The biggest cryptocurrency Bitcoin  $107,431.55The price of ‘s price fell below $ 108,000, making investors nervous again. Among the reasons that increased the selling pressure in the market, the US Supreme Court’s decision on Trump tariffs, the re-triggering of the Hindenburg Omen indicator and intense sales by giant investors came to the fore. Despite optimistic expectations for November, experts warn about the fragility of the cryptocurrency market.

$107,431.55The price of ‘s price fell below $ 108,000, making investors nervous again. Among the reasons that increased the selling pressure in the market, the US Supreme Court’s decision on Trump tariffs, the re-triggering of the Hindenburg Omen indicator and intense sales by giant investors came to the fore. Despite optimistic expectations for November, experts warn about the fragility of the cryptocurrency market.

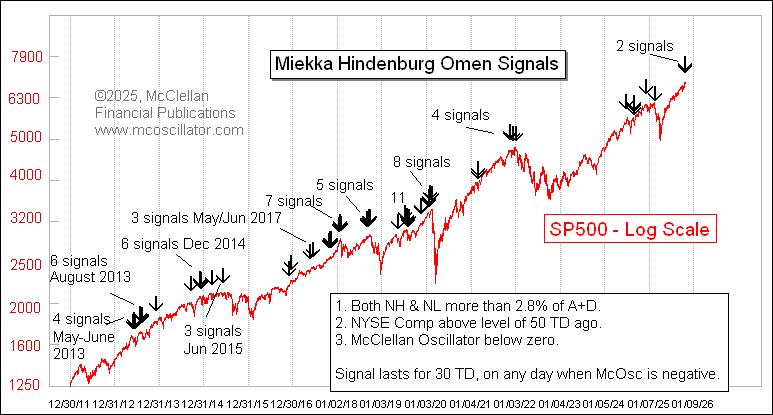

Hindenburg Omen Sounds Alarm for Cryptocurrency Market

Known for predicting Black Monday in 1987 and the financial crisis of 2008 Hindenburg Omen The reintroduction of the indicator increased investors’ concerns about a sharp decline. The index giving a signal for the second time in the last month, especially Bitcoin and Ethereum  $3,717.97 It increased fear as it came at a time when outflows from ETFs were accelerating. The weakness in the markets spread to technology stocks, and the declines in Meta, Oracle and Microsoft stocks reduced risk appetite.

$3,717.97 It increased fear as it came at a time when outflows from ETFs were accelerating. The weakness in the markets spread to technology stocks, and the declines in Meta, Oracle and Microsoft stocks reduced risk appetite.

technical analyst Tom McClellanstating that the importance of the indicator increases in cluster periods, argued that the latest signals are not a coincidence. 10x Research He expects a deeper correction if Bitcoin loses the $107,000 support. explained. cryptocurrency The research company cited factors such as the weakening of ETF demand, miners’ search for artificial intelligence-driven income, and the loss of ground in the buyer base in Ethereum as the precursors of a possible collapse.

Huge Sales and Trump Tariff Tension

Another factor that increased the uncertainty in the markets was the sales made by large investors. According to internal blockchain data, long-term investors have sold over 405,000 BTC in the last 30 days. While more than $450 million of positions were liquidated in the last 24 hours alone, $250 million of the liquidations took place within 4 hours.

According to Lookonchain data, a whale transferred a total of 13,000 units worth approximately $1.48 billion to the Kraken, Binance, Coinbase and Hyperliquid exchanges in October. BTC deposited. During the same period, another address made a profit of $14.7 million from the sale of 3,000 ETH.

Another topic that increased tension in global markets was the lawsuit regarding the Trump administration’s customs tariffs. Before the case that the US Supreme Court will hear on Wednesday, Trump shared on his Truth Social account, “The USA would be a third world country without tariffs.” Although the new trade agreements signed with China during the Asian tour and the 1-year agreement on critical minerals brought a short-term recovery, they could not fully restore investor confidence.