One of the well-known analysts of the cryptocurrency market Ali MartinezBitcoin (BTC) in its latest reviews  $107,431.55Ethereum (ETH)

$107,431.55Ethereum (ETH)  $3,717.97Chainlink

$3,717.97Chainlink  $16.09 He pointed out notable technical formations for (LINK), Solana (SOL) and Hyperliquid (HYPE). In the charts he shared from his X account, he stated that despite the short-term volatility, the market is approaching important breaking points.

$16.09 He pointed out notable technical formations for (LINK), Solana (SOL) and Hyperliquid (HYPE). In the charts he shared from his X account, he stated that despite the short-term volatility, the market is approaching important breaking points.

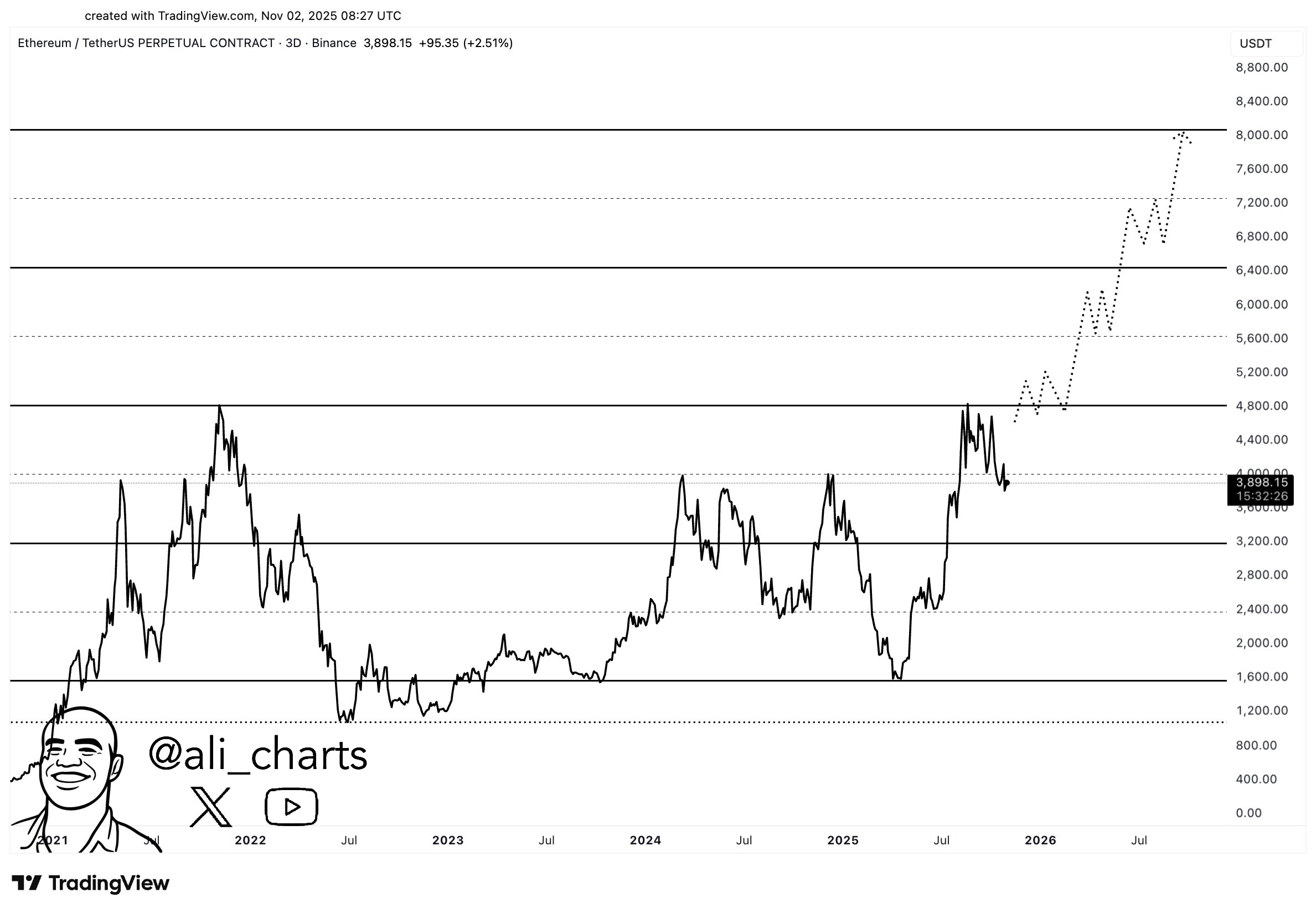

Critical Turning Point in Bitcoin and Ethereum

According to Martinez Bitcoincontinues to be traded in an expanding formation. The analyst warned that if the current structure is confirmed, a sharp correction may follow a new peak. He stated that Bitcoin, which is traded around $ 110,000, may first rise to the level of $ 126,000 and then retreat towards the $ 80,000 band. The scenario that Martinez points out is seen as a strong sign that the market has not yet completed its top formation.

Ethereum On the front, the picture is more hopeful. Martinez, ETHHe stated that if . This indicates the beginning of a process in which investors may regain risk appetite, especially in the medium term.

CryptoAppsyAccording to the data provided by , BTC and ETH are traded at $ 107,450 and $ 3,715, respectively, with a decrease of 2.88 and 4.60 percent in the last 24 hours.

Balance of Opportunities and Threats in Altcoins

Chainlink Defining the $15 region as a “gold buying area” for the price, Martinez predicts that if the price finds support at this level, there may be a breakout that may extend to $100. solana On the side, it is emphasized that the rise will remain weak unless it exceeds $ 200. Analyst, LEFTHe stated that if it exceeds this threshold, it may accelerate up to $260, otherwise a decline below $150 will be inevitable.

hyperliquid The picture for is more cautious. Martinez suggested that if the head-and-shoulders formation evident on the chart is confirmed, the price may drop to $20. This analysis reveals that the market has not yet made a full direction choice, but technical pressure is gradually increasing.

According to current data, LINK, SOL and HYPE are affected by the decline in the overall market and are priced with a decrease of more than 3 percent in the last 24 hours.