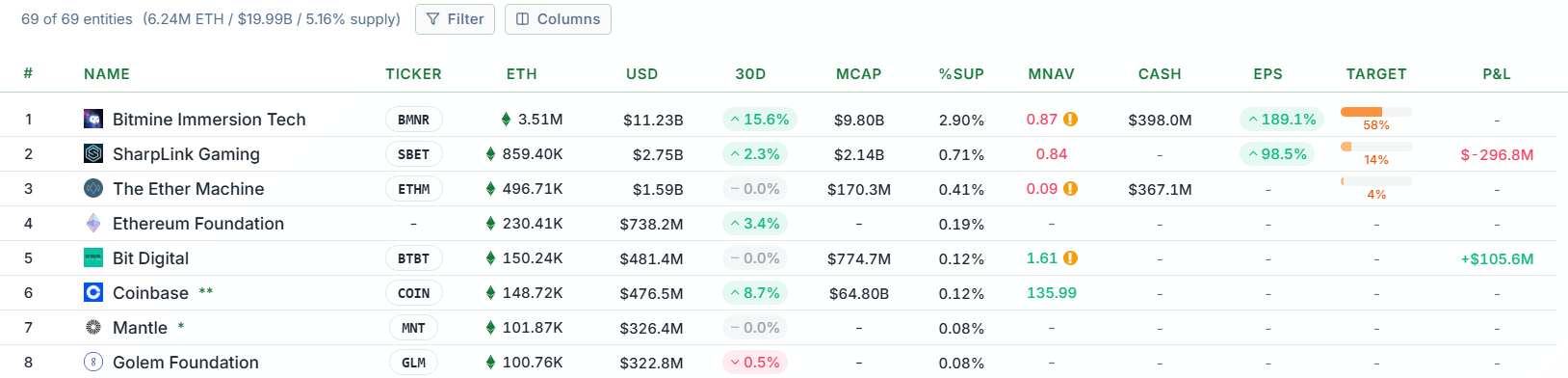

Tom Lee launched his Ethereum reserve company in June and has raised billions of dollars in ETH. It is determined to be the ETH version of Strategy and is taking firm steps on this path. his opinion of Ethereum It is believed that it will easily surpass Bitcoin. Lee targets $200 thousand for BTC by the end of the year and $1 million in the long term. However, he argues that the biggest macro investment in the next 10-15 years is Ethereum.

There are many reasons for this and I can summarize as follows;

- Wall Street is now building the foundations of blockchain. Crypto-related products, new applications and integrations have become very common news. Ethereum is at the center of this, and Lee thinks the altcoin king will be the main beneficiary in this process.

- Another thesis of Lee is the layering of artificial intelligence in the Ethereum ecosystem and his belief in the huge potential there.

- Just like in artificial intelligence, the examples we have seen for years and increasing this year show that the biggest work in the field of tokenization will be in Ethereum. Stablecoin and RWA growth will increase Ethereum fee revenues and aid ETH growth according to Lee.

- If Bitcoin is digital gold, Lee argues that Ethereum is digital oil. This is the common infrastructure aspect of Ethereum. So blockchain will be Ethereum powering the economy.

- He expects ETH reserve companies to grow much faster due to the staking aspect. The largest ETH reserve company is Lee’s.

Lee in the next 5 years of Ethereum He argues that it will reach 60 thousand dollars.