Leading altcoins Stellar  $0.313421, dogecoin

$0.313421, dogecoin  $0.190291, Chainlink

$0.190291, Chainlink  $18.08 And Aave As the end of the week approached, it separated from the general market and moved in different directions. While XLM followed a horizontal trend, DOGE and LINK fell sharply. AAVE, on the other hand, could not escape the selling pressure despite the strong fundamentals in the DeFi sector. Low transaction volume, decrease in institutional interest and technical breakdowns were decisive for the direction of the market.

$18.08 And Aave As the end of the week approached, it separated from the general market and moved in different directions. While XLM followed a horizontal trend, DOGE and LINK fell sharply. AAVE, on the other hand, could not escape the selling pressure despite the strong fundamentals in the DeFi sector. Low transaction volume, decrease in institutional interest and technical breakdowns were decisive for the direction of the market.

XLM and DOGE Followed Different Courses

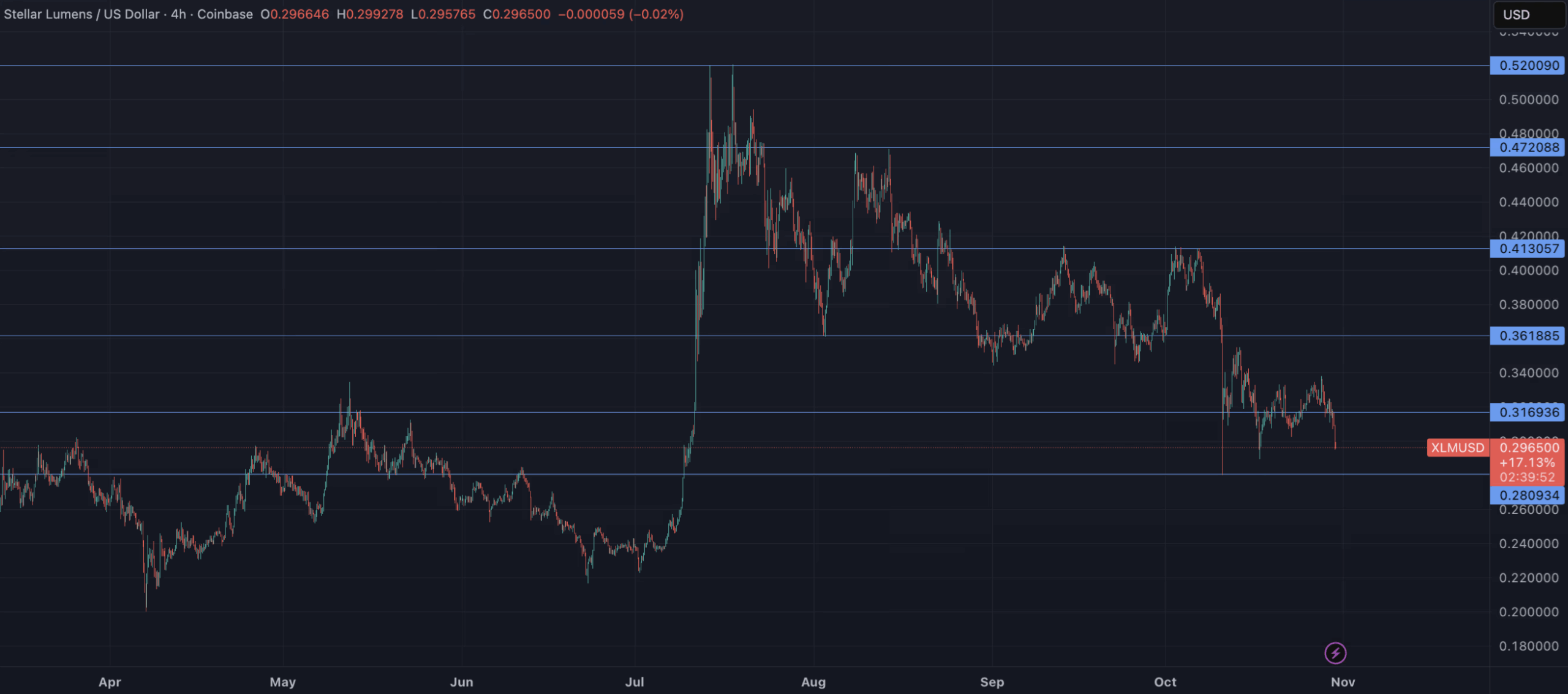

Stellar’s XLM The coin remained flat at $0.2975. While the cryptocurrency market was rising, XLM lagged 3.5 percent, showing that investor interest remained weak. The transaction volume, which remained 21 percent below the 30-day average, indicated a lack of institutional support. While the $0.2950 support remained strong, the $0.3000–$0.3050 region acted as significant resistance. Technical indicators reveal that an upward break is difficult unless supported by an increase in volume.

DOGE It lost the support of $ 0.1940 and fell by 5.5 percent to $ 0.1843. Intraday volume increased by 180 percent to 1.17 billion coins. This showed that large-scale sales were effective. Position reduction by institutional investors increased the risk of the price falling to $0.1765. Regaining $0.1950 in the short term is critical as the RSI indicator approaches the oversold zone.

Corporate Sales Pressure on LINK and AAVE

LINK It dropped by 8 percent in the last 24 hours to $16.9 and hit its lowest level in the last two weeks. The break of the supports with a transaction volume of 3.94 million coins confirmed the strong selling pressure. On-chain data shows institutional buyers are withdrawing from the market. in an interesting way Chainlink Reserve It bought back 64,445 LINK units with its network revenues. This latest buyback was recorded as the largest nominal purchase since August.

AAVE It dropped by 16 percent weekly to $208. The break of the $211 support strengthened the technical weakness. Despite this, Aave’s corporate lending platform Horizon showed a remarkable performance, reaching a size of $450 million in two months. However, the volatility on the volume side and the falling trend structure indicate that the pressure on the price may continue in the short term.