Nexperia announced today that there will be no change in its current trade relations, and the EU and China are trying to reach an agreement. Although the USA and China reached a 12-month agreement, the European Union has not yet been able to solve its problems with China. Predictions that the enthusiasm in the field of artificial intelligence is starting to fade are on the agenda again, and cryptocurrencies do not like this weather at all. Alright SEI Coin And AAVE What’s the latest situation on the front?

SEI Coin Price Target

Although BTC regained $ 104 thousand, it lost again at the time of writing. Since we have shared more than one comprehensive assessment of the cause of the decline today, it is pointless to repeat the same things. Crypto In particular, there is no major change in the last hours, but it is now unreasonable for liquidations to continue downwards.

BTC may hunt for $120,000 to liquidate billions of dollars of easy short positions. The end of the shutdown, the Supreme Court decision in Trump’s favor, and other exciting developments in the field of AI could change things.

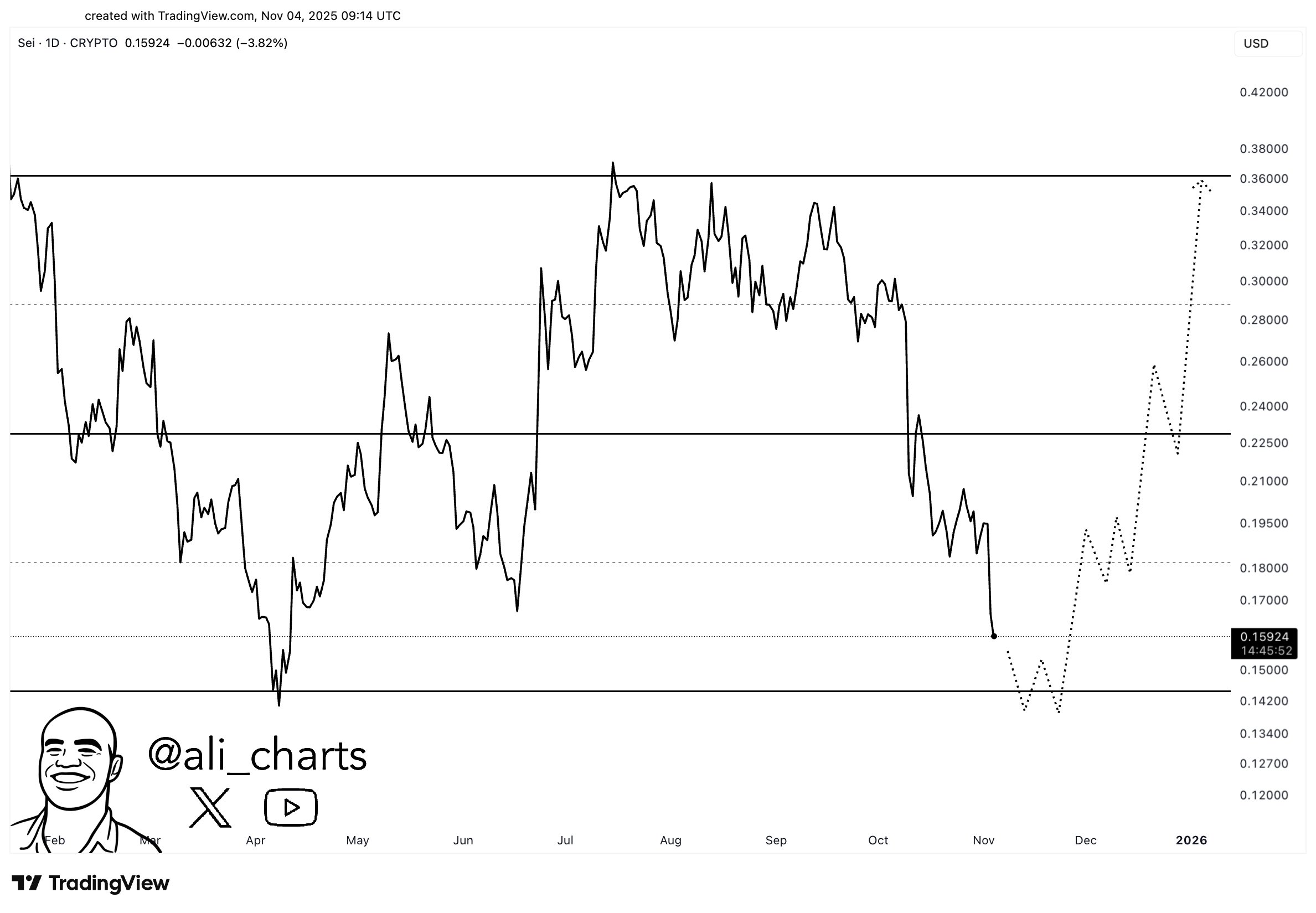

SEI Coin It was on Ali Martinez’s agenda today and the analyst said that the $0.15 support level is extremely important. The price is currently just above this support. In the scenario where support is maintained, the analyst expects a return to $0.23-0.36. This is more than 100% upside.

Bitcoin  $104,050.19 Let’s briefly touch upon an interesting analysis. Sherpa after a long time in BTC shared a strong bearish forecast and is targeting $85,000 if we don’t see a bounce.

$104,050.19 Let’s briefly touch upon an interesting analysis. Sherpa after a long time in BTC shared a strong bearish forecast and is targeting $85,000 if we don’t see a bounce.

AAVE Coin

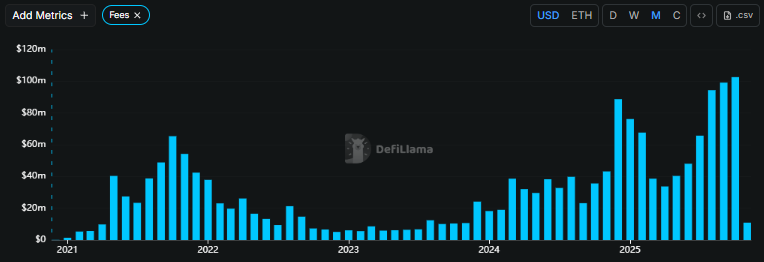

These days, altcoins are doing whatever they can to differentiate themselves a little from the general negativity. We have seen that most of them have started a buyback program, some of them are working on it. AAVE DAO is also planning a $50 million acquisition, supported by revenues from the protocol. Since it is one of the lucrative protocols of DeFi, this step of AAVE should be taken seriously.

Kyle said:

“Aave DAOlaunched a $50 million annual buyback program backed by protocol profits.

Aave’s solid cash flow, which generated $98.3 million in fees and $12.6 million in revenue last month and has a TVL of $35 billion, supports this bold move. The signal is clear: DeFi aims for stable growth by avoiding speculation.”