Bitcoin  $101,831.62The price of is struggling to defend itself at the $100,000 level again. Glassnode’s end market report According to the report, the last bull phase ended when the price fell below the short-term investor cost floor of $112,500, and the market retreated 21 percent, entering a fragile equilibrium. Analysts stated that the current structure has not yet turned into panic selling, but long-term investors continue their sales.

$101,831.62The price of is struggling to defend itself at the $100,000 level again. Glassnode’s end market report According to the report, the last bull phase ended when the price fell below the short-term investor cost floor of $112,500, and the market retreated 21 percent, entering a fragile equilibrium. Analysts stated that the current structure has not yet turned into panic selling, but long-term investors continue their sales.

Selling Pressure Increased After Demand Decline

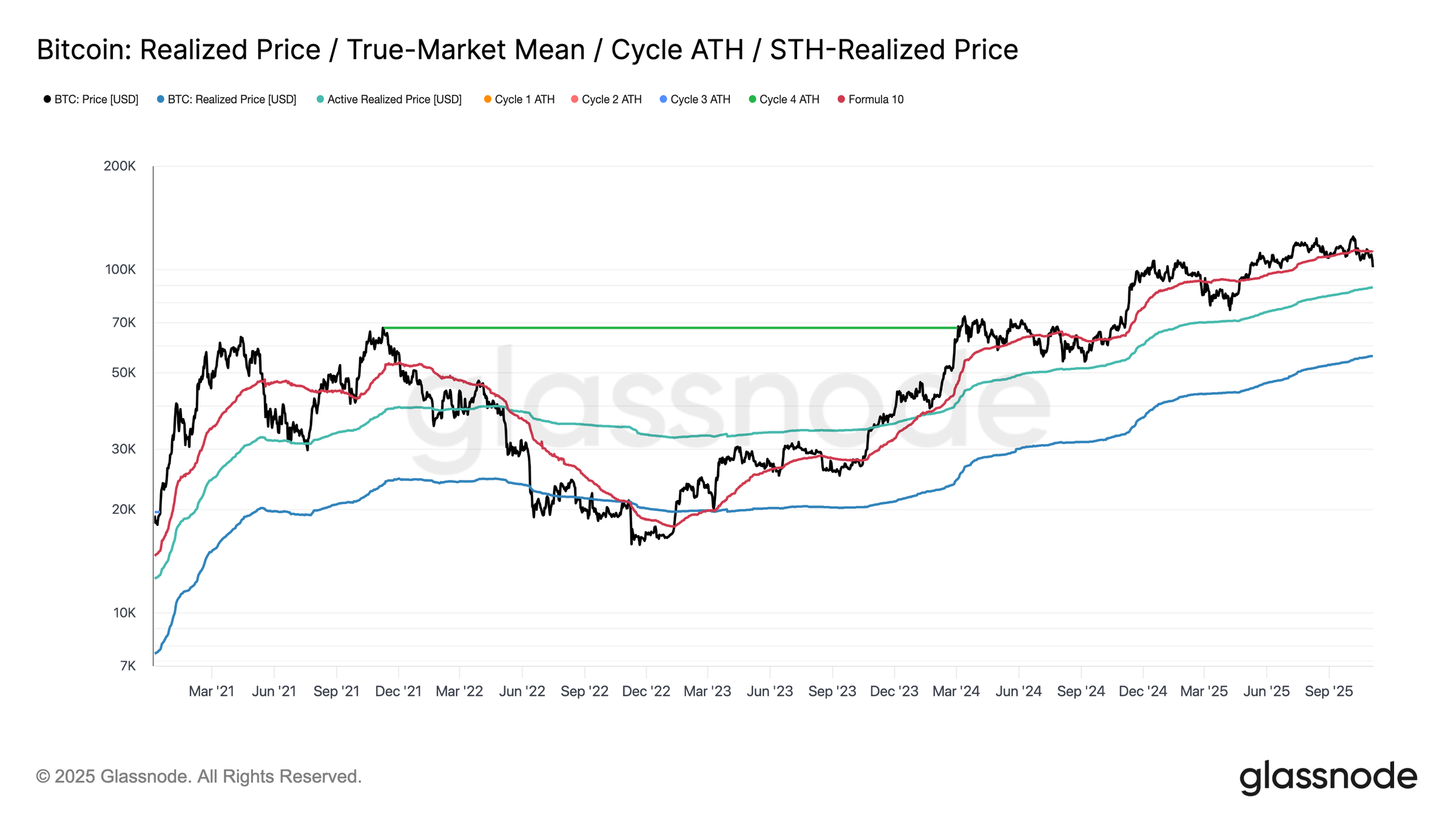

Internal blockchain indicators reveal that Bitcoin is trying to hold on around $100,000, but demand weakness is clearly felt. This ratio indicates a typical correction range, although the 71 percent supply is still in the money as the price falls below short-term investors’ cost level. glassnodeAccording to “active investor realized price” data, around $88,500 stands out as downward structural support. This level formed the base of long consolidation periods in past cycles.

Since July, the supply held by long-term investors has decreased by 300,000 BTC. This shows that “selling at the dip” behavior is prominent instead of “selling at the top” in the early cycle. The fact that even experienced investors tend to realize their profits is seen as an important signal that the lack of confidence is deepening.

Market on Defense as Corporate Demand Fade

in the USA spot Bitcoin ETFThere has been a net outflow of between 150 and 700 million dollars per day in the last two weeks. The reversal of fund flows, in contrast to the strong inflows in September and October, indicates a significant slowdown in institutional interest. In spot exchanges CVD Data shows that selling pressure prevails. Binance and while net outflows continue in other major stock exchanges coinbase Even on the side, a neutral trend is observed.

futures marketWith the unwinding of leveraged positions, the directional premium decreased from 338 million dollars to 118 million dollars. It is noticeable that derivative investors are moving away from aggressive long positions and turning to neutral risk management. options marketWhile the demand for put options with a strike price of 100,000 dollars is increasing, the increase in premiums reveals that investors still prefer the hedging strategy instead of “buying the dip”.