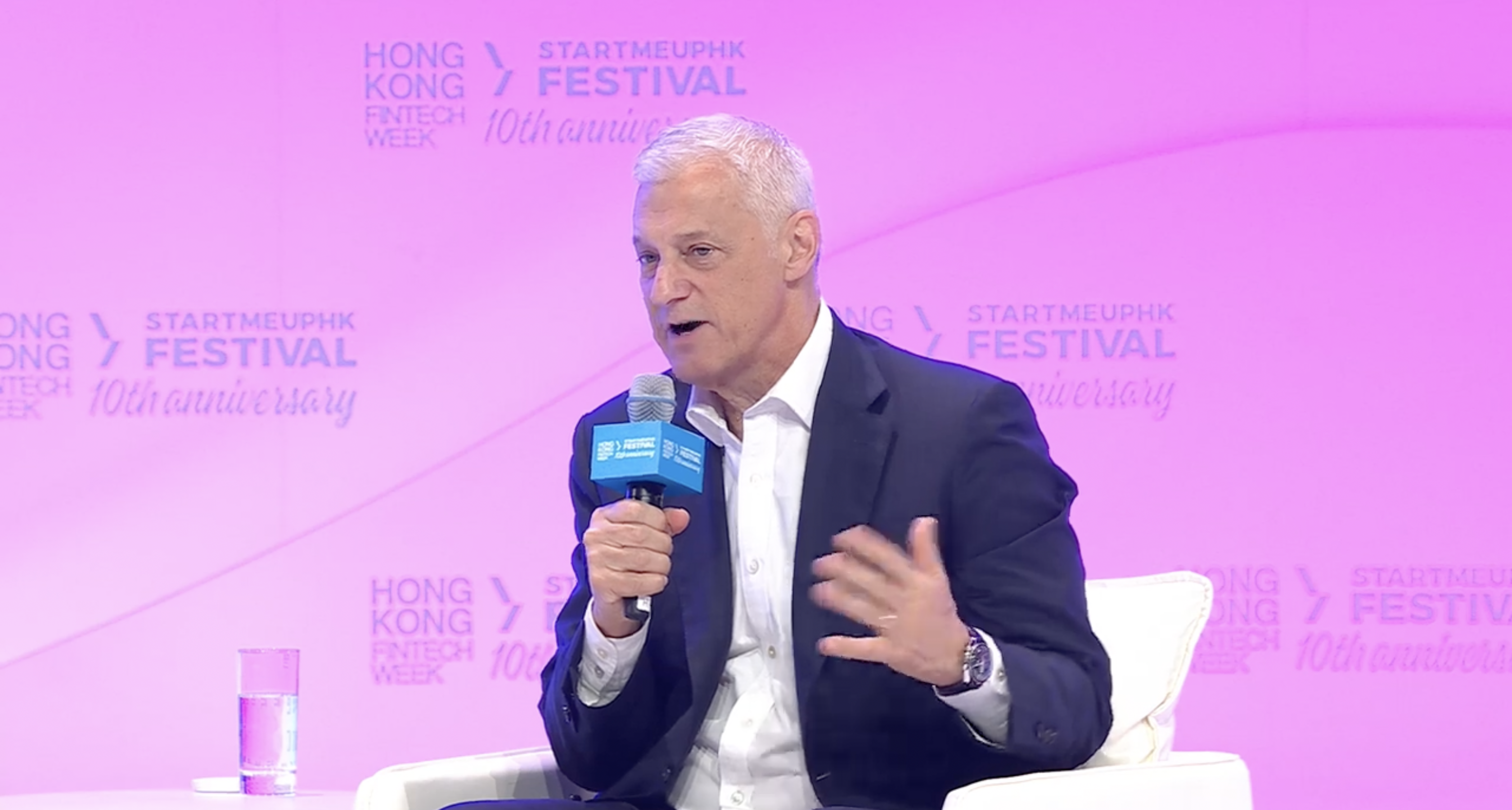

CEO of Standard Chartered Bill WintersHe stated that Hong Kong’s breakthroughs in tokenized money and stablecoins will play a key role in the digital transformation of global trade. Speaking at the Hong Kong FinTech Week event, Winters said Hong Kong dollar-based stablecoin projects and tokenized deposit tests could usher in a new era in international payments. expressed. The statements of Standard Chartered CEO came at a time when the city’s financial authorities were accelerating cryptocurrency regulations.

Hong Kong Dollar Indexed Cryptocurrency Plan

Bill Winters emphasized that Hong Kong’s tokenized deposit and stablecoin initiatives could become a cornerstone of the digital commerce ecosystem. Standard Chartered’s Hong Kong unit along with Animoca Brands and HKT Hong Kong Monetary AuthorityUnder the new regulatory framework of (HKMA), an HKD-supported stablecoin It had applied for a license for export. This trio consortium stands out as one of the five institutions included in the stablecoin trial environment that the HKMA launched last year. Winters said that these projects will accelerate the transition to a completely digital international trade order.

Hong Kong’s pilots aim to eliminate the slowness of cross-border transactions in the traditional financial system. Thanks to tokenized deposits, banks and businesses will be able to make instant and low-cost payments via cryptocurrencies. According to Winters, all these innovations Hong KongIt will position Turkey as the digital finance center of Asia.

Global Liquidity Access Approval from SFC

Hong Kong Securities and Futures Commission (SFC) allowed licensed cryptocurrency exchanges to access global liquidity pools with the new circular published at the same event. Within the scope of the cryptocurrency roadmap called “ASPIRe”, local platforms will now be able to share global order books. In this way, price discovery processes are expected to improve and market efficiency to increase.

SFC stated that the new system will significantly narrow the differences between prices, but operational and settlement risks may also increase. The regulator required platforms to provide pre-funding, payment-for-delivery (DvP), unified market surveillance and compensation reserves to protect customer assets. The decision puts Hong Kong on global cryptocurrency marketWhile accelerating its integration into Asia, it is transforming the region into one of Asia’s most innovative cryptocurrency hubs.