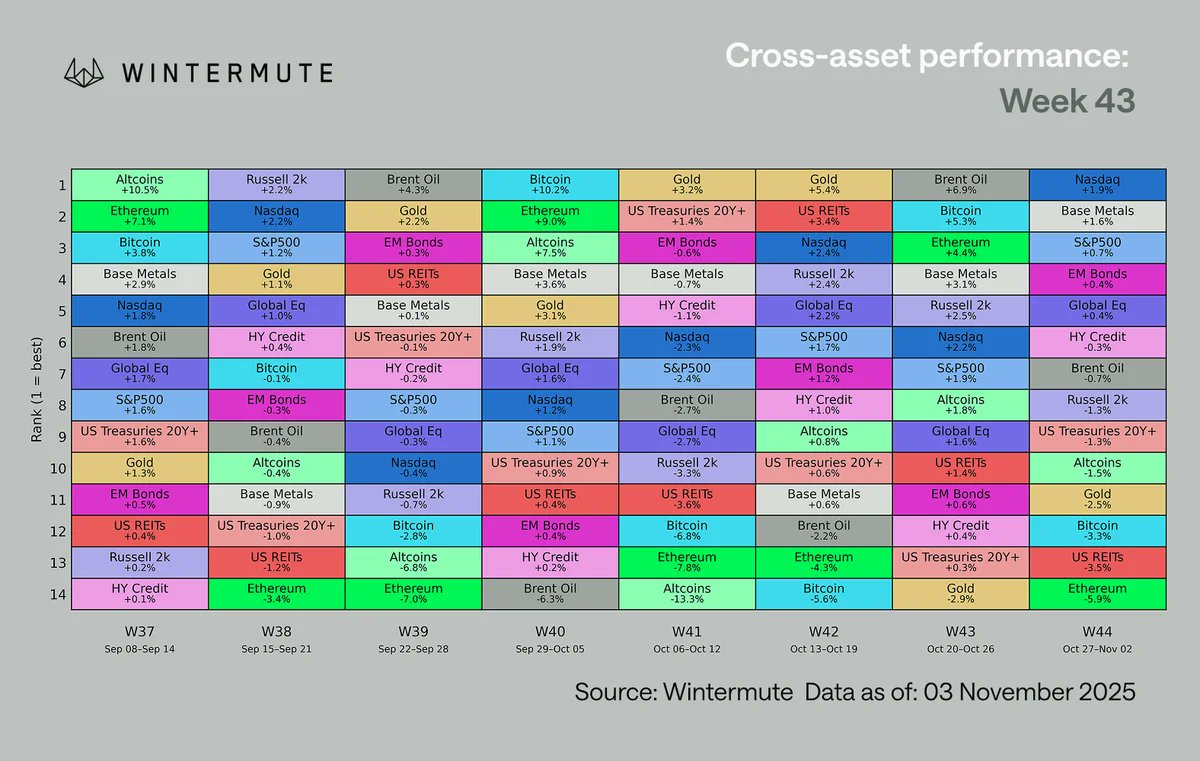

While global liquidity increased, interest rate cuts by major central banks directed capital flows to stocks and artificial intelligence stocks. Wintermute’s latest market to the report according to cryptocurrencyDespite strong macroeconomic support, currencies lagged behind other asset classes. The company emphasized that the four-year cycle theory has become obsolete and that the main determinant of prices is now the direction of liquidity.

Liquidity Doesn’t Flow to Cryptocurrencies

wintermuteHe stated that global liquidity has clearly increased, but has not reached cryptocurrency. While the US Federal Reserve’s (Fed) 25 basis point interest rate cut, the end of monetary tightening, and stocks approaching their historical peaks increased risk appetite, most of the new money flows were concentrated in stocks and artificial intelligence stocks. cryptocurrency marketHowever, only the supply of stablecoins increases.

increased by 50 percent since the beginning of the year stablecoin spot Bitcoin volume has exceeded 100 billion dollars since the summer months.  $104,050.19 Net inflows in its ETFs stagnated. DAT (Digital Asset Trust) activities also dried up. Trading volumes on exchanges such as Nasdaq collapsed. Among the three main forces supporting the market in the first half: ETFs, stablecoins and DAT flows, only the stablecoin side survived.

$104,050.19 Net inflows in its ETFs stagnated. DAT (Digital Asset Trust) activities also dried up. Trading volumes on exchanges such as Nasdaq collapsed. Among the three main forces supporting the market in the first half: ETFs, stablecoins and DAT flows, only the stablecoin side survived.

Although the Structure is Strong, Demand is Lacking

According to Wintermute’s analysis, the market structure is extremely healthy despite everything. Leveraged positions have cleared, volatility has fallen and macro conditions have become supportive. However, the direction of liquidity has changed. Capital is flowing into growth-oriented stocks and technology assets, not into cryptocurrencies as in previous cycles.

The report reveals that the four-year cycle concept has no longer made sense, and the dynamics of miner supply and block reward halving do not affect prices in the maturing market. The main factor determining price movements today is the direction and redistribution of capital. Wintermute, ETF And DAT He is of the opinion that the re-acceleration of inflows will be the first signal of a new upward phase for the cryptocurrency market.

CryptoAppsy according to data Bitcoin While it was traded at $ 102,040 with a decrease of 2.53 percent in the last 24 hours, Ethereum  $3,494.70 It changes hands at $3,333, down 5.04 percent. Many leading ones such as XRP, BNB, Solana altcoin is priced with a decrease of 2 to 3 percent in the same period.

$3,494.70 It changes hands at $3,333, down 5.04 percent. Many leading ones such as XRP, BNB, Solana altcoin is priced with a decrease of 2 to 3 percent in the same period.