Bitcoin  $101,831.62is facing a remarkable hedging approach in the options market after its 18 percent loss of value in a short time. The price briefly fell below $100,000, causing investors to quickly rearrange their positions in case of a decline. Deribit data reveals that open positions in put options worth $80,000 and $90,000 have reached historical levels.

$101,831.62is facing a remarkable hedging approach in the options market after its 18 percent loss of value in a short time. The price briefly fell below $100,000, causing investors to quickly rearrange their positions in case of a decline. Deribit data reveals that open positions in put options worth $80,000 and $90,000 have reached historical levels.

Decline Expectations Increased in the Options Market

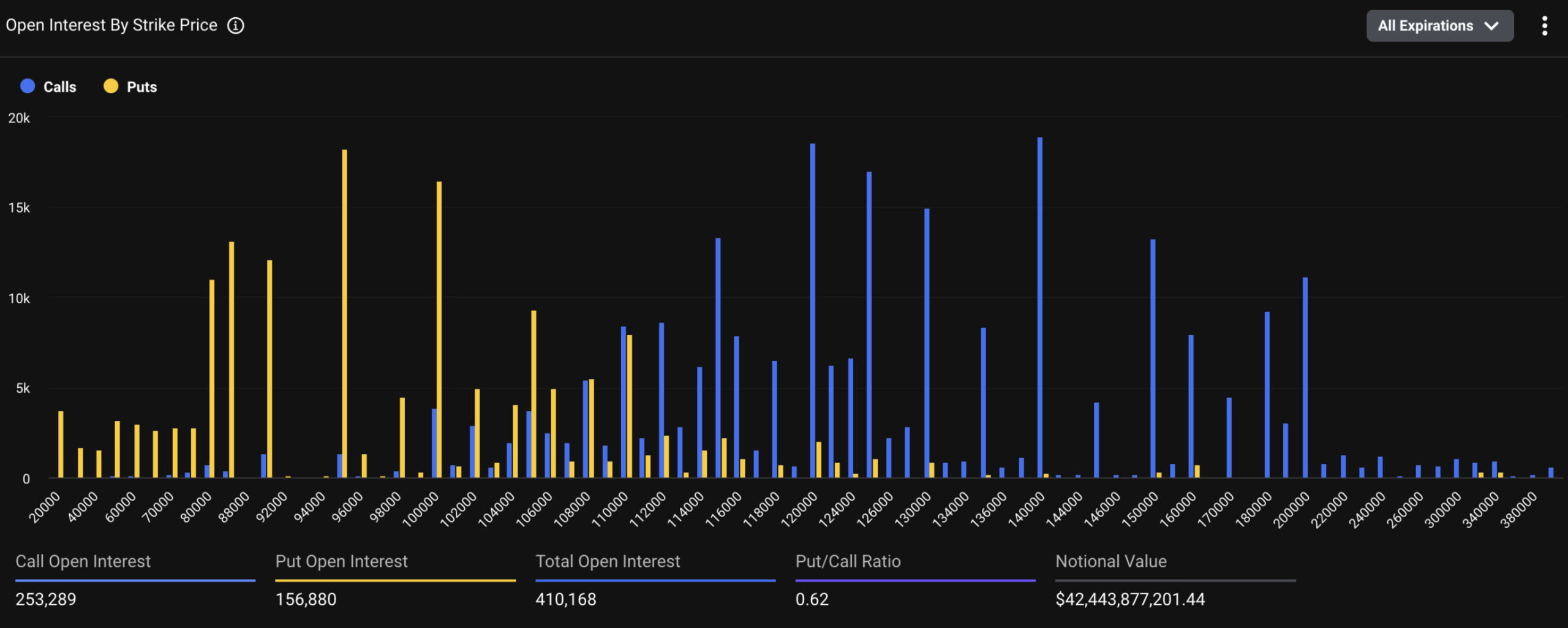

traded on Deribit Bitcoin options‘s total open position value is over 40 billion dollars. Although the trading density is concentrated in contracts worth around $110,000 in options with November and December expiry, the demand for put options at $80,000 has increased significantly in recent days. The increase in interest at the $80,000 level shows that investors are taking positions to protect against the risk of the price falling further. According to Deribit’s data, the increase in $80,000 put positions is a strong indicator that the market has become cautious.

For those who don’t know put option It gives the investor the right to sell the asset at a predetermined price by a certain date and often serves as insurance against price declines. According to Deribit data, the open position value in put contracts at $ 80,000 exceeds $ 1 billion, while puts at $ 90,000 are around $ 1.9 billion. On the other hand, the open positions of call options of $ 120,000 and $ 140,000 are approaching these levels, but most of them consist of return positions written against spot assets.

Macro Pressure and ETF Outflows Push Bitcoin’s Price

price of bitcoin It briefly hit below $100,000 at the beginning of the week, falling 18 percent from its record high of $126,000 four weeks ago. One of the biggest factors in the decline is the Fed President Jerome PowellThere were increasing macro pressures with the hawkish statements of . Spot according to Singapore-based QCP Capital Bitcoin ETFThere was a total outflow of over 5.2 billion dollars from ‘s during four trading days. This pullback turned the year’s strongest supporter into a short-term obstacle.

According to CoinGlass data, more than $1 billion of long positions were liquidated as liquidity tightened. Analytics platform ecoinometrics He emphasized that if the price continues to remain around $ 100,000, it may trigger ETF outflows, which may create a chain selling pressure on the price. CryptoAppsy According to the data, BTC is trading at $ 103,121 with an increase of 1.31 percent in the last 24 hours at the time of writing.