In the cryptocurrency market, attention is focused on XRP. Because Ripple  $2.51Scenarios are on the agenda about what would happen if ‘s burned its locked tokens, reducing the supply by 20%. Currently, the total supply of XRP stands at approximately 99.9 billion tokens; Approximately 60 billion of this is in circulation in the market, and 35 billion is held in the escrow account under the control of Ripple.

$2.51Scenarios are on the agenda about what would happen if ‘s burned its locked tokens, reducing the supply by 20%. Currently, the total supply of XRP stands at approximately 99.9 billion tokens; Approximately 60 billion of this is in circulation in the market, and 35 billion is held in the escrow account under the control of Ripple.

A significant part of the crypto community is of the opinion that Ripple burning the tokens in the escrow account would be positive in terms of price. In this way, the concern about centralization in supply can also be reduced. However, it is reminded that supply alone does not determine the price; factors such as demand, area of use and regulatory environment are also effective.

Supply Interruption: What Scenarios Are There?

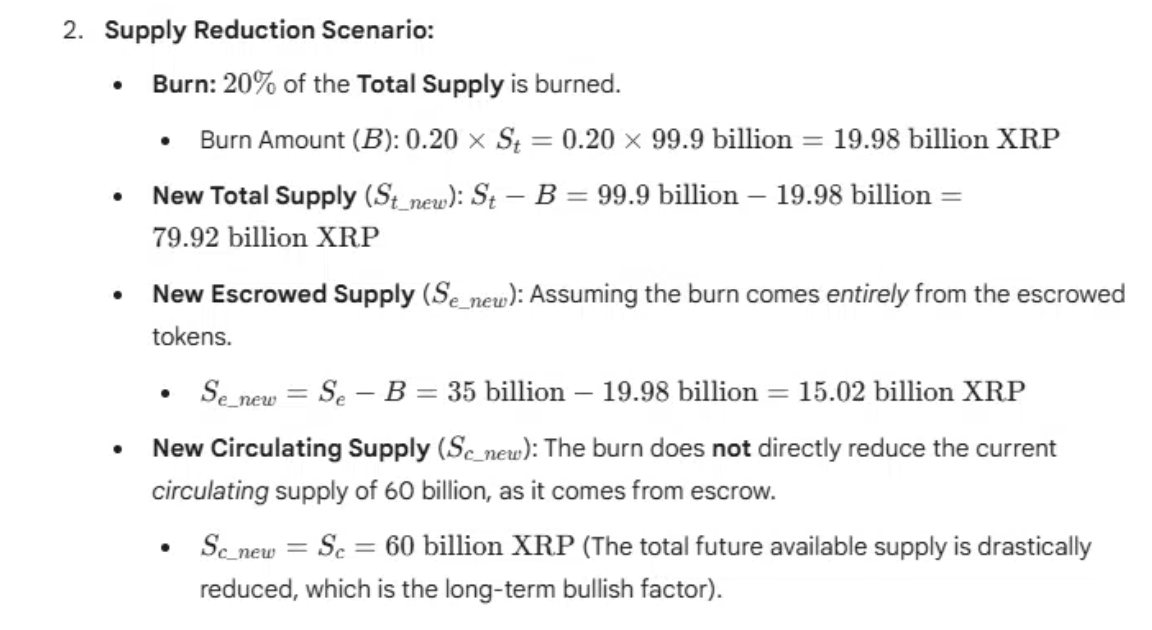

According to analysts, if Ripple burns 20% (about 19.98 billion tokens) but not all of the tokens in its escrow, the total supply could drop from 99.9 billion to about 79.9 billion. In this case, the number of tokens in circulation will remain constant (since burning occurs from the escrow account), but there will be a contraction in terms of “future supply”.

In this model, Ripple’s escrow account is reduced from 35 billion to 15 billion, while circulation remains at 60 billion. Transaction volume may not change directly in the near term, but supply pressure may occur in the long term. Analyzes state that with such an interruption, “long-term upward pressure” may occur in terms of price, and if demand remains the same or increases while supply shrinks, a price climb may occur.

Usage and Demand

Of course, supply alone is not enough. Factors such as usage rate, integration with payment systems, stablecoin projects and regulatory environment will determine the future of XRP. For example, the burn mechanism for XRP operates mainly through transaction fees; A very small amount of XRP is destroyed in each transaction.

In the past, there were rumors about a mass burning from the escrow account, but there was no official commitment from the company for such a large-scale burning. Additionally, XRP is different from similar fixed-supply cryptocurrencies, such as Stellar.  $0.306384 Like XLM, it has its differences; XLM had made a major supply cut in 2019, but in XRP’s case, such a level of movement has not yet become practical.

$0.306384 Like XLM, it has its differences; XLM had made a major supply cut in 2019, but in XRP’s case, such a level of movement has not yet become practical.

In short, such burning scenarios create excitement in the XRP world, but real-world conditions limit such projections. Cutting the supply by 20% could be a strong move in theory, but in this case the main determining factor will be the increase in demand and the prevalence of use. Burning alone does not automatically drive the price up; Dimensions such as transaction volume, institutional adoption and regulatory clarity are more critical.