Bitcoin  $110,860.50 price It is just under 110 thousand dollars and the guru of on-chain analysis, Ki Young Ju, shared his new assessment after a long time. The analyst, who was wrong in his previous prediction and admitted that he was wrong, caused great disappointment. This misconception, which causes the reliability of on-chain data to be questioned, may come to nothing these days.

$110,860.50 price It is just under 110 thousand dollars and the guru of on-chain analysis, Ki Young Ju, shared his new assessment after a long time. The analyst, who was wrong in his previous prediction and admitted that he was wrong, caused great disappointment. This misconception, which causes the reliability of on-chain data to be questioned, may come to nothing these days.

Bitcoin On-Chain Analysis

Historical data does not always repeat itself and is sometimes wrong. However, Ki Young Ju thinks that handling on-chain data under current conditions (ETF, institutional Bitcoin treasury companies) can still give accurate results. Sharing his comments about different metrics in his evaluation shared today, he said, “I gave up on predicting the Bitcoin price, but I did not give up on data analysis.”

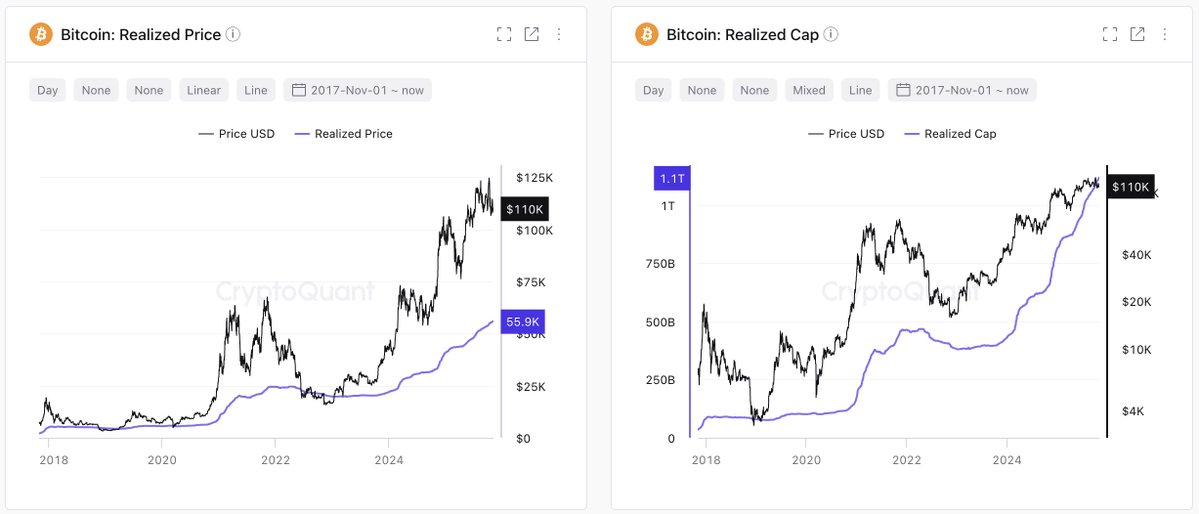

The first chart shared by the on-chain guru is the average cost base of Bitcoin wallets. This one is at $55,900.

“Realized market capitalization continues to rise (+$8 billion this week), indicating that on-chain inflows remain strong.

“The price did not rise due to selling pressure, not because of weak demand.”

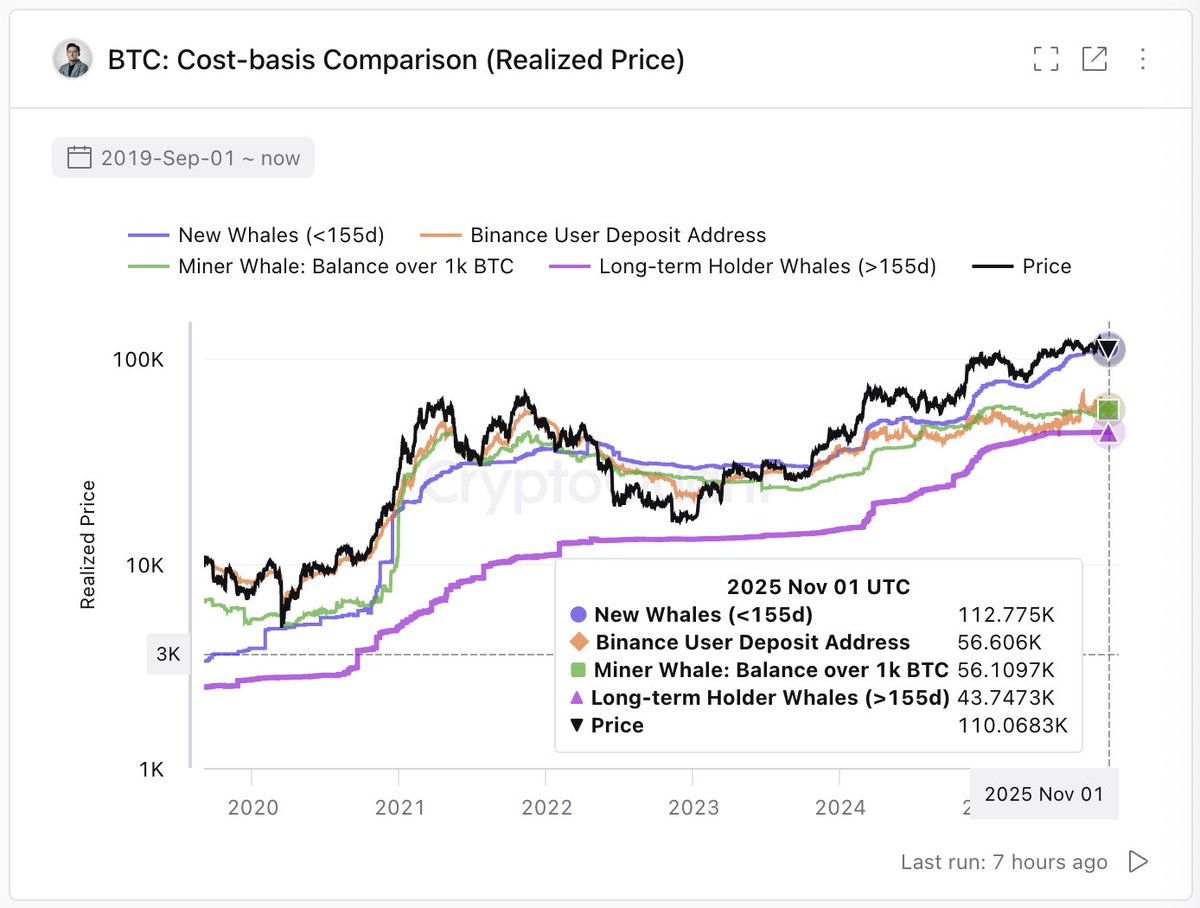

Secondly, what the analyst looks at is where the inflows came from. ETFs are in the majority and treasury companies are also following them.

“ETFs / Storage Wallets: $112,000 (-1%)

Binance Traders: $56,000 (+96%)

Miners: $56,000 (+96%)

Long Term Whales: $43,000 (+155%)”

At the current price of 110 thousand dollars, long-term investors are the most profitable group. ETF investors, on the other hand, are costing at the rise threshold of 112 thousand dollars.

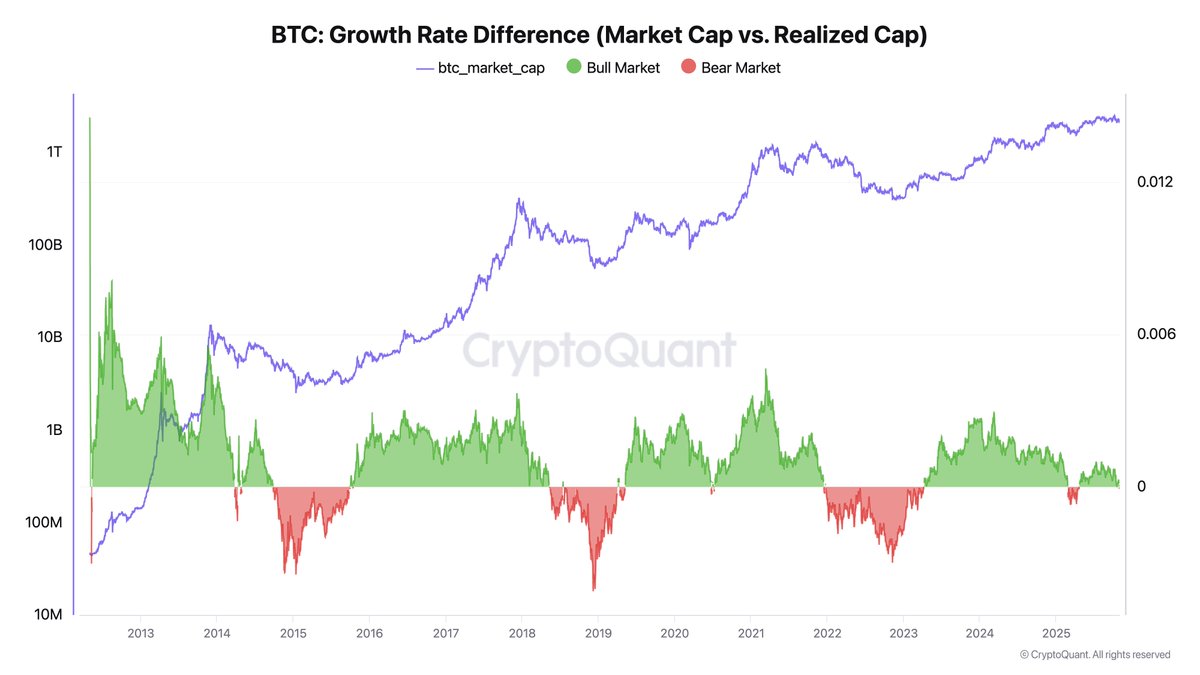

“When the growth rate gap between market value and realized value widens, this indicates a stronger valuation multiple.

In a bull market, market value increases faster than actual inflows. Approximately $1 trillion in on-chain inflows have created $2 trillion in market value. “For now, this difference seems reasonable.”

Is the Ascension Over?

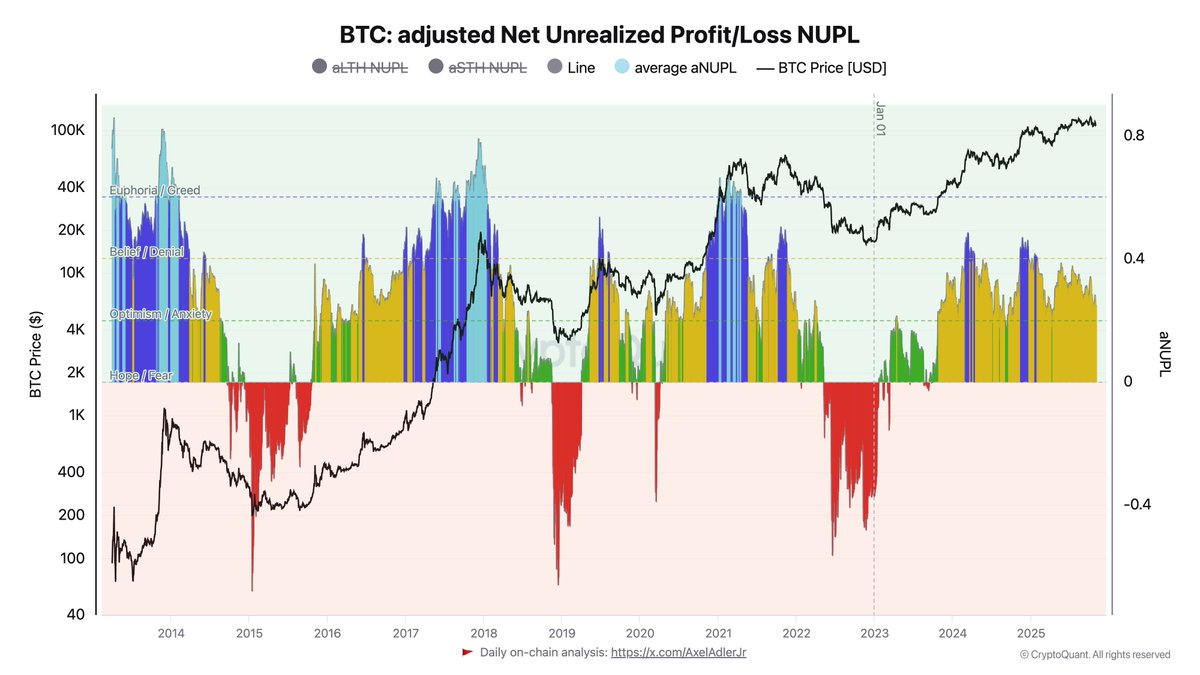

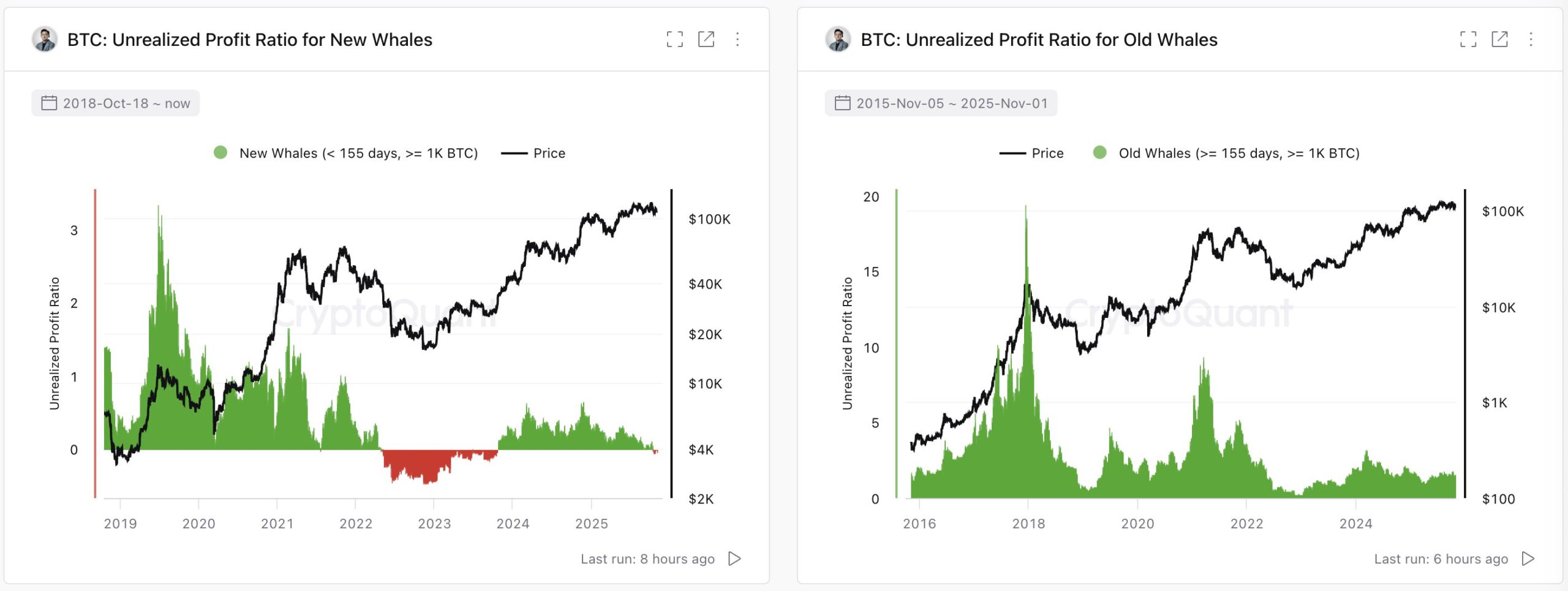

The analyst who mentions that the whales’ unrealized gains are not excessive (he looks at this for all whales) believes that we are still far from enthusiasm. The second prediction of CryptoQuant CEO is that this time the situation is different and high profit rates will not be the same in hyper-growing markets.

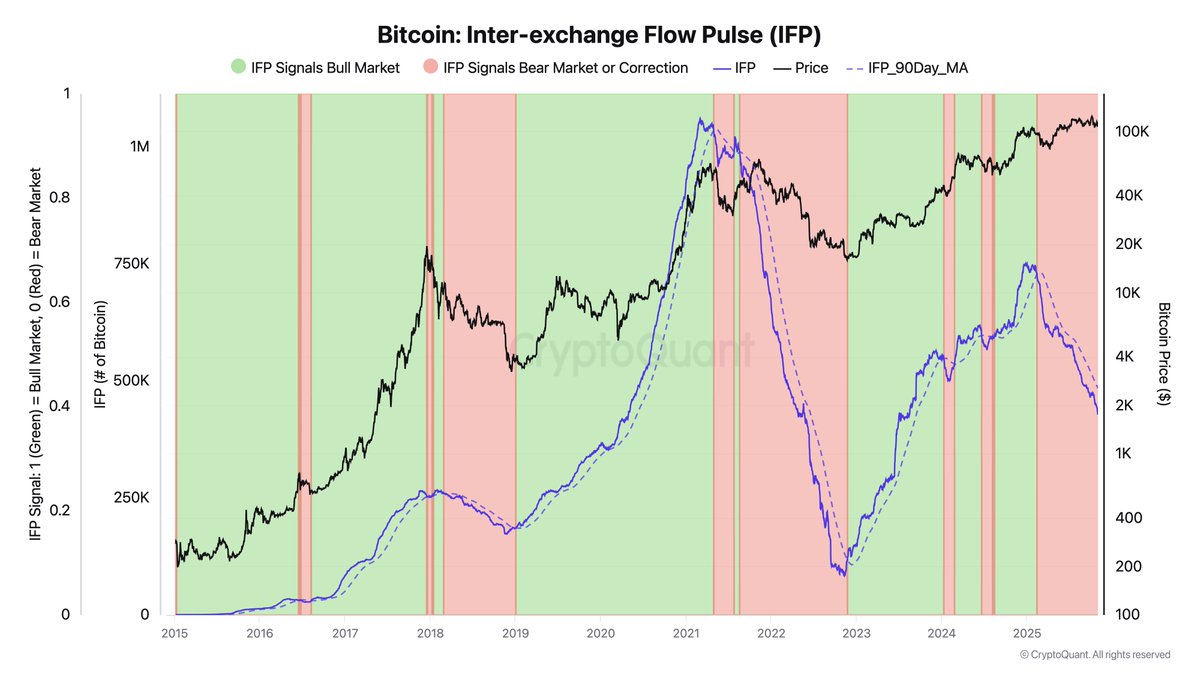

Another important detail is that BTC inflows from spot-oriented exchanges to futures exchanges have decreased sharply. Ki Young Ju He interprets this decline as a result of whales not opening long positions with BTC collateral as much as before. In other words, a decrease in BTC collateral means less long positions, which undermines the rise.

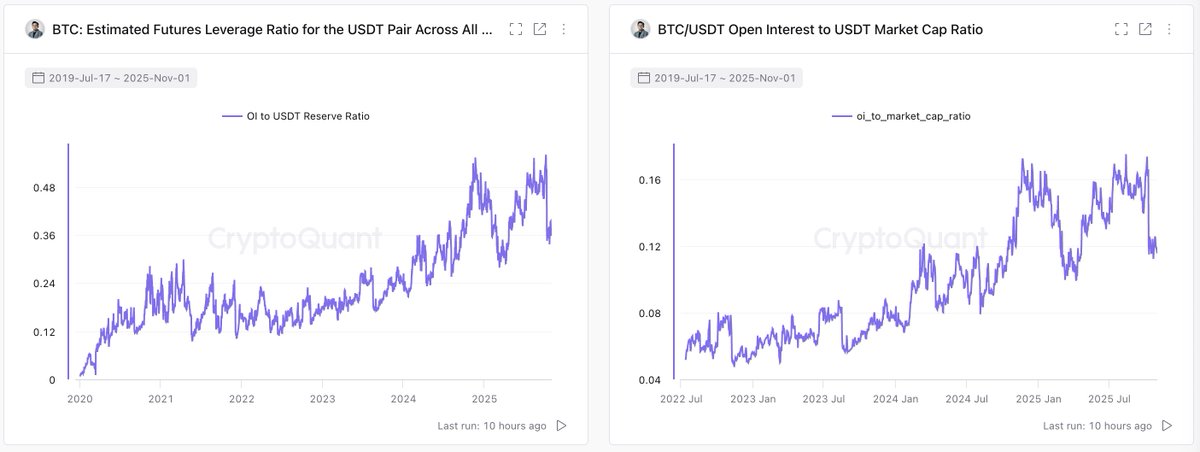

Despite the recent crash, leverage in futures is high. The ratio of open positions on the exchanges to the USDT balance on the exchanges confirms that the leverage ratio remains high.

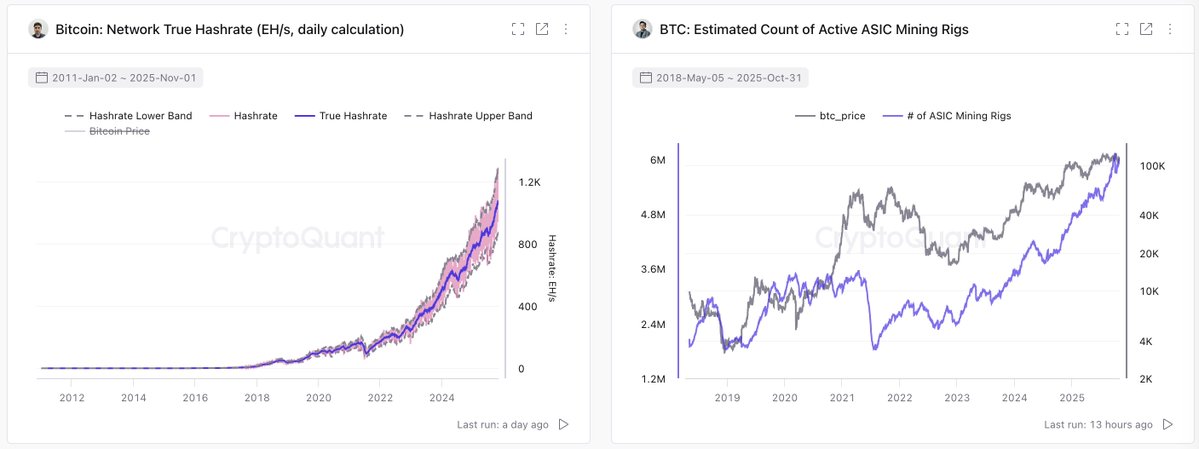

Bitcoin hashrate continues to reach peaks. Publicly traded miners are growing rather than shrinking, a clear bullish signal in the long term.

Demand mainly ETFs And MicroStrategy It is fed by large companies such as. However, the recent weakening of both prevents the market recovery. In other words, increasing ETF inflows and reserve companies taking action to increase the amount of BTC on hand will be a new bullish signal.

It has become difficult to predict where and how much liquidity will enter for direction, and this explains why we cannot be sure of the rise.

“Short-term whales (mostly ETFs) over the last 6 months are nearly at breakeven, while long-term whales are up ~53%.

In the past, the market moved in a four-year accumulation and distribution cycle between individual investors and whales. “It has now become more difficult to predict where and how much new liquidity will enter, making it unlikely that Bitcoin will follow the same cyclical pattern again.”

In summary, the usual cyclical signals have been disrupted, but there are still signaling metrics by which we can see whether the rise will continue. For the rise in cryptocurrencies, it is necessary for the excitement in the ETF channel to revive and for BTC to remain above 112 thousand dollars (ETF average cost) to prevent ETF sales. Since technical analysis also points to the importance of 112 thousand dollars, we can say that the on-chain confirms this level.