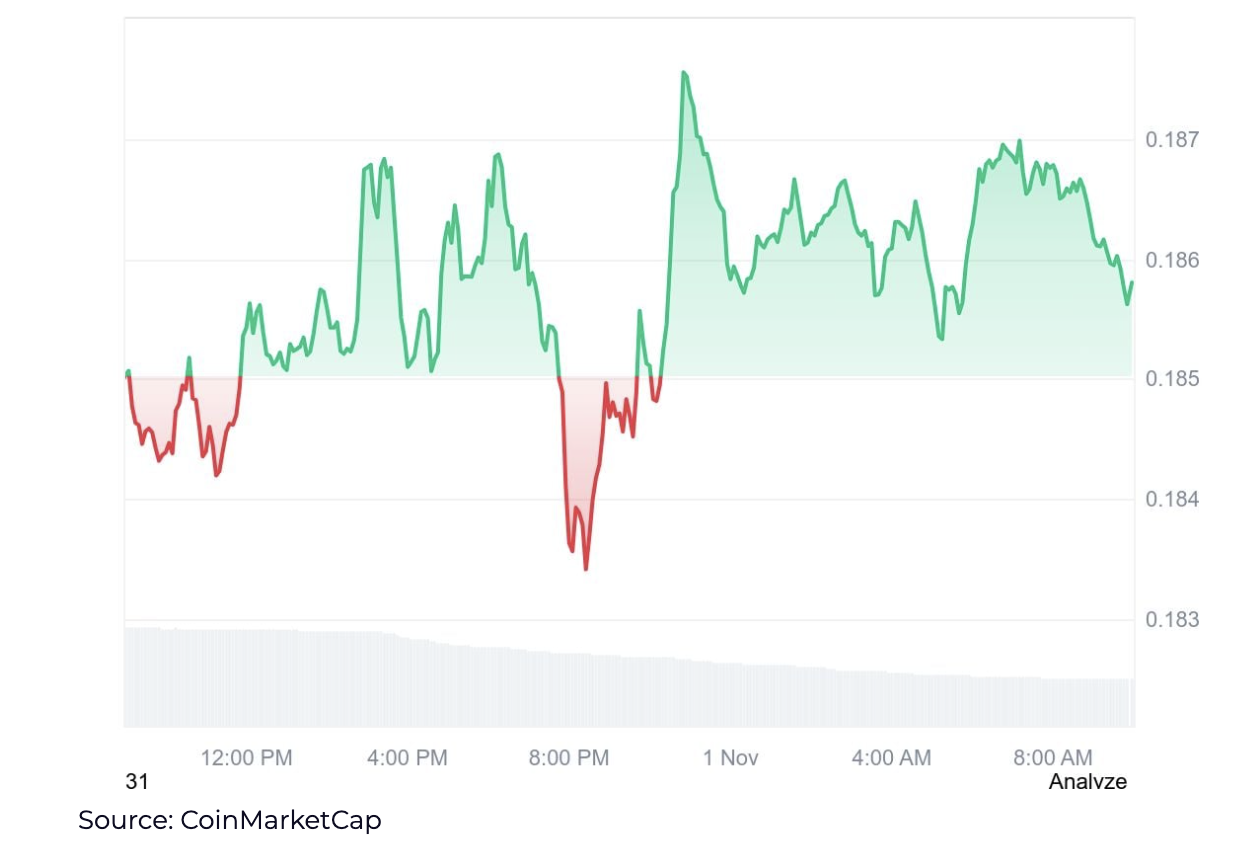

dogecoin  $0.187458rose by 4% on Friday, distinguishing itself from the broad markets that remained stable. The S&P 500 index was unchanged, while the Nasdaq gained only 0.3%. This rise came at a time when investors evaluated the uncertainties in the US Federal Reserve (Fed) statements. However, despite the price increase, futures data indicates that Dogecoin may lose momentum.

$0.187458rose by 4% on Friday, distinguishing itself from the broad markets that remained stable. The S&P 500 index was unchanged, while the Nasdaq gained only 0.3%. This rise came at a time when investors evaluated the uncertainties in the US Federal Reserve (Fed) statements. However, despite the price increase, futures data indicates that Dogecoin may lose momentum.

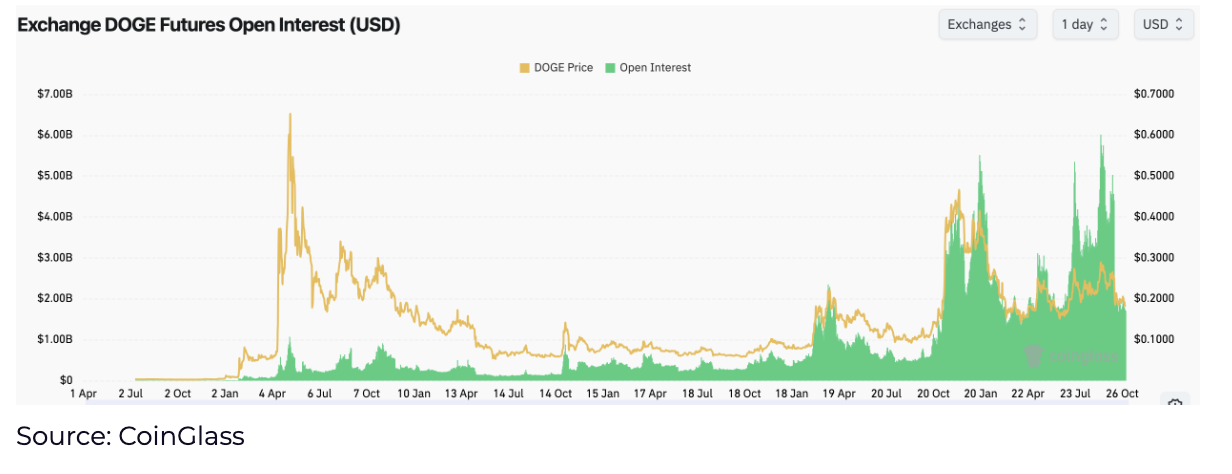

Sharp Fall in Futures: Volume Declined by 74%

Open interest in Dogecoin futures has fallen more than 65%, from a peak of $5.03 billion on Oct. 7 to $1.70 billion as of Nov. 1, according to CoinGlass data. Likewise, transaction volume decreased by 74% since October 11, from $20.45 billion to $1.34 billion. This decline indicates that investor interest is rapidly weakening.

Despite this, institutional investors remain cautiously optimistic in the medium term. The move by asset managers such as 21Shares to launch a spot Dogecoin ETF has created renewed expectation in the market. If spot ETFs are approved, institutional capital inflow to DOGE may accelerate.

Technical Indicators are Neutral, Resistance Points are Strong

Technical indicators show that there is no clear direction in the market yet. The Relative Strength Index (RSI) is hovering around 52, while the MACD indicator is showing a slight positive divergence. This picture suggests that investors are in the accumulation phase rather than speculative purchases.

However, DOGE is still trading below both the 100-day and 200-day exponential moving averages (EMA). These levels turned into strong resistance zones after the correction in October. A possible break below $0.18 could pull the price back to the $0.15–0.16 range and risk erasing gains for the year.

Dogecoin’s performance also reflects the cautious mood in the overall crypto market. Bitcoin  $110,116.33 While it remains horizontal in the $ 110,000 band, Ethereum

$110,116.33 While it remains horizontal in the $ 110,000 band, Ethereum  $3,874.93 It is trying to hold on to the $3,800 level. Especially in recent days, Fed Chairman Jerome Powell’s hawkish statements have caused investors to move away from risky assets. In this environment, DOGE’s rise can be considered as a short-term buying opportunity.

$3,874.93 It is trying to hold on to the $3,800 level. Especially in recent days, Fed Chairman Jerome Powell’s hawkish statements have caused investors to move away from risky assets. In this environment, DOGE’s rise can be considered as a short-term buying opportunity.

In conclusion, although Dogecoin’s recent rise is technically remarkable, fundamental indicators raise questions about the permanence of this move. The sharp decline in futures volumes suggests that whales are being cautious. Although spot ETF rumors support short-term optimism, Dogecoin must break above $0.20 permanently for a strong trend to begin. Otherwise, the current recovery may remain as a breathing period before a new correction.